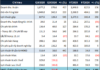

VNG Corporation (stock code: VNZ) has released its 2023 audited financial statements, reporting a 12% year-on-year decline in revenue to VND 7,593 billion. The company incurred a net loss of over VND 2,100 billion in 2023, doubling its losses from the previous year. Compared to the self-prepared report of VND 540 billion, the net loss increased fourfold.

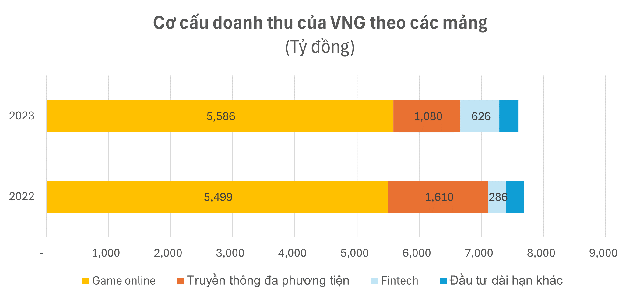

For the first time, VNG disclosed details about its business segments. Despite investing in multiple business areas, online gaming remains its primary source of revenue and profits.

According to VNG’s financial statements, the online gaming segment generated the highest revenue of VND 5,482 billion, accounting for 72% of the total. Revenue from this segment increased by a modest 1% compared to the previous year. It was also the only profitable business segment for the company, contributing VND 391 billion in profits, although this figure represents a 60% decrease from the previous year.

VNG’s online gaming segment is handled by its subsidiary, VNGGames, which publishes and develops games. Starting with the legendary “Vo Lam Truyen Ky,” VNG’s gaming division has made its mark not only in Vietnam but also in the region. Currently, the company publishes a range of popular games, including League of Legends: Wild Rift, PUBG Mobile, and Valorant…

However, the online gaming segment is a rare bright spot in VNG’s business, as all other segments reported losses. The first notable loss-making segment is multimedia, which primarily generates revenue from advertising.

In the past year, advertising revenue for VNG decreased by 33% compared to 2022, amounting to VND 1,080 billion. While this segment used to be a cash cow for the Vietnamese tech unicorn, it recorded a loss of VND 241 billion in 2023, compared to a profit of VND 451 billion in the previous year.

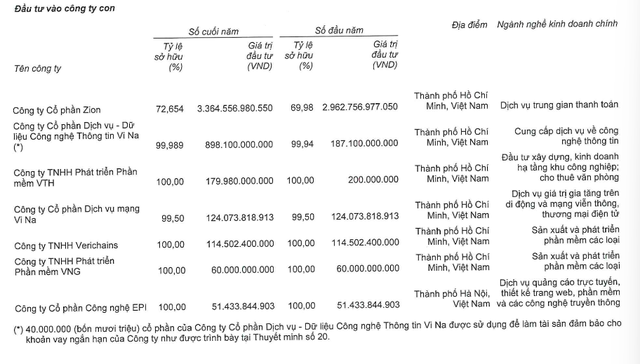

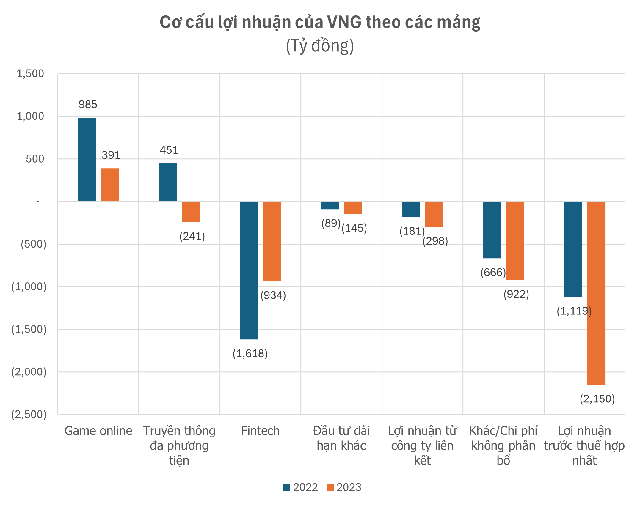

The financial technology services segment incurred the largest loss for VNG, amounting to VND 934.2 billion. However, this figure is half of the loss recorded in the previous year. The most notable product in this segment is the ZaloPay e-wallet, operated by Zion, a company in which VNG holds over 72% ownership.

According to VNG, Zalo Pay has partnered with 39 banks and 5,000+ merchants, and its monthly active user growth reached 51% in 2021. Zalo Pay is also among the top 5 most popular e-wallets in Vietnam. Despite its wide reach, Zalo Pay, along with other business segments, has yet to turn a profit for Zion. The company has incurred losses for six consecutive years from 2017 to 2022 and continued to do so in 2023. The scale of these losses (before tax) amounted to VND 721 billion in the previous year.

In the past year, VNG has continued to invest in Zalo Pay. In the Q4 financial statements, the value of long-term investments increased by 36% from the beginning of the year to VND 4,839 billion. VNG’s ownership stake in Zion increased from 69.98% at the beginning of the year to 72.654%, corresponding to an investment value of nearly VND 3,365 billion, an increase of VND 190 billion compared to the end of Q3 and over VND 400 billion compared to the beginning of the year.