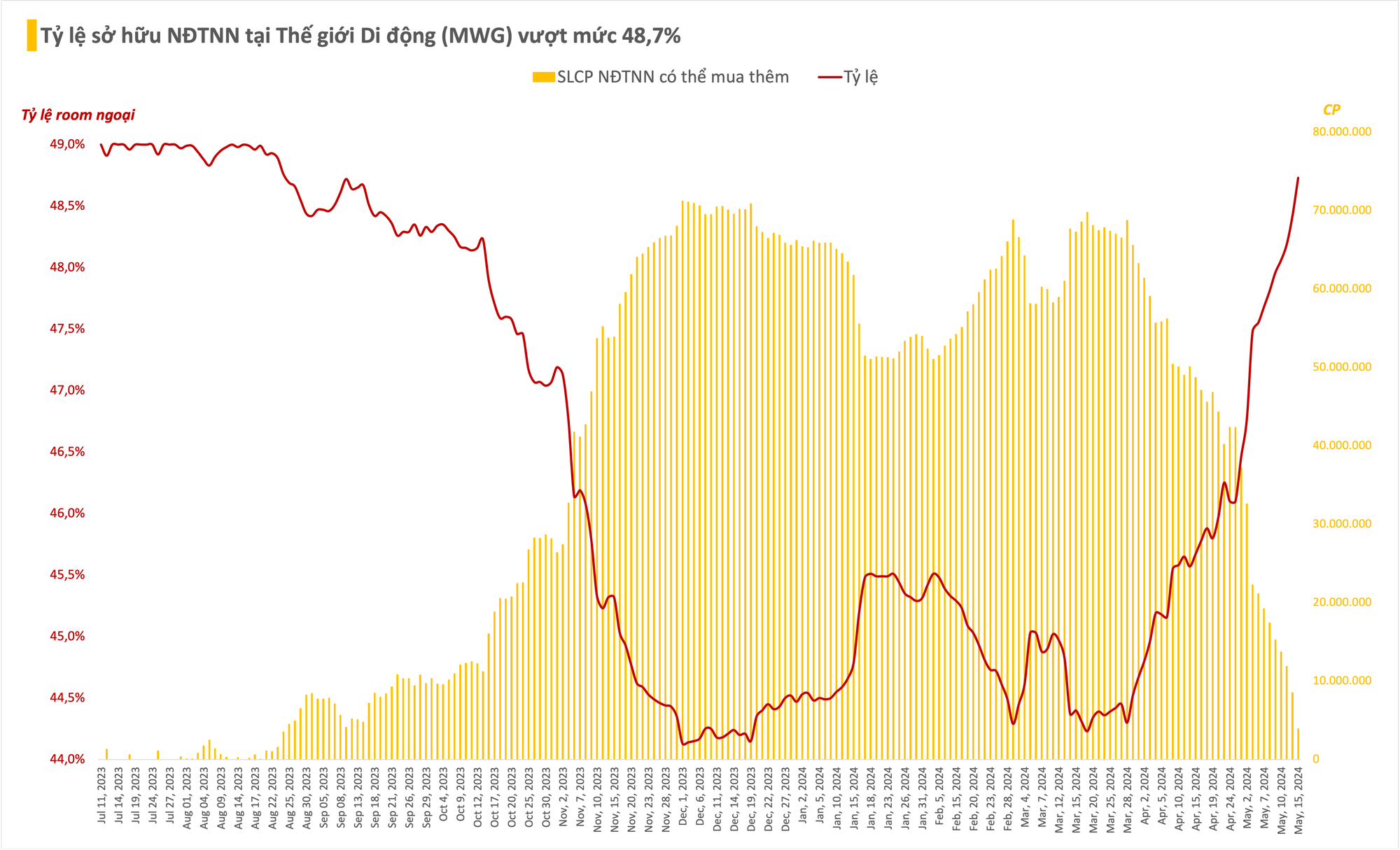

Foreign investors have been consistently buying Mobile World Investment Corporation (MWG) stock over the past dozen sessions, with an average net purchase of about 2 million shares per session. As a result, the foreign ownership ratio in Mobile World has gradually increased from 46% to nearly the maximum threshold of 49% that foreign investors can own in this leading retail enterprise.

On May 15 alone, foreign investors net bought more than 4 million MWG shares, pushing the foreign ownership ratio to 48.73%. This means that foreign investors’ additional holdings of MWG shares are now only about 3.96 million units.

Being excluded from the VNDiamond index and sold by ETFs referencing this index has not significantly impacted MWG stock. Instead, the company’s strong and better-than-expected financial results have become a catalyst for its stock to shine.

According to the latest update, Mobile World reported preliminary revenue of VND 11,500 billion for April 2024, up 15% year-on-year and 17% month-on-month. Thus, the cumulative revenue for the first four months of 2024 is estimated at VND 43,000 billion, a 17% increase year-on-year. The company did not disclose profits, but previously reported a net profit of VND 902 billion in Q1, 43 times higher than the same period last year and the highest in the past six quarters since Q3 2022.

The business performance of The Gioi Di Dong and Dien May Xanh chains has been positive, maintaining stable revenue in recent months, thanks to the strong contribution of electrical appliance products. Notably, Bach Hoa Xanh (BHX) achieved an average revenue of VND 1.9 billion per store in April, the highest monthly revenue ever achieved by BHX since its operation. With this figure, it is likely that MWG’s supermarket chain turned profitable last month, as many securities companies expected.

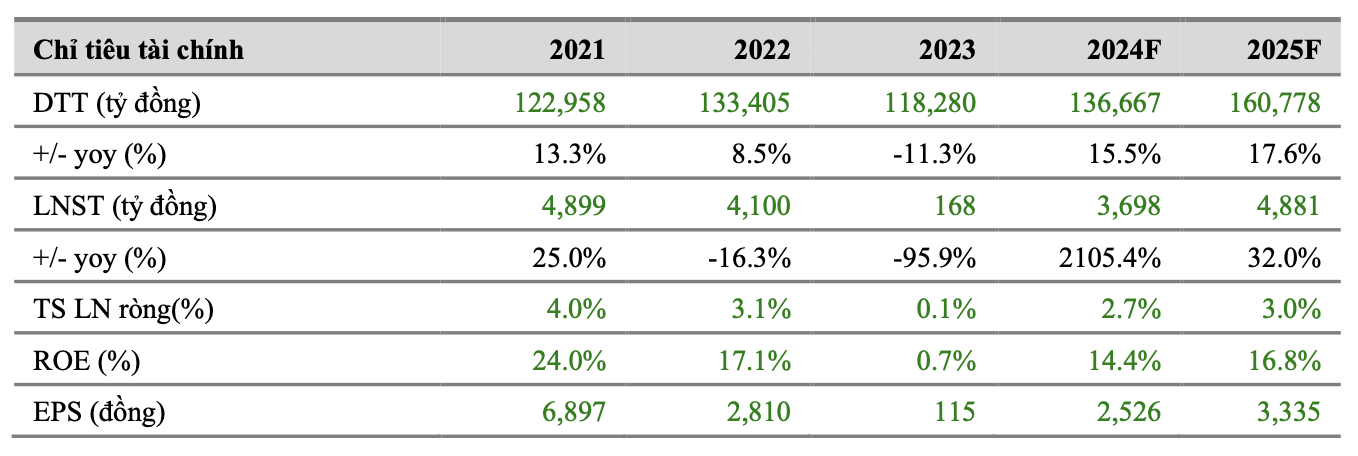

In the latest report, Vietcombank Securities (VCBS) expects the profit margin of the ICT and Electrical Appliance chains to recover strongly, while BHX targets positive profits in 2024. VCBS forecasts MWG’s net revenue to reach VND 136,667 billion (+15%) and net profit to reach VND 3,698 billion (a 21-fold increase).

Source: Vietcombank Securities (VCBS)