Prior to this payout, industrial park giant IDICO had made two advance dividend payments for 2023, totaling a rate of 35% and a value of VND 1,155 billion.

At the 2024 Annual General Meeting of Shareholders, IDICO approved a profit distribution plan for 2023 with a 40% cash dividend rate. Accordingly, of the total 25% dividend rate for this period, IDICO will pay the remaining 5% dividend for 2023 (equivalent to VND 500 per share) and an advance payment of 20% for the first dividend of 2024 (equivalent to VND 2,000 per share).

With nearly 330 million circulating shares, the company is estimated to have disbursed nearly VND 165 billion to complete the 2023 dividend and VND 660 billion for the first 2024 advance dividend payment. The expected payout date is June 19, 2024.

For 2024, IDC plans to maintain a dividend rate of 40%. If implemented, this will be the third consecutive year that IDC has offered a 40% cash dividend to its shareholders (since 2022).

Regarding this issue, which is of great interest to shareholders, Ms. Nguyen Thi Nhu Mai, Chairwoman of the Board of Directors of IDC, stated that the company aims to maintain a dividend distribution rate of 30-40% for the upcoming years (starting from 2024). This policy is based on the expectation of leasing 120-150 hectares of land annually and generating a cash flow of VND 3-4 trillion from business operations.

Therefore, depending on the investment objectives each year, the Board of Directors will present to the shareholders a dividend distribution plan in cash or shares to ensure the benefits of the shareholders and increase the charter capital according to the roadmap to VND 4.5-5 trillion to match the scale of development of the Corporation.

IDC AGM: Plans to Move to HOSE, Maintain 40% Cash Dividend for How Long?

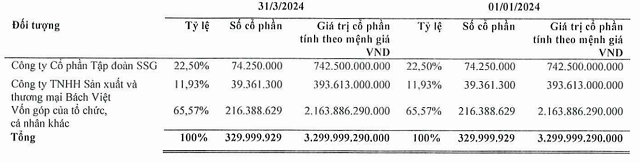

As of the end of March 2024, IDICO had two major shareholders: SSG Group Joint Stock Company, holding 22.5%, and Bach Viet Production and Trading Company Limited, holding 11.93%. Thus, in this dividend distribution, the two shareholders are expected to receive nearly VND 186 billion and over VND 98 billion, respectively.

|

IDC’s Shareholder Structure as of March 31, 2024

Source: IDC

|

In terms of business performance, for the first quarter of 2024, IDC recorded revenue of over VND 2,467 billion, up 115% year-on-year, thanks to one-time revenue recognition from infrastructure leasing contracts in industrial parks totaling nearly VND 1,308 billion, 6.3 times higher than the same period last year. Net profit exceeded VND 695 billion, 4.7 times higher year-on-year.

| IDC’s Financial Performance from Q1/2022 – Q1/2024 |

For 2024, IDICO has set a business plan with a consolidated revenue target of VND 8,466 billion and a pre-tax profit of VND 2,502 billion, representing increases of 13% and 22%, respectively, compared to the previous year. The company has achieved 30% and 40% of these targets, respectively, in the first three months of the year.

As of the close on May 22, 2024, the IDC share price stood at VND 63,600 per share, up 26% since the beginning of the year, with an average trading volume of over 2.2 million shares per session.

Share Price Movement of IDC since the Beginning of 2024