Binance is encouraging small- and mid-cap crypto projects to buck the trend of low pricing and excessively high fully diluted valuations (FDV) in the industry. They are inviting these projects to join their listing programs and pledge support with sustainable models. Binance Research writes:

“We aim to foster the growth of the blockchain ecosystem by supporting small- and mid-cap projects with strong fundamentals, organic community bases, sustainable business models, and a dedicated team that acts as responsible participants in the industry.”

Binance is responding to the trend of launching projects with high market capitalizations while many tokens remain locked.

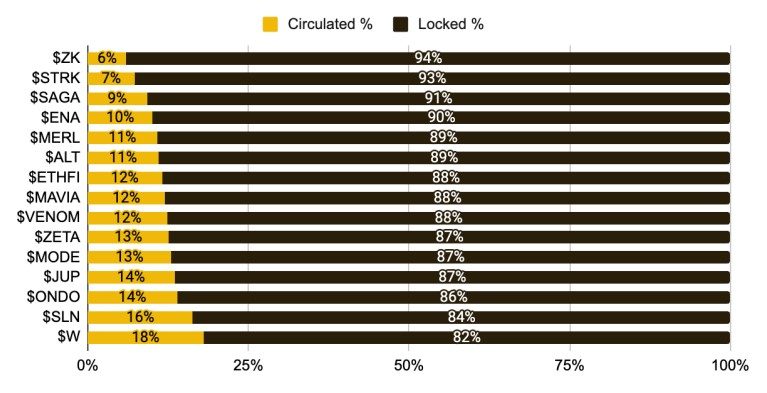

Binance Research emphasized that launching with a low circulating supply has become prevalent among token projects, resulting in a significant portion of the token supply being allocated for future releases.

According to the report, these tokens experience rapid price appreciation under bullish market conditions. This is attributed to the limited liquidity available during the launch phase.

Binance writes: “However, it is evident that this type of price surge is unsustainable when a wave of token supply hits the market upon unlocking.”

In May 2024, approximately $3 billion worth of crypto tokens are scheduled to be unlocked. Projects like Sui and Pyth Network are expected to unlock over $1 billion worth of crypto tokens, allocated to various crypto holders, including early investors.

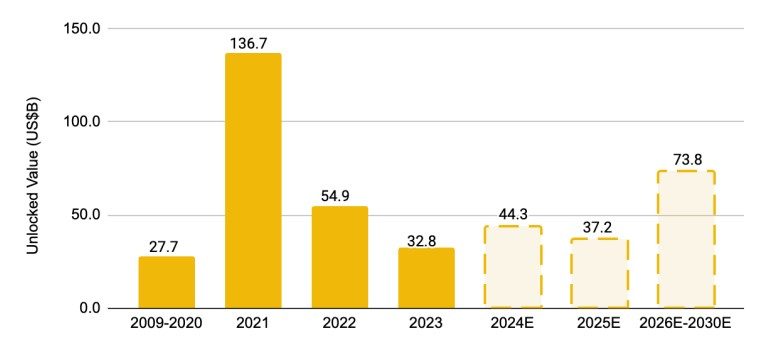

Citing data from Unlock Token and CoinMarketCap, Binance estimates that approximately $155 billion worth of tokens will be unlocked from 2024 to 2030.

The exchange notes that the influx of tokens will create significant selling pressure in the market without a corresponding increase in demand and inflows.