Diên Vĩ was found to have failed to disclose or delayed the disclosure of a series of bond-related documents, violating regulations. Specifically, the company did not publish a report on the bond issuer’s fulfillment of commitments to bondholders for 2022. Additionally, they disclosed the following documents past the deadline: Report on the use of proceeds from the 2021 bond issuance; Financial Statements for 2021 and the first half of 2023; and Interest and Principal Repayment Status for 2021.

As a consequence of these violations, Diên Vĩ was fined 92.5 million VND.

Currently, Diên Vĩ has three bond issues outstanding in the market, totaling DVRCH2124001, DVRCH2125002, and DVRCH2126003, which were issued in October 2021. Lots 4001 and 5002 each comprise 3,000 bonds with a face value of 100 million VND, raising 300 billion VND each, while Lot 6003 consists of 3,860 bonds, raising 386 billion VND. All three were issued on October 1, 2021, with Lot 4001 having a three-year term, Lot 5002 a four-year term, and Lot 6003 a five-year term.

The purpose of the issuance was for Diên Vĩ to acquire a 70% stake in Khang An – Nhơn Trạch, as per the share transfer agreement dated July 15, 2021, between Diên Vĩ and Mr. Nguyễn Hoàng Minh. The assets of Khang An – Nhơn Trạch were also used as collateral for Lot 001, along with all of Diên Vĩ’s capital contributions (70% of charter capital) in Khang An – Nhơn Trạch.

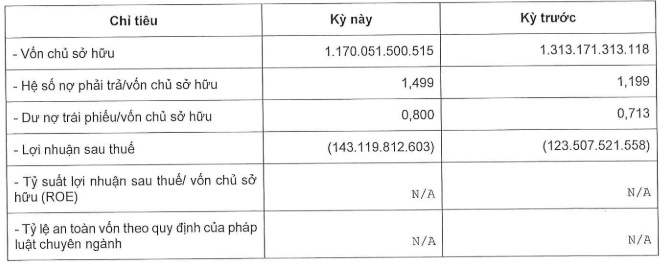

In terms of financial performance, Diên Vĩ recorded a loss of nearly 124 billion VND in 2022. This loss continued into 2023, with the company incurring a further loss of 143 billion VND. As of the end of 2023, the bond debt-to-equity ratio was 0.8, corresponding to a total bond debt of approximately 936 billion VND.

|

Diên Vĩ’s Financial Ratios for 2023

Source: CBonds

|

Châu An