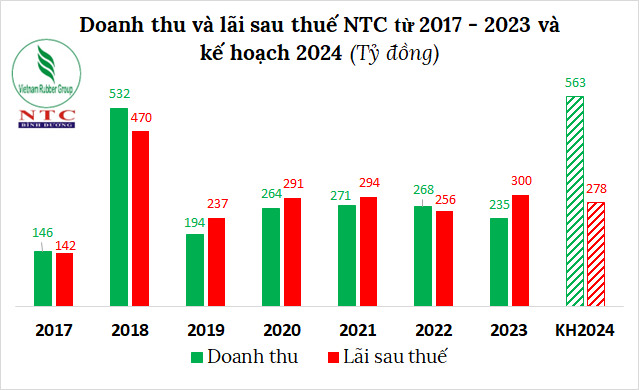

According to the recently published annual general meeting documents for 2024, Nam Tan Uyen has set ambitious targets for the year. The company aims to achieve a record-high operating revenue of over VND 563 billion, marking a 2.4-fold increase from 2023, while targeting a post-tax profit of more than VND 278 billion, a 7% decrease.

Source: VietstockFinance

|

In terms of investment and construction plans, the company has allocated a budget of VND 112 billion for additional capital contribution to the Joint Stock Company of Bac Dong Phu Industrial Park, and nearly VND 316 billion for infrastructure projects in the Nam Tan Uyen Industrial Park (NTC-1), its expansion phases 1 and 2 (NTC-2 and NTC-3), as well as for repairs of the M1 module 2 factory, the fire protection system in factory A2, and housing in the expanded industrial park. The company also plans to select contractors and procure a frame press machine.

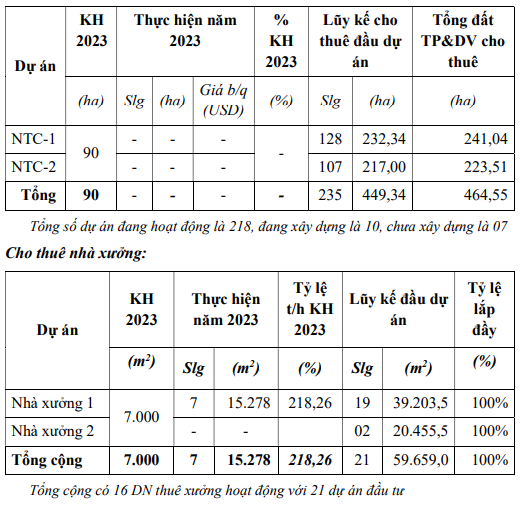

Nam Tan Uyen has set a target to lease 90 hectares of industrial land and 20,000 square meters of built-up factories in 2024. Notably, the company did not lease any land in 2023, falling short of its plans. However, they exceeded their target for factory leasing, achieving 2.2 times the planned area.

|

NTC did not lease any land in 2023

Source: NTC

|

Addressing this issue, NTC attributed the challenges to the difficult economic climate globally and in Vietnam, which impacted investment attraction and business operations. Additionally, the company explained that while they have been allocated land for the NTC-2 project by the Binh Duong provincial People’s Committee, the lack of rental price information has prevented them from proceeding with infrastructure development and subsequent land leasing as planned.

As of December 31, 2023, NTC had signed 235 land lease contracts with enterprises in the existing and expanded industrial parks.

In terms of financial performance, Nam Tan Uyen reported a slight decrease in revenue and profit for the first quarter of 2024. The company recorded a 2% decline in net revenue compared to the same period last year, amounting to nearly VND 57 billion, while post-tax profit decreased by 18% to over VND 65 billion. These results represent 13% and 7% of the annual plan, respectively.

| Financial performance of NTC from Q1/2022 to Q4/2024 |

The company attributed the decrease in profit to a nearly 22% drop in financial income, totaling VND 44 billion, mainly due to lower dividends received from external investments.

Nam Tan Uyen’s profit retreats 18% in Q1