Market liquidity increased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 957 million shares, equivalent to a value of more than 23.3 trillion VND. The HNX-Index reached nearly 100 million shares, equivalent to a value of more than 1.9 trillion VND.

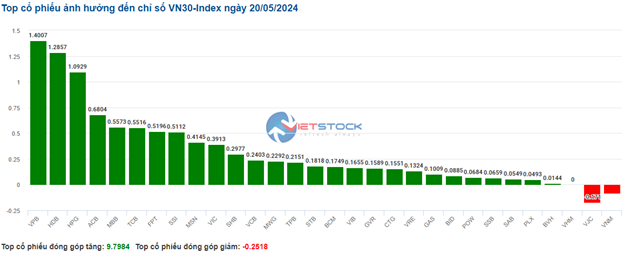

The VN-Index opened the afternoon session on a less favorable note, with strong and continuous fluctuations as selling pressure gradually increased towards the end of the session. However, efforts from the buyers kept the index above the reference level at closing. In terms of impact, BCM, VPB, HPG, and HDB were the codes with the most positive influence on the VN-Index, with nearly 3 points gained. On the opposite side, FPT, VHM, VJC, and VNM were the codes with the most negative impact, taking away more than 1.5 points from the overall index.

| Top 10 stocks impacting the VN-Index on May 20, 2024 |

The HNX-Index followed a similar trajectory, with positive influences from codes such as PVI (5.07%), NTP (9.81%), BAB (4.1%), and KSV (5.9%)…

|

Source: VietstockFinance

|

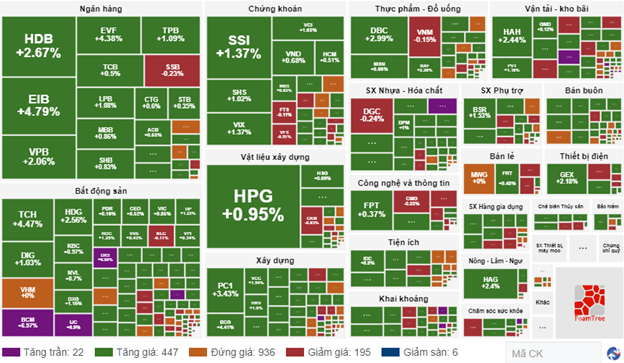

The insurance industry was the group with the strongest growth, up 3.89%, mainly driven by codes such as MIG (+6.98%), BIC (+6.86%), BVH (+3.67%), and PVI (+5.07%). This was followed by the consulting services industry and the household goods manufacturing industry, with increases of 2.28% and 1.37%, respectively.

On the other hand, the technology and information industry recorded the largest decline in the market, down -0.48%, mainly due to the code FPT (-1.12%), CTR (-2.53%), and CMG (-3.75%).

In terms of foreign trading, they continued to net sell more than 808 billion VND on the HOSE exchange, focusing on codes such as VHM (203.28 billion), VNM (144.45 billion), MWG (105.66 billion), and VPB (83.05 billion). On the HNX exchange, foreigners net sold more than 55 billion VND, focusing on SHS (21.94 billion), CEO (16.61 billion), and IDC (9.21 billion).

| Foreign trading net buying and selling dynamics |

Morning Session: Selling pressure increases, VN-Index cools down

The market opened on a positive note, with a gap of more than 9 points from the previous session. However, selling pressure emerged towards the end of the morning session, causing difficulties for the market. At the end of the morning session, all three exchanges maintained their gains, although the increase narrowed compared to the beginning. The VN-Index rose 5.68 points, temporarily standing at 1,278.79 points, while the HNX-Index gained 1.04 points to reach 242.58 points.

The trading volume of the VN-Index recorded in the morning session exceeded 524 million units, with a value of more than 12 trillion VND. The HNX-Index recorded a trading volume of nearly 56 million units, with a trading value of over 1 trillion VND.

The consulting services industry is leading the market with a solid increase of 2.56%. Within this sector, the TV2 stock has continued its impressive growth in recent sessions, with a recorded increase of 3.81% in the morning session.

Stocks in the seafood group, including VHC, ANV, ASM, IDI, and DAT, all ended the morning session with positive growth. In contrast, stocks such as FMC, CMX, and ACL turned red at the end of the morning session, with decreases of 1.76%, 0.22%, and 0.4%, respectively.

Money flow remained robust in the insurance group, with stocks such as PVI (+2.53%), MIG (+2.91%), BMI (+2.54%), and BVH (+0.37%) performing well. The remaining stocks in this group, including VNR, PGI, PTI, and PRE, remained unchanged.

On the other hand, the auxiliary production industry did not witness much positive growth from the beginning of the session. Stocks such as AGG, PTB, DHC, HTP, HHP, and DLG all declined, while the remaining stocks in the group saw negligible increases.

10:45 am: Money flow favors banking stocks, VN-Index maintains its upward momentum

The market continued its positive momentum after a three-session winning streak. The trio of banking, real estate, and securities industries took the lead in driving the current uptrend.

The breadth of stocks in the VN30 basket was overwhelmingly positive, with 28 gainers. On the upside, the banking group stood out, with four stocks among the top contributors to the VN30 index’s gain: VPB, HDB, ACB, and MBB, contributing 1.4 points, 1.29 points, 0.68 points, and 0.56 points, respectively. Conversely, VJC and VNM were the rare losers, but their declines were not significant.

Source: VietstockFinance

|

Within the leading industries, the banking group recorded the highest trading value, reaching 1,800 billion VND, with a trading volume of over 90 million units. The group saw an overwhelming majority of gainers, with 18 out of 21 stocks in the green. Notable performers included VCB, up 0.44%; BID, up 0.71%; CTG, up 0.6%; and TCB, up 0.5%…

Additionally, from a technical analysis perspective, the EVF stock is currently experiencing a rebound with an increasing trading volume above the 20-session average. Its MACD and Stochastic Oscillator are also pointing upwards after generating buy signals. These indicators suggest a potential recovery for this stock.

Source: https://stockchart.vietstock.vn/

|

The real estate group ranked second in terms of trading value, reaching over 1,600 billion VND by 10:30 am. The trading volume exceeded 78 million units, with the majority of gainers being large-cap stocks such as VIC, up 0.75%; VRE, up 0.43%; BCM, at the upper limit; and KBC, up 1.14%… Only a few stocks remained in the red, but the selling pressure was not significant, including VHM, NLG, and D2D.

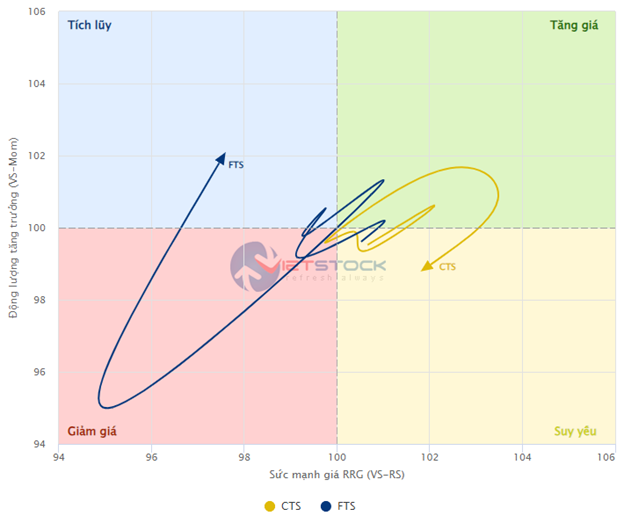

Following closely was the securities sector, which also witnessed a broad-based advance. Major stocks such as SSI rose 1.37%, VND gained 0.68%, VCI climbed 1.52%, SHS increased 1.02%, and HCM edged up 0.17%. Meanwhile, FTS and CTS, which had high RS scores previously, moved in the opposite direction, falling 0.22% and 0.12%, respectively.

Source: VietstockFinance

|

The market breadth favored the bulls, with more than 440 gainers versus around 190 losers. The VN-Index rose over 10 points to 1,283 points, while the HNX-Index gained 0.89%, hovering around 243 points. The UPCoM-Index climbed 0.41%.

Source: VietstockFinance

|

The total trading volume across the three exchanges surpassed 400 million units, equivalent to a value of over 9.3 trillion VND. A notable point was the strong selling pressure from foreign investors, who net sold more than 386 billion VND, focusing on VHM, HPG, and VNM.

Furthermore, it is worth mentioning that foreign investors have consistently net sold VHM for the past four months, and the trading value has been increasing. Since the beginning of May, they have net sold more than 3,300 billion VND of this stock.

| Foreign investors continuously net sell VHM |

Opening: Positive momentum with a sea of green

The VN-Index opened the morning session on a strong note, with most sectors trading in positive territory. The real estate sector made the most significant contribution to the market’s gains.

As of 9:30 am, the real estate sector, with a gain of 1.05%, was the main driver of the market’s upward momentum. BCM led the sector, surging 4.25%, followed by TCH, up 3.68%; VHM, up 0.61%; VIC, up 0.43%; VRE, up 0.87%; NVL, up 1.05%; KDH, up 0.68%; PDR, up 0.58%; KBC, up 1.3%; and DIG, up 0.51%… All of these stocks contributed significantly to the index’s rise.

Additionally, the securities sector maintained its solid performance from the start, with a gain of 0.79%. Notable performers within the sector included SSI, up 1.1%; HCM, up 0.51%; VND, up 0.91%; BSI, up 0.17%; VIX, up 0.82%; VDS, up 1.42%; VCI, up 0.51%; SHS, up 1.02%; and ORS, up 0.66%.