Oil falls to a seven-week low

Oil prices dropped by around 3% to a seven-week low on May 1st due to unexpected growth in US crude inventories, potential for a ceasefire in the Middle East, and persistent inflation in the US, which could slow down interest rate cuts and the anticipated growth in oil demand.

Brent crude oil fell by $2.89/barrel, or 3.4%, to $83.44, while WTI crude fell by $2.93, or 3.6%, to $79.00, with both types of oil closing at their lowest levels since March 12th and entering oversold territory for the first time since December 2023.

In other energy markets, US diesel closed at its lowest level since July 2023, and gasoline prices fell to a seven-week low. The US Energy Information Administration (EIA) reported that energy companies unexpectedly added 7.3 million barrels of crude oil in the previous week. A Reuters survey had predicted a decrease of 1.1 million barrels, while the American Petroleum Institute indicated an increase of 4.9 million barrels.

In the Middle East, hopes for a ceasefire between Israel and Hamas rose following renewed efforts by the US and Egypt, even as Israeli Prime Minister Benjamin Netanyahu vowed to carry out a long-promised attack on Rafah. Meanwhile, the Federal Reserve kept interest rates steady and signaled a continued move towards reducing borrowing costs but warned about recent disappointing inflation indicators.

Gold Rises

Gold prices surged more than 1% as the US dollar and US Treasury bond yields weakened following the Federal Reserve’s interest rate decision and comments from Chairman Powell. Spot gold rose 1.7% to $2,323.38/ounce after hitting its lowest level since April 5th earlier in the session. Gold futures for June delivery on the COMEX exchange gained 0.4% to $2,311/ounce. The US dollar weakened by 0.3%, making gold less expensive for holders of other currencies.

Copper Falls as Funds Take Profits

Copper prices declined as funds continued to take profits near the $10,000/ton level following the metal’s strongest rally in years. Three-month copper on the London Metal Exchange (LME) fell 0.9% to $9,904.50, after touching a two-year high of $10,208 on April 30th. Copper found support above the $9,500 level, with investor profit-taking causing a slight pullback in prices. Copper, one of the world’s most widely used metals, has risen 16% so far this year.

Trading was quiet, with several Asian markets, including China, closed for holidays. Copper supplies edged higher, with inventories rising in Taiwan, and LME warehouse stocks recovering from three-week lows. A stronger US dollar also pressured prices, making the greenback-denominated metal more expensive for buyers holding other currencies.

Japanese Rubber Prices Fall

Japanese rubber prices declined due to weak oil prices and a drop in the Tokyo stock market, but trading was thin as Asian investors took a break for the holidays. Rubber futures for October delivery on the Osaka Exchange closed 3.6 yen, or 1.2%, lower at 303.4 yen ($1.92)/kg. Rubber prices faced downward pressure as other commodities like oil and gold maintained their downward trend, but the 300 yen level is expected to provide support in the current situation.

Coffee Prices Dip

Robusta coffee futures for July delivery closed down 43 cents, or 1.1%, at $3,978/ton, after setting a record high of $4,338/ton last week. Robusta continues to find support from concerns about dry weather in Vietnam, the world’s top robusta producer. Arabica coffee futures for July fell 0.3% to $2.16/lb.

Coffee giant Starbucks cut its annual revenue forecast after reporting a decline in same-store sales for the first time in nearly three years, as the company struggled with weak demand in the US and China, its two largest markets.

Sugar Prices Slip

Raw sugar futures for July delivery closed down 1% at 19.22 US cents/lb. White sugar futures for August delivery fell 0.5% to $566.30/ton.

Corn and Soybean Prices Rise, Wheat Falls

Corn prices on the Chicago Board of Trade (CBOT) rose due to concerns about rainy weather in the US corn belt, which could delay planting. CBOT July corn futures closed up 4 cents at $4.50-3/4 per bushel. Investors are monitoring the planting progress and awaiting the US Department of Agriculture’s monthly supply-demand report to be released on May 10th.

Soybean prices extended gains due to inter-market spread trading after a strike by Argentine oilseed workers was called off. CBOT July soybean futures settled 7-1/4 cents higher at $11.70-1/4 per bushel. Wheat prices on the Chicago exchange continued to retreat from multi-month highs reached last week amid news of rain in key growing regions in southern Russia and the US Plains.

CBOT July wheat futures ended down 4 cents at $5.99-1/4 per bushel.

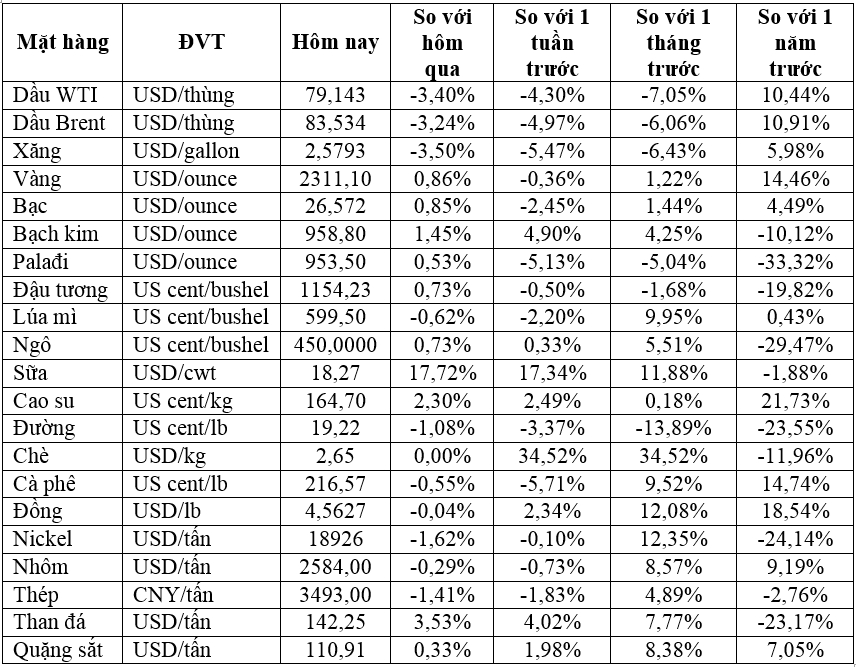

Prices of Key Commodities on May 2nd