The VN-Index closed the May 16 session with a 14-point gain, nearing the 1,270-point mark. The return of banking stocks played a crucial role in the index’s surge, with trading value on the HOSE surpassing 22,600 billion VND, a significant increase from the previous session.

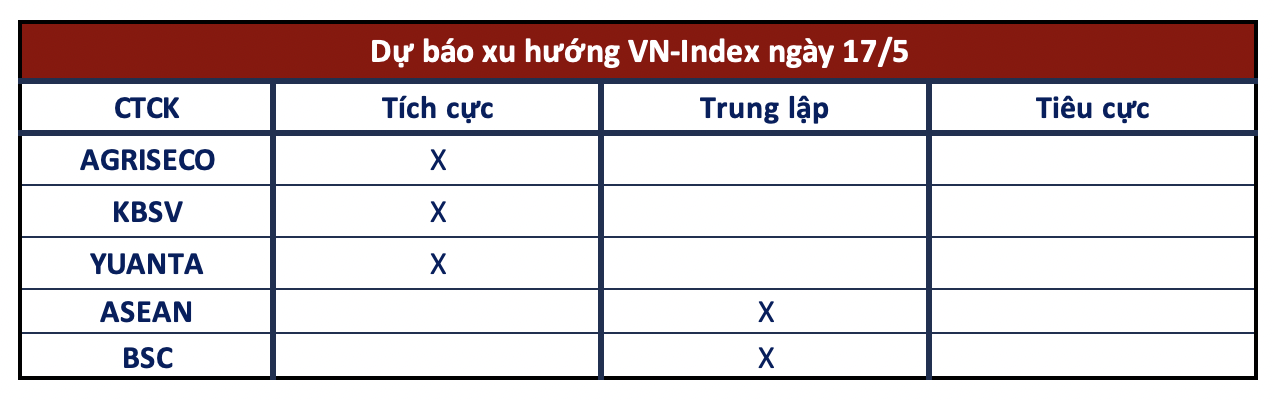

Looking ahead to the next trading session, most securities companies anticipate the market to continue its upward momentum. Investors are advised to gradually open long positions.

Market to Maintain Upward Trajectory

Agriseco Securities

On the daily chart, the VN-Index gapped up and broke above the 1,250 level amid strong buying pressure from the start of the session. Agriseco Research believes the market will remain positive in the coming sessions, driven by upward momentum. Improving liquidity indicates a restoration of confidence in the medium-term uptrend. However, selling pressure may gradually increase as the index approaches the 12-month high zone of 1,270-1,300 points.

Agriseco recommends that investors hold on to their existing long positions and consider raising their stop-loss levels to protect profits and manage risks as the VN-Index enters the medium-term resistance zone. For new positions, it is advisable to buy on dips towards the 1,250 level and, further down, the 1,230 level, targeting stocks that have established a base above both the 20-day and 50-day moving averages but have not yet rallied significantly from these support levels.

Chances of Breaking New Highs Prevail

KBSV Securities

In addition to improved liquidity, the rotation of funds into banking stocks is providing fresh impetus for the index. The resistance zone around 1,260 (+-10) is likely to be conquered. While the potential for a pullback remains, the odds favor the continuation of the uptrend, with a possibility of breaking above the 1,29x zone. Investors are advised to place buy orders in stages for trading positions as the index retreats towards support levels, with near-term support around 1,24x and further support around 1,220 (+-5) in the event of a deeper correction.

Yuanta Securities

The market is expected to extend its gains in the next session, while the VN30 index may undergo a correction to test the new support level of 1,306 points. Large-cap stocks are undergoing significant positive fluctuations, attracting short-term money flow. This correction phase is likely to be brief, lasting within the session. Short-term sentiment indicators continue to rise, suggesting high odds for new buying opportunities and low short-term risks.

Investors Advised to Stay Vigilant

Asean Securities

The upward momentum is favorable, but it is possible that today’s rally is aimed at settling futures contracts. Therefore, the current trading zone may not be safe for new long positions. Investors are advised to refrain from buying and remain vigilant.

BSC Securities

In the upcoming sessions, the VN-Index is likely to trade within the 1,270-1,280 zone. However, profit-taking pressure at this former resistance zone poses a risk.