The rice giant of An Giang, Loc Troi, had high hopes for its strategic shift towards a stronger focus on the rice industry, aiming to capitalize on the significant export opportunities in the 2022-2023 period. However, poor cash flow management, high debt, and advancing production funds to farmers have led to a challenging financial situation for the company.

In 2023, while Loc Troi’s rice exports propelled the segment’s revenue to a record high of VND 11,233 billion, its gross profit stood at a meager VND 253 billion. Consequently, the group’s rice gross profit margin dipped to 2%, a decline from the previous year’s figure of 2.9%.

This thin profit margin in the rice industry was acknowledged by Loc Troi’s representatives during their 2023 Annual General Meeting of Shareholders. To procure and process rice for export, Loc Troi had to provide interest-free advances for production, seeds, and other expenses to farmers. Meanwhile, the company faced high borrowing costs from banks during a period of challenging capital market conditions, eroding the profits generated.

Increasing rice exports, diminishing corporate profits

Loc Troi is not alone in this predicament, as many prominent players in the rice industry concluded 2023 with lackluster results. Despite higher revenues driven by robust exports, these companies grappled with razor-thin profits and witnessed significant declines in their gross profit margins.

According to data from the Ministry of Agriculture and Rural Development, Vietnam exported approximately 8.29 million tons of rice in 2023, generating USD 4.78 billion in revenue. This represented a 16.7% increase in volume and a remarkable 38.4% surge in value compared to 2022, marking a historic high in Vietnam’s over 30-year participation in the global rice trade.

The year 2023 also witnessed a growing appetite for Vietnamese rice among importing nations. The strong international demand propelled Vietnam’s average rice export price to successive peaks, culminating in a high of USD 663 per ton in early December 2023, surpassing competitors and claiming the top spot globally.

Paradoxically, as revenues climbed, profits dwindled due to elevated borrowing costs and the pressure of purchasing rice from farmers. Notably, the Vietnam Plant Variety Joint Stock Company (NSC) maintained a relatively high gross profit margin of 31%, albeit with a near 4% decline.

Some industry giants even reported losses. For instance, Trung An High-tech Agriculture Joint Stock Company (TAR), despite achieving a remarkable 18% revenue increase to VND 4,484 billion, slipped into a post-tax loss of over VND 19 billion. In contrast, the company had recorded a profit of VND 75 billion in 2022. TAR’s gross profit margin also contracted from 4.2% to 2.9% during this period.

Cement companies struggle despite public investment wave

Similarly, cement companies found themselves in hot water due to ineffective inventory management and cash flow issues, despite the anticipated benefits from the wave of public investment.

Recently, HNX announced a list of unprofitable cement manufacturers ineligible for margin trading in 2023, including prominent names such as Bim Son Cement Joint Stock Company (BCC, with a net loss of over VND 227 billion), Vicem But Son Cement Joint Stock Company (BTS, net loss of over VND 96 billion), Hai Phong Cement Joint Stock Company (HCT, incurring its first loss in many years), and Vicem Hoang Mai Joint Stock Company (HOM, unexpectedly losing over VND 31 billion after consecutive profitable years).

While public investment was expected to provide a much-needed boost to the economy and related industries, including cement, at the beginning of 2023, its impact was not immediate due to the lag in capital disbursement.

Vicem Hoang Mai, for instance, has consecutively secured contracts to supply cement to the Nghe An Provincial Finance Department for rural development projects. However, a significant portion of the revenue remains in “accounts receivable,” indicating that payments are yet to be received.

Leaders of some companies involved in public investment projects acknowledge that while this sector provides a stable source of revenue to sustain operations and pay employee salaries, the profit margins tend to be relatively low.

At Vinaconex’s Annual General Meeting of Shareholders earlier this year, Mr. Dao Ngoc Thanh, Chairman of the Board of Directors, attributed the modest profit margins in public investment projects to fluctuations in material prices, rising labor costs, and prolonged settlement and payment processes.

In mid-2023, Mr. Ha Quang Hien, Chief of Office of the Vietnam National Cement Corporation (Vicem), also noted that the company’s production and consumption targets, both domestically and in exports, had not been met despite various measures implemented to boost sales.

Overall, the long-term and sustainable momentum for the cement industry hinges on the recovery of the real estate sector and the performance of the clinker export market.

Soaring coffee prices, plunging corporate profits

The coffee industry presents another paradox, with soaring prices leading to plunging corporate profits.

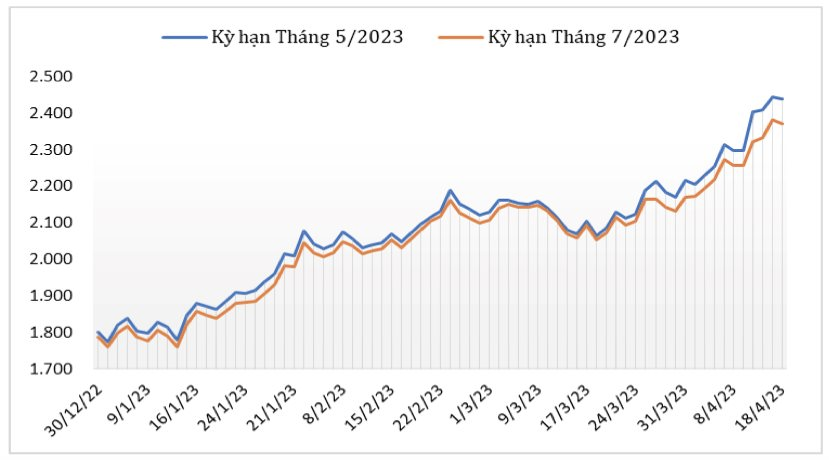

In the first quarter of 2024, coffee prices climbed steadily due to concerns over supply shortages. While prices ranged from VND 59,000-60,000/kg in November 2023, they surged to VND 62,000-69,000/kg in December. This upward trend continued into January 2024, reaching VND 82,000/kg, and further escalated to VND 86,000/kg in early March, settling at VND 94,500/kg currently.

Consequently, the price of Vietnamese Robusta coffee has soared to the highest level globally, surpassing even India. One would assume that Vietnamese coffee traders are reaping substantial benefits from this price surge. However, according to industry insiders, while the demand for coffee bean purchases has intensified, the supply remains scarce. Farmers are hoarding their beans due to high prices, leaving traders with insufficient inventory to fulfill their commitments to processing companies, who, in turn, are facing losses from buying high and selling low.

Photo: In early 2024, Vietnamese coffee prices soared to the highest level globally.

This situation has placed Vietnamese coffee exporters in an unprecedented predicament, with some even incurring record losses. Mr. Nguyen Ngoc Luan, founder of Meet More agricultural coffee brand in Hoc Mon, Ho Chi Minh City, shared that the doubling of coffee prices compared to the previous year has pushed processing companies into a bind. With input costs soaring to VND 85,000-95,000/kg, these companies cannot raise their selling prices due to previously signed contracts with fixed prices around VND 50,000-60,000/kg.

Mr. Luan emphasized that companies have never faced such a challenging situation, as coffee prices typically don’t fluctuate to this extent. Meet More, for instance, is reluctant to sign new contracts at low prices. The company is currently shouldering losses and hopes to endure until June 2024.

Similarly, Mr. Nguyen Duc Hung, CEO of Napoli Coffee, a franchise system with over 2,000 stores nationwide, revealed that his company is also “absorbing losses” due to skyrocketing raw material prices. According to Mr. Hung, their current inventory can only fulfill 70% of their export commitments. For the remaining 30%, the company has no choice but to pay penalties for contract cancellations, as their overseas partners refuse to adjust prices by 5-10%. Continuing with these exports would only deepen their losses.