Illustration

Oil Rises 1% on Hopes of Stronger Demand

Oil prices climbed 1%, with Brent crude registering its first weekly gain in three weeks, after economic indicators from the world’s top two oil consumers – China and the US – bolstered hopes for higher demand.

Brent crude futures settled at $83.98 a barrel, up 71 cents, or 0.9%. US West Texas Intermediate (WTI) crude rose 83 cents, or 1.1%, to $80.06. For the week, Brent rose about 1%, while WTI gained 2%.

China’s industrial output increased 6.7% year-over-year in April as the country’s manufacturing recovery gained momentum, suggesting that demand could strengthen in the coming months. China also announced significant steps to stabilize its crisis-hit property sector.

The drawdown in oil and refined product inventories at global trading hubs also created optimism about demand, reversing the trend of rising stockpiles that had weighed on crude prices in previous weeks. The US oil rig count rose by 1 this week to 497, the first increase in four weeks.

Recent US economic indicators have provided optimism about global oil demand. US consumer prices rose less than expected in April, fueling expectations for lower interest rates.

Gold Posts Second Weekly Gain, Silver Hits 11-Year High

Gold prices notched a second straight weekly gain, buoyed by renewed hopes for US interest rate cuts and Chinese stimulus measures. Spot gold rose 1.5% to $2,412.83 per ounce by 17:45 GMT, heading towards its all-time high of $2,431.29 reached on April 12, 2024.

US gold futures settled up 1.3% at $2,417.40. Spot gold prices climbed over 2% this week.

Silver prices broke through the $30 barrier to hit an 11-year high. Spot silver rose 4.8% to $31.02 per ounce after breaching the key resistance level of $30. Platinum gained 2.3% to $1,081.37, after hitting a one-year high on Thursday. The metal has climbed 9% this week. Palladium rose 1.2% to $1,007.

Copper Hits 26-Month High, Nickel Reaches 9-Month Peak

Nickel prices surged to a nine-month high amid unrest in top producer New Caledonia, while copper climbed to a 26-month peak after China announced new support for its property sector.

Three-month nickel on the London Metal Exchange (LME) closed up 5.2% at $20,820 a ton after touching $21,365, the highest since August 2023.

Analyst Dan Smith stated that the upward momentum in nickel and copper could continue in the short term as speculators keep buying, but the fundamental supply-demand dynamics will eventually drive a correction, especially for nickel.

On the LME, copper rose 2.3% to $10,662 a ton, its strongest level since March 2022. Aluminum gained 1.1% to $2,614 a ton, zinc climbed 2.3% to $3,027.50, tin rose 2.1% to $34,445, and lead fell 0.5% to $2,283.50.

Iron Ore Climbs to One-Week High on China’s Property Stimulus

Iron ore futures extended their gains to a one-week high and are on track for a weekly rise, supported by recovering consumption and brighter demand prospects in China due to the latest property stimulus efforts.

The September iron ore contract on the Dalian Commodity Exchange (DCE) in China finished the trading day up over 2.18% at 891.5 yuan ($123.47) per ton, its highest since May 8. Prices rose 2.8% for the week.

The June 2024 iron ore contract on the Singapore Exchange climbed 1.37% to $118.15 a ton, its highest since May 8. Prices have advanced 1.8% this week.

Real estate investment in China fell 9.8% in the first four months of 2024 compared to a year earlier, following a 9.5% drop in the first quarter. Additionally, China’s new home prices fell at the fastest monthly pace in over nine years in April.

On the Shanghai Futures Exchange, rebar rose 1.34%, hot-rolled coil gained 0.97%, wire rod climbed 1.16%, and stainless steel added 1.84%.

China’s crude steel output in April fell 2.6% from the previous month and 7.2% from a year earlier to 85.94 million tons. Crude steel production in the first four months of the year declined 3% to 343.67 million tons.

Coffee Rises, Cocoa Falls Over 20% for the Week, a Two-Month Low

Cocoa futures on ICE fell over 20% for the week, touching a two-month low. Cocoa for July in New York fell 0.1% to $7,384 per ton. Meanwhile, London cocoa for July 2024 dropped 108 pounds, or 1.7%, to £6,121 per ton. Prices declined 24% for the week.

The Ivory Coast Coffee and Cocoa Council (CCC) suspended around 40 cooperatives that were suspected of illegally stockpiling cocoa beans to sell them at higher prices to exporters struggling to fulfill their contracts, according to two sources.

Robusta coffee for July 2024 rose $98, or 2.9%, to $3,518 per ton. Arabica coffee for July 2024 climbed 4.4% to $2,066 per lb.

The USDA forecast that coffee production in three key Central American countries would remain largely stable as the region faced weather crises and labor shortages.

Sugar Falls 6% for the Week

Meanwhile, raw sugar fell back to its lowest level in 18 months from the previous session. Sugar futures for July dropped 0.2 cents, or 1.1%, to 18.13 cents per lb after dipping to an 18-month low of 17.95 cents on Thursday. Prices for the July contract fell 6% for the week. White sugar for August delivery declined 0.3% to $534.70 per ton.

Wheat Falls After Forecast of Higher Yields in Kansas

Wheat futures in Chicago declined after forecasts of above-average yields in Kansas, the top US wheat-growing state, according to analysts.

The July wheat contract on the CBOT fell 12 cents to $6.51-1/4 per bushel. Prices dropped about 1.9% for the week, reversing from a 10-month high on Wednesday due to concerns about adverse crop weather in Russia, the world’s largest wheat exporter.

Corn Falls on Improved US Weather Forecasts

Corn futures settled lower, driven by improved weather forecasts in the US. The July corn contract on the CBOT fell 4-1/2 cents to $4.52-1/2 per bushel.

Soybeans Extend Gains on Poor Weather in Brazil

Soybeans, on the other hand, expanded their gains as forecasts of increased rainfall in southern Brazil raised concerns about crop damage from flooding. The July soybean contract rose 11-3/4 cents to $12.28 per bushel.

Japanese Rubber Prices Rise on Thai Weather Concerns

Japanese rubber futures rose for the fifth straight session on Friday, tracking higher physical prices in top producer Thailand due to concerns about prolonged unfavorable weather, while stronger oil prices also provided support.

The October 2024 rubber contract on the Osaka Exchange climbed 5.3 yen, or 1.64%, to 327.8 yen ($2.10) per kg. Prices rose over 7% this week.

The September rubber contract on the Shanghai Futures Exchange (SHFE) gained 150 yuan, or 1.03%, to 14,720 yuan ($2,037.17) per ton.

Thailand’s benchmark smoke sheet grade three rubber (RSS3) hit a near one-month high of 86.29 baht ($2.38) per kg on Thursday.

Thailand’s Meteorological Department warned of “severe weather conditions,” “heavy to very heavy rainfall,” and “flash floods” in the upper part of the country from May 17-22.

Rubber futures for June on the SICOM exchange in Singapore settled 0.2% lower at 169 US cents per kg.

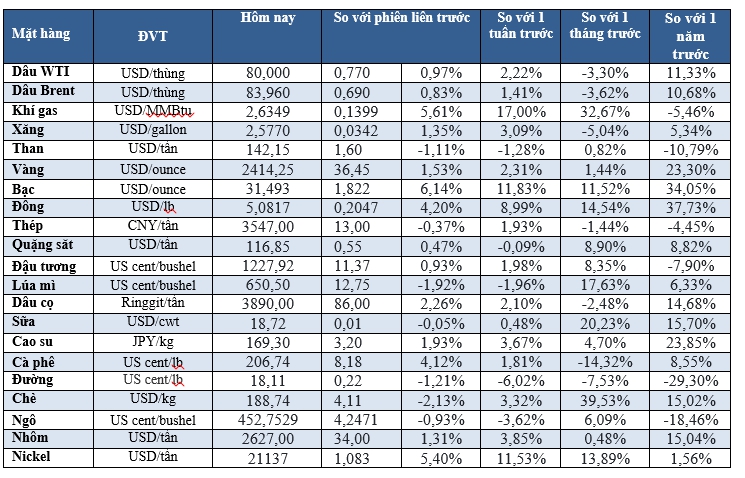

Prices of Key Commodities on May 18, 2024