The Industrial Real Estate Business Landscape in 2023

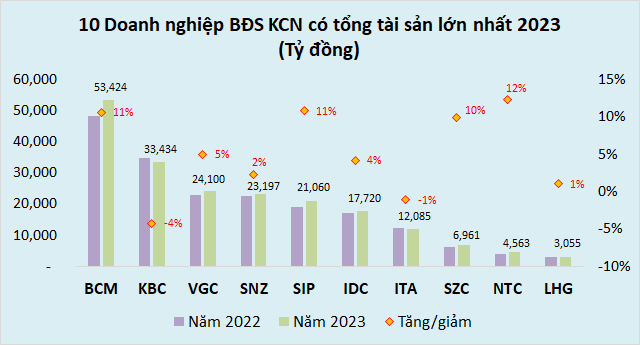

As of the end of 2023, Becamex IDC (HOSE: BCM) was the largest industrial real estate company in terms of total assets, amounting to 53,424 billion VND, an 11% increase from the previous year.

Close behind was Kinh Bac City Development Share Holding Corporation (HOSE: KBC) with 33,434 billion VND, a 4% decrease, followed by Viglacera (HOSE: VGC) with over 24,100 billion VND, a 5% increase, and Sonadezi (UPCoM: SNZ) with 23,197 billion VND, a 2% increase.

Sai Gon VRG Investment Joint Stock Company (HOSE: SIP) and IDICO (HNX: IDC) rounded out the top six with total assets of 21,060 billion VND and 17,720 billion VND, respectively.

|

Source: VietstockFinance |

Contrasting Plans for 2024

Riding on the growth momentum from 2023, many industrial real estate companies have set ambitious targets for 2024.

Notably, KBC, the leading industrial park developer in Northern Vietnam, aims for a consolidated revenue of 9,000 billion VND and a net profit of 4,000 billion VND in 2024, representing a 48% and 78% increase, respectively, from the previous year.

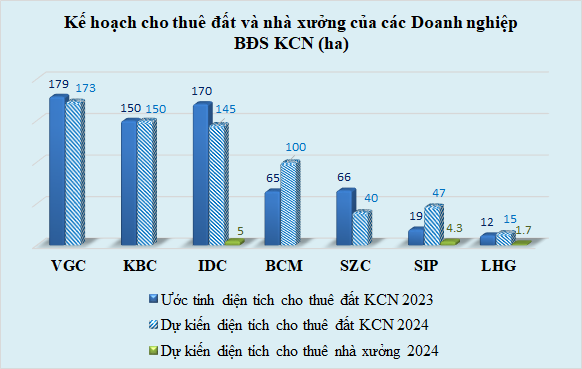

KBC attributes these ambitious goals to the expected lease of approximately 150 hectares of industrial land in industrial parks such as Nam Son Hap Linh, Quang Chau, Tan Phu Trung, and especially Trang Due 3. The company also plans to recognize revenue and profits from several urban area projects this year.

On the other hand, some industrial giants have adopted a more cautious approach, setting conservative business targets for 2024.

For instance, Viglacera has announced a 1% increase in consolidated revenue to 13,353 billion VND for 2024, while expecting a 31% decrease in pre-tax profit to 1,110 billion VND. During the year, the company will focus on leasing land and workshops in various industrial parks and establishing new entities to develop additional industrial parks across Vietnam.

Similarly, Sonadezi has approved consolidated revenue and post-tax profit targets of over 6,366 billion VND and 1,370 billion VND, respectively, for 2024, representing a 10% increase and a slight 2% decrease compared to the previous year. The company plans to allocate a dividend payout of 11% for the year.

Meanwhile, BCM, the industrial powerhouse in Binh Duong, has set a post-tax profit target for 2024 that matches the previous year’s performance, amounting to 1,666 billion VND, alongside a modest 4% increase in total revenue to 7,569 billion VND.

Long-Term Strategies for the Warehouse Business

In 2024, SIP anticipates consolidated revenue of nearly 5,388 billion VND and a post-tax profit of almost 793 billion VND, reflecting decreases of 30% and 21%, respectively, from 2023. The company plans to lease 47 hectares of industrial land and 4.3 hectares of workshop space, mainly in the Phuoc Dong Industrial Park.

SIP’s leadership has shared their intention to construct a 13-hectare ready-built workshop area in the Le Minh Xuan Industrial Park. Additionally, the company is exploring the development of a similar project in the Dong Nam Industrial Park and has already commenced construction in the Loc An – Binh Son Industrial Park.

Mr. Tran Manh Hung, Chairman of SIP, emphasized the future challenges in acquiring land for industrial parks near Ho Chi Minh City and Long Thanh. He stated, “In the future, finding land for industrial parks in these areas will be extremely difficult. Therefore, SIP also intends to leverage its capabilities to create a portfolio of workshops, bringing long-term benefits to the company.”

For the year 2024, Long Hau Corporation (HOSE: LHG) has set a total revenue target of nearly 744 billion VND, a 53% increase from 2023, and a post-tax profit goal of over 131 billion VND, a 21% decrease. Similar to SIP, LHG is optimizing its remaining land resources by attracting high-tech and environmentally friendly customers while also allocating land for the development of rental products and workshops.

Long Hau emphasized that, in addition to seeking and developing additional land in Long An and neighboring provinces, workshops for rent will remain a key focus for the company. Accordingly, in 2024, Long Hau plans to complete and introduce the 3A ready-built workshop project (19-20-21-22) with an area of 17,000 m2 and initiate the construction of a high-rise workshop (phase 2), offering approximately 26,000 m2 of workshop space for rent.

|

Source: VietstockFinance |

Thanh Tu