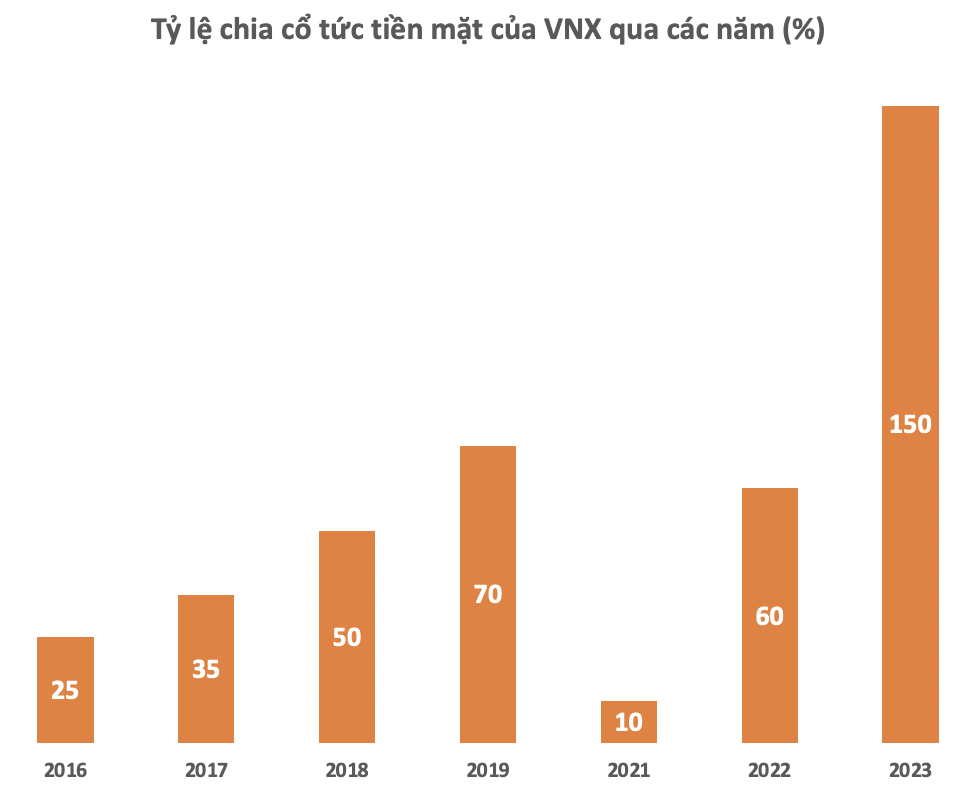

Joint Stock Company for Advertising and Trade Fair Vinexad (coded VNX) announced that on May 31, it will finalize the list of shareholders to pay 2023 dividends in cash at a rate of 150%, meaning that for each share owned, shareholders will receive VND 15,000. The ex-dividend date is May 30, and the expected dividend payment date is June 19, 2024. With more than 1.2 million shares currently in circulation, the company expects to spend approximately VND 18.3 billion on dividend payments for this period.

This is the highest dividend payout in 14 years, since its listing on the UPCoM in 2010, and it also surpasses the previously approved plan of 50%. Previously, in June 2023, the company also paid 2022 dividends in cash at a rate of 60%. Looking back at its history, the company has consistently paid out substantial dividends of 20-70% annually.

The company’s enviable dividend policy is a factor that makes many investors reluctant to let go of their shares. In the market, VNX shares have had “zero liquidity” for the past 1.5 years. The current share price of VNX stands at VND 27,000/share, which is more than half of its historical peak reached during the 2020 phase.

Before “freezing” trading, VNX had attracted attention with its rapid upward trajectory. From a price of less than a cup of iced tea at VND 700/share in early 2019, this stock soared to VND 60,000 in August 2019, equivalent to an increase of 86 times within just one year.

Additionally, the fact that the majority of the shares are held by the leaders and their relatives is another reason why this stock has not seen any transactions for an extended period. In the shareholder structure, Mr. Nguyen Khac Luan, the General Director, is the largest shareholder, owning 13.48% of the capital. Mr. Pham Quynh Giang, the Chairman of the Board of Directors, is the second-largest shareholder with 12.32% of the capital. Mrs. Nguyen Thi Hang, Mr. Giang’s wife, holds 7.67% of the shares. Moreover, Mr. Dinh Van Khai, the Deputy General Director, also holds 12.04% of the capital.

Record Profit in 2023, EPS Among the Top in the Market

Joint Stock Company for Advertising and Trade Fair Vinexad, formerly known as a company under the Ministry of Industry and Trade, was established in 1975. It was equitized in 2006 and is headquartered at a “golden location” at 9 Dinh Le, Trang Tien Ward, Hoan Kiem District, Hanoi.

In 2010, the company officially began trading on the UPCoM under the stock code VNX. Being a business with a relatively small scale, since its establishment, Vinexad has only increased its charter capital from VND 7 billion to VND 12 billion.

Vinexad is the first company in Vietnam in the field of advertising, media, exhibitions, and international trade promotion. Every year, the company organizes and participates in dozens of large-scale fairs and exhibitions domestically and internationally, attracting thousands of businesses.

The company is also known for its membership in the Global Association of the Exhibition Industry (UFI) and the Asia Exhibition and Conference Association (AFECA). Leveraging its strengths in the field of exhibitions and events, the company is promoting expansion in key markets such as China, South Korea, and more.

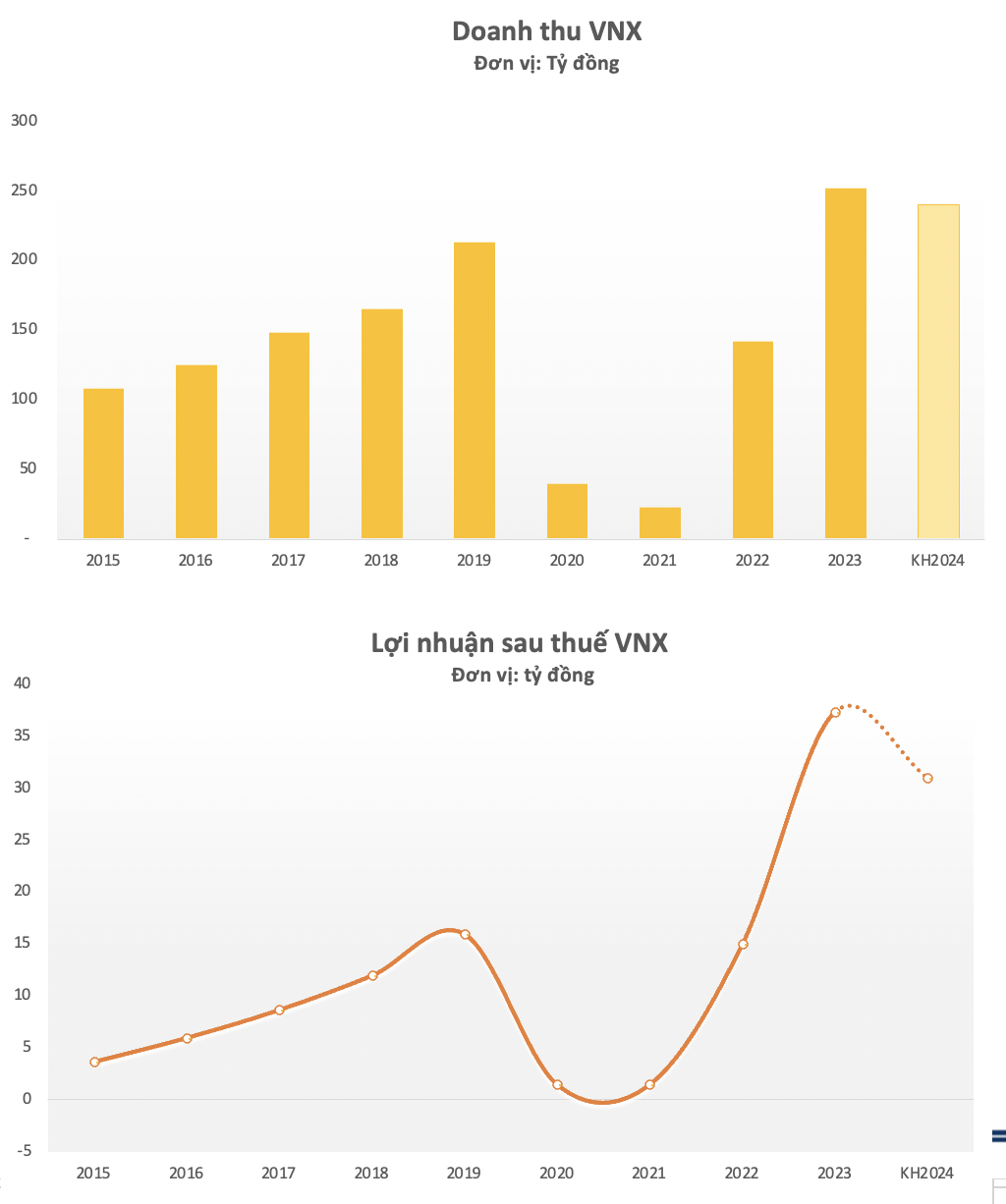

Vinexad consistently rewards its shareholders with generous dividends each year due to its stable business operations. Although revenue and profits are not exceptionally high, they have been steadily growing in the 2015-2019 period. However, in 2020, the COVID-19 pandemic dealt a direct blow to its main business segment of organizing exhibitions and events, causing the company’s performance to plummet.

In the past two years, Vinexad’s business has rebounded strongly. According to the 2023 audited financial statements, the company recorded revenue of VND 252 billion, a 78% increase compared to the previous year. After deducting expenses, the company reported a profit after tax of VND 37 billion, 2.5 times higher than in 2022. This is also the highest profit in Vinexad’s history. Notably, the company’s EPS increased significantly from VND 12,385 to VND 30,580, ranking among the top 3 companies with the highest EPS on the stock market.

For 2024, Vinexad has set a business plan with a revenue target of VND 240 billion and an after-tax profit of VND 31 billion, representing decreases of 5% and 17%, respectively, compared to the previous year. The planned dividend for 2024 is 50% in cash.

The proceeds from this offering will be used to supplement working capital for business activities, specifically to pay for exhibition space to the provider, Saigon Exhibition and Convention Joint Venture Company. The offering is expected to be carried out in 2024. If the offering is successful, the company’s charter capital will increase to over VND 18 billion.