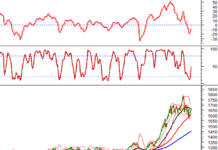

Gold prices surged to a new all-time high during Monday’s Asian trading session (May 20), propelled by mounting expectations of a Federal Reserve rate cut and escalating geopolitical tensions in the Middle East. Domestic gold prices followed suit, albeit at a slower pace, with selling prices of gold bars and rings increasing by 100,000–300,000 VND per tael compared to the previous week.

As of nearly 10:00 a.m. Vietnam time, the spot gold price in the Asian market rose by $14.3/oz compared to Friday’s close in the US, equivalent to a 0.6% increase, reaching $2,429.7/oz, according to data from Kitco Exchange. Earlier, gold prices touched $2,440.5/oz, breaking the previous record of around $2,430/oz set in April.

At the current rate, the world gold price is equivalent to about VND 74.5 million per tael if converted according to Vietcombank’s selling exchange rate, up VND 500,000 per tael from the previous week.

At the same time, the SJC gold bar price in Hanoi, listed by Phu Quy Group, was VND 88.4 million/tael and VND 90.4 million/tael, respectively, for buying and selling, up VND 600,000/tael and VND 300,000/tael compared to Saturday morning.

Phu Quy’s plain rings were priced at VND 76.1 million/tael (buying) and VND 77.6 million/tael (selling), up VND 200,000/tael and VND 100,000/tael, respectively. The Rong Thang Long rings, offered by Bao Tin Minh Chau Jewelry Company, were quoted at VND 76.13 million/tael and VND 77.63 million/tael.

In Ho Chi Minh City, SJC Company quoted SJC gold bars at VND 88.6 million/tael and VND 90.6 million/tael, up VND 900,000/tael and VND 200,000/tael, respectively, from the previous week. The SJC ring was priced at VND 75.7 million/tael for buying and VND 77.4–77.5 million/tael for selling, depending on the weight of the product.

Gold prices rallied as traders increasingly bet on the Fed initiating a rate cut as soon as September this year—a scenario that bodes well for non-interest-bearing assets like gold.

Moreover, such a rate environment also bodes ill for the US dollar, and since gold is priced in dollars, a weaker greenback means a potential boost for the precious metal. Last week, both the US dollar index and US Treasury bond yields fell, propelling gold prices 2% higher, after inflation data showed that the US Consumer Price Index (CPI) for April rose less than expected.

According to Bloomberg, gold’s safe-haven appeal is growing after a helicopter carrying Iranian President Ebrahim Raisi crashed in foggy weather on Sunday. This incident heightened anxiety about geopolitical risks in the Middle East, following an attack on an oil tanker by Houthi rebels in the Red Sea on Saturday.

“This gold price rally is being driven by the uncertainty surrounding Iran,” said Nicholas Frappell, a Sydney-based analyst at ABC Refinery.

According to data from the US Commodity Futures Trading Commission (CFTC), the number of gold futures contracts betting on a price increase for the week ending May 14 rose to its highest level since May 14.

In Kitco News’ weekly gold price outlook survey, 11 out of 14 experts, or 79%, predicted that gold prices would rise this week.

“Last week, the bulls were clearly in control in the gold market. Gold prices continued to surge with higher highs and higher lows. In April, the $2,400/oz level was in serious doubt, but this Friday, there were many signs that this price level has been accepted, thus opening the door for a move to $2,500/oz,” said James Stanley, senior market strategist at Forex.com, in an interview with Kitco News.

However, some experts cautioned about the risk of a gold price pullback as investors lock in profits at the new peak.

Darin Newsom, a senior analyst at Barchart.com, believed that gold prices would struggle to hold on to all of their recent gains. “From a purely technical standpoint, June looks to be the potential peak for gold’s short-term uptrend,” Newsom told Kitco News.

This week, a few US economic data releases are expected, although none are as significant as last week’s CPI reports. Of particular note this week is the release of the Fed’s April 30-May 1 meeting minutes on Wednesday.

The US dollar in the international market edged higher after falling 0.8% last week, with the Dollar Index hovering around 104.5 points.