FPT Corporation has announced its plans to issue additional shares in 2024, as per a resolution by its Board of Directors. The company intends to issue 190.5 million new shares to increase its charter capital, offering existing shareholders 3 new shares for every 20 shares they own. This move will boost FPT’s charter capital from VND 12,700 billion to VND 14,605 billion. The additional capital will be sourced from undistributed post-tax profits as of December 31, 2023, as stated in the 2023 audited financial statements.

Following the issuance, FPT’s charter capital is expected to increase from VND 12,700 billion to VND 14,605 billion. The company plans to complete this process by the third quarter of 2024, with the record date for shareholders’ eligibility set to be the same as the record date for the remaining 2023 dividend payout. Additionally, FPT intends to distribute approximately VND 1,200 billion in cash dividends to its shareholders, representing a 10% dividend payout ratio, in the second quarter of 2024.

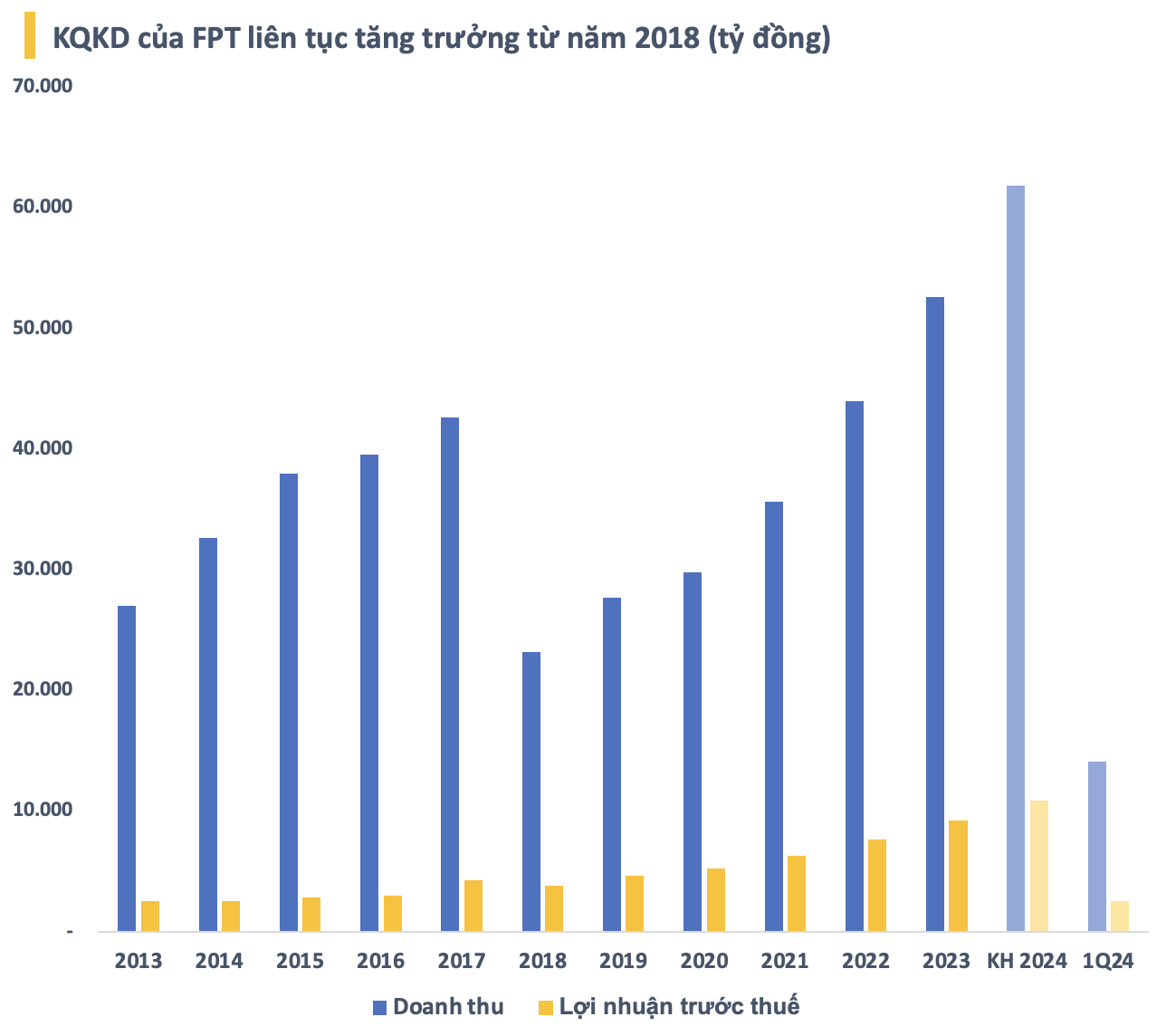

For 2024, FPT has set ambitious targets, aiming for a revenue of VND 61,850 billion (~USD 2.5 billion) and a pre-tax profit of VND 10,875 billion. These goals reflect an approximate 18% increase compared to the company’s performance in 2023. In the first quarter of this year, FPT recorded a pre-tax profit of VND 2,534 billion, a 19.5% increase year-over-year, thus achieving about 23% of its annual plan. The company’s first-quarter post-tax profit attributable to parent company shareholders stood at VND 1,798 billion, a 20.4% increase compared to the previous year, marking the highest level since its inception.

FPT has also made significant strides by forging a partnership with NVIDIA, a tech giant, to build an AI factory. This strategic collaboration aims to boost AI research and development, enhance high-quality human resources, and establish NVIDIA and FPT as development partners in NVIDIA’s partner network.

In the stock market, FPT’s share price has witnessed a slight correction after reaching an all-time high and currently stands at VND 133,000 per share, reflecting a more than 38% increase since the beginning of the year. Consequently, the company’s market capitalization has reached approximately VND 168,900 billion (~USD 7 billion), marking a nearly USD 2 billion increase compared to the end of last year.

In a separate development, the State Capital Investment Corporation (SCIC) has announced its plan to divest from FPT in the second tranche of 2024. SCIC intends to offload its entire 5.8% stake in the company, which is currently valued at nearly VND 9,800 billion based on the current market price.