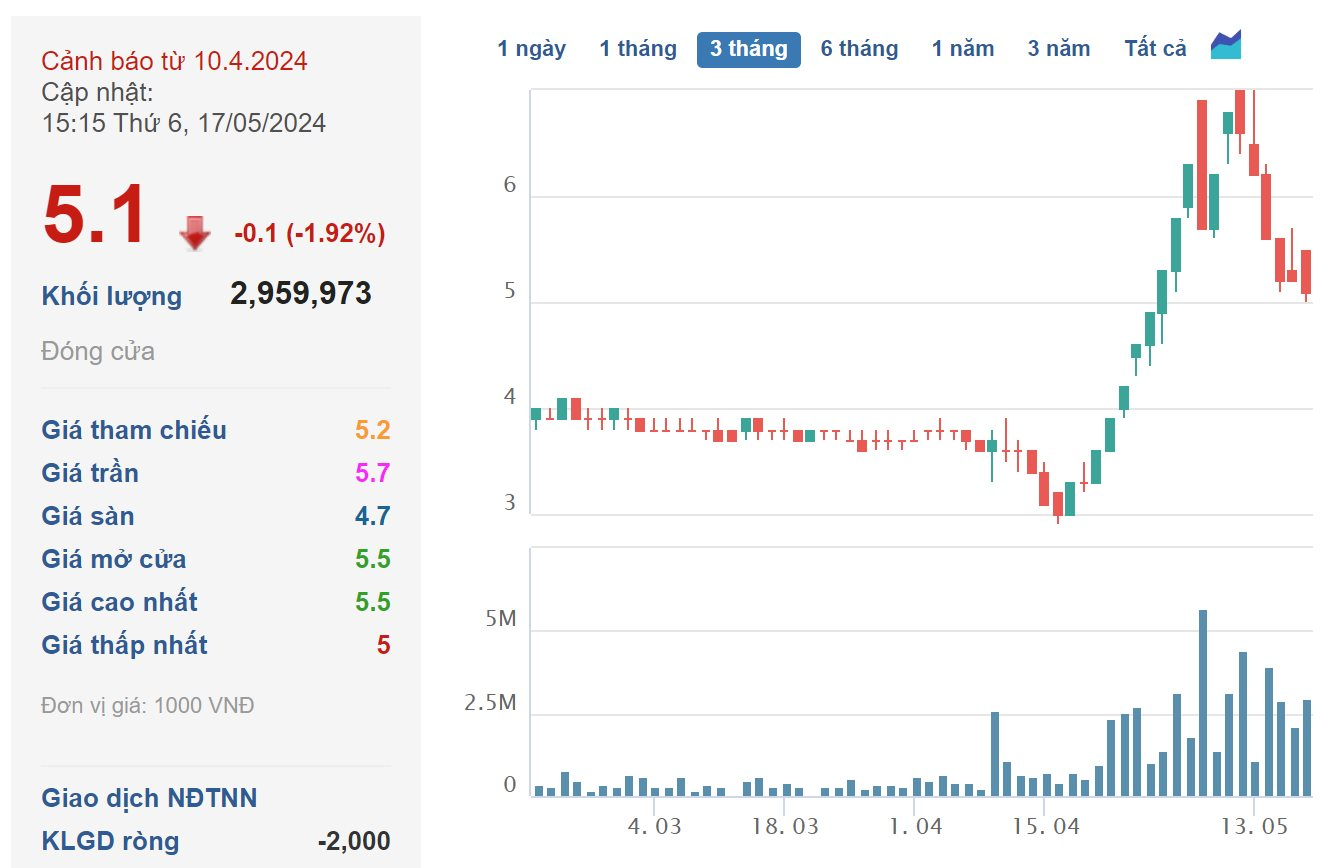

Recent sessions have seen AAV shares of AAV Group JSC (HNX: AAV) continue to attract attention as they plummet after many sessions of “making waves”.

Prior to this, between April 16 and May 9, 2024, AAV shares consistently hit the ceiling price limit, pushing the market price from 3,000 VND/share to nearly 7,000 VND/share. In other words, AAV shares surged by 127% in less than a month of trading. Currently, AAV is retreating to the 5,000 VND/share region.

Notably, the company’s meteoric rise occurred against a backdrop of dismal business performance. In parallel, AAV also underwent some top-level changes in the first quarter of 2024.

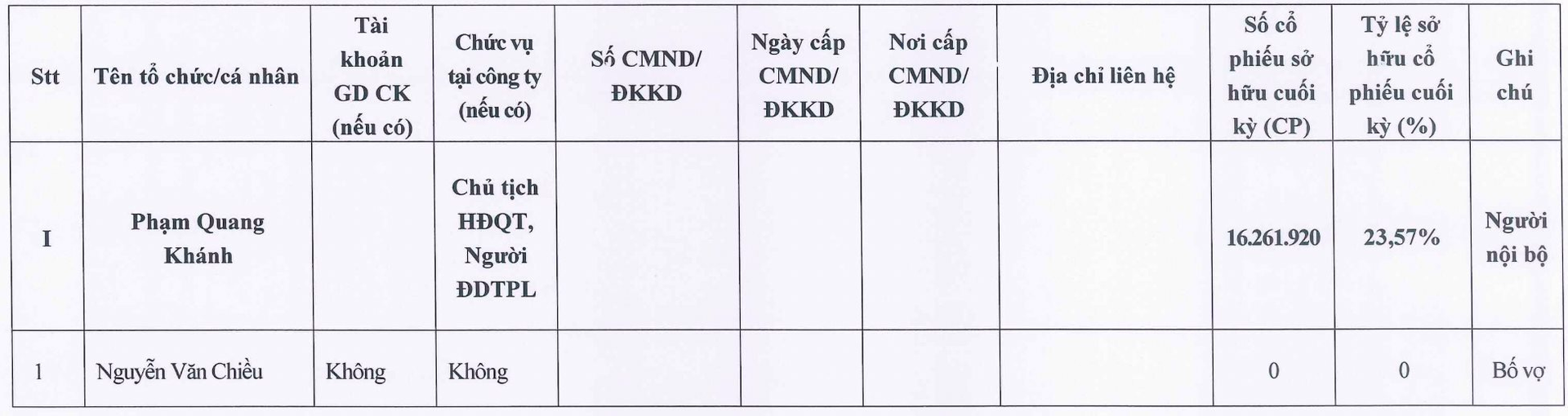

At the end of March 2024, Mr. Pham Quang Khanh submitted his resignation from the position of Chairman of the Board of Directors, citing “personal reasons”. Subsequently, AAV appointed Mr. Pham Thanh Tung as his replacement.

Both Mr. Khanh and Mr. Tung are currently the only major shareholders of AAV.

According to the 2023 Management Report, Mr. Khanh owns over 16 million shares, equivalent to 23.57% of the company’s capital. A relative of Mr. Khanh, Mrs. Trinh Thi Thu Ha (mother-in-law) holds 9,408 AAV shares.

Image: Management Report as of the end of 2023.

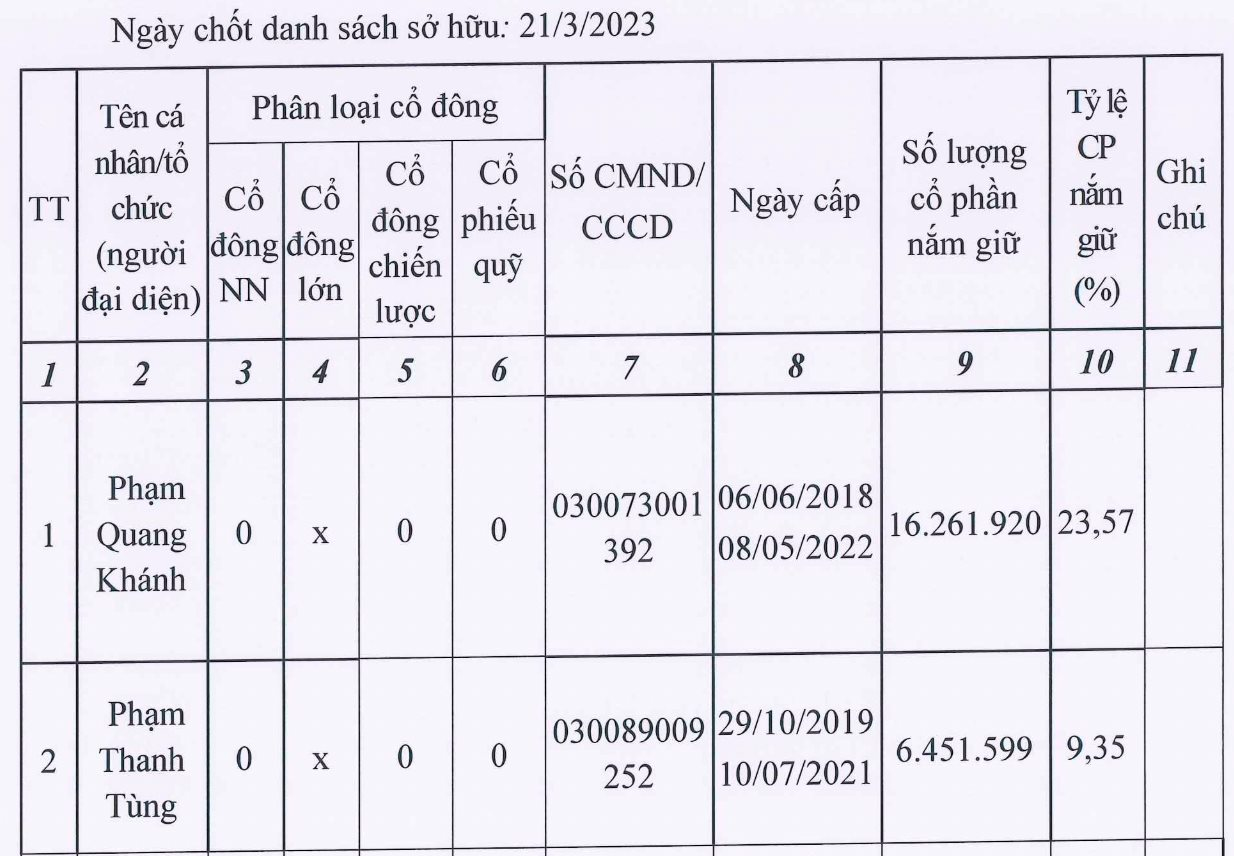

As for the new Chairman, Mr. Tung, according to the Management Report as of March 21, 2023, he held 6.45 million AAV shares, equivalent to 9.35% of the company’s capital. With AAV’s gains in the past month, Mr. Tung’s total assets increased by nearly VND 25 billion.

It is worth noting that Mr. Tung is relatively young, having been born in 1989. Prior to becoming the Chairman of AAV, on June 13, 2023, Mr. Tung acquired 3.36 million AAV shares through a transfer with a total value of VND 42 billion (equivalent to VND 12,500/share).

Image: Management Report as of March 21, 2023.

Most real estate projects are “stuck”

Regarding AAV, also known as Viet Tien Son Real Estate JSC, it was established in 2010 and is headquartered in Viet Tien Son Office Building, Eastern Residential Area, Yet Kieu Street, Cong Hoa Ward, Chi Linh City, Hai Duong Province.

The company operates in the field of real estate investment, construction, and business, as well as frozen food business, travel services, and production and business of oriental medicine and functional foods.

According to the company’s website, since 2015, AAV Group has shifted its real estate investment model from infrastructure construction and land subdivision to a model that combines real estate development with project management and accompaniment.

The company’s key projects include Con Son Resort (which the company has been researching and developing for many years), Hoa Lac Vien Cemetery Park, and more recently, a complex of hotels, offices, and apartments for rent to meet the needs of foreign experts and joint ventures in Hai Duong province.

Currently, the company’s projects are facing legal issues. For instance, the Eastern Residential Area of Yet Kieu Street (Chi Linh City, Hai Duong) has not been approved for adjustment or site clearance, and thus does not meet the conditions for capital mobilization as per regulations.

Meanwhile, for the Tran Hung Dao Street Eastern Residential Area project (formerly known as the Golf Course Residential Area project), the investor is still in the process of requesting an extension of the project implementation period to carry out the next steps.

Regarding the Con Son Resort project, AAV Group stated that the corporation will continue to coordinate with competent authorities in site clearance work.

As for the “spiritual” real estate project, Hoa Lac Vien Cemetery Park, the company is in the process of preparing an environmental impact assessment report.

Six consecutive quarters of losses

In terms of business performance, according to the consolidated financial statements for the first quarter of 2024, AAV reported a loss of 3.3 billion VND. This marks the sixth consecutive quarter of losses for this real estate enterprise.

Specifically, AAV Group recorded a meager revenue of 1.2 billion VND, a decrease of 98.2% compared to the same period last year. After deducting cost of goods sold, gross profit stood at 749 million VND, a decline of 68.3% year-on-year.

Financial income, entirely derived from interest on deposits and loans, brought in 128 million VND for AAV Group, representing an 86.1% drop compared to the previous year. Meanwhile, other income for the company did not generate any revenue, whereas in the same period last year, it stood at 13.6 billion VND.

According to the company’s explanation in the report, the first quarter of 2024 witnessed challenges in AAV’s production and business activities, leading to a significant decrease in sales and services revenue, resulting in a net loss for the reporting period.

As of March 31, 2024, AAV Group’s total assets amounted to 909 billion VND. Short-term assets accounted for 595 billion VND, with the majority comprising receivables.

The company’s liabilities as of the end of March 2024 stood at 133 billion VND. Short-term debt amounted to 82.2 billion VND (a decrease of 6%), while short-term financial loans and borrowings totaled 71 billion VND.