On May 17, Indovina Bank Limited (IVB) announced the sale of five secured non-performing loans, with a total debt value of nearly VND 1,100 billion.

Notably, the list includes a loan of over VND 480 billion from Duong Man Joint Stock Company – a member of Hoa Binh Limited Company (Hoa Binh Group) where Mr. Nguyen Huu Duong (aka Duong “bia”) is the Chairman of the Board of Directors.

Mr. Nguyen Huu Duong (aka Duong “bia”), Chairman of the Board of Directors of Hoa Binh Group

|

As of April 30, Duong Man’s debt obligations equaled the sale price of over VND 480 billion, with the secured assets being real estate and stocks valued at nearly VND 654 billion.

According to the announcement, IVB is selling the entire loan with its original status, including all rights and interests attached to the loan, as well as the right to dispose of the secured assets and other related rights and interests owned by the selling party, before, during, and after the debt sale.

The sale will be on a non-recourse basis, with the price determined by market value and mutual agreement between the parties after obtaining IVB’s approval. IVB will select the buyer based on the principle of the highest bid from complete and valid submissions.

The deadline for receiving applications from organizations and individuals interested in purchasing the debt is May 31, at Indovina Bank Limited, 97A Nguyen Van Troi, Ward 11, Phu Nhuan District, Ho Chi Minh City.

Duong Man is the first and only company in Vietnam and Southeast Asia to produce malt, the main ingredient in beer. With a capacity of over 40,000 tons/year, Duong Man is one of the official malt suppliers to Saigon Beer, Alcohol, and Beverage Joint Stock Company (HOSE: SAB).

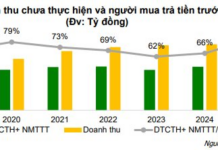

However, Duong Man has been facing continuous losses in its business operations. From 2020 to 2022, the company incurred losses of nearly VND 92 billion, VND 52 billion, and VND 34 billion, respectively. This losing streak continued into 2023, with a loss of nearly VND 51 billion, marking four consecutive years of losses totaling approximately VND 228 billion.

Four Years of Consecutive Losses: Duong Man Fails to Repay Bond Interest and Principal