Motorcycle Data (McD), a renowned consultancy and research firm specializing in the two-wheeled industry, has released statistics on the largest motorcycle markets globally, based on data from over 90 countries. Interestingly, McD also collects data on other two-wheeled vehicles, such as ATVs and tuk-tuks, as well as three-wheeled vehicles.

According to McD’s insights, global motorcycle sales reached 15.3 million units in the first quarter of 2024, reflecting a modest 0.9% growth compared to the same period last year.

| Q1 2024 Sales | |

|---|---|

| India | 4,563,416 |

| China | 3,712,540 |

| Indonesia | 1,784,601 |

| Vietnam | 660,459 |

| Philippines | 593,018 |

| Thailand | 545,796 |

| Brazil | 430,510 |

| Mexico | 335,581 |

| Pakistan | 248,483 |

| Turkey | 242,586 |

India, the world’s most populous country, takes the top spot as the largest motorcycle market globally. With over 4.5 million units sold in the first quarter of 2024, India’s market showed a significant 20.6% growth year-on-year.

China, the second-largest market, trailed behind with approximately 850,000 fewer sales. China’s motorcycle sales reached 3.7 million units in the first three months of 2024. The country has also been a prime destination for automotive and motorcycle brands like Honda, as it boasts the largest automobile market globally.

Hero Splendor, India’s best-selling motorcycle in 2023.

Indonesia, the third-largest market globally and the leader in Southeast Asia, sold nearly 1.8 million motorcycles in Q1 2024. However, this figure represents a 4% decline compared to the same period in 2023. Indonesia is a highly attractive market for automotive and motorcycle manufacturers in the region, given its large consumer base.

Vietnam, ranking fourth globally, sold 660,459 motorcycles in the first quarter of 2024, a 6% decrease year-on-year. McD’s report for the first four months of 2024 revealed a further decline, with sales reaching 904,684 units, indicating that April sales were lower than expected.

Vietnam, the fourth-largest motorcycle market in the world for Q1 2024.

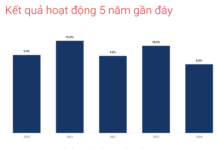

McD’s analysis suggests that the Vietnamese motorcycle market peaked in 2022 before declining in 2023. While there were initial expectations for growth in 2024, the current data paints a less optimistic picture.

According to McD, the overall Vietnamese motorcycle market is shrinking, with scooter sales down 5.8% and manual transmission motorcycle sales plunging by 16.1%.

In the two-wheeled vehicle segment with engine displacement below 50cc or a maximum speed below 45km/h, sales dropped by 28.4%. Conversely, two-wheeled vehicles with engine displacement above 50cc and a maximum speed above 45km/h saw a sales increase of 10.8%.

McD also highlighted that Honda and Yamaha are the leading motorcycle brands in Vietnam. While Honda managed a slight growth of 0.3% in the first four months of the year, Yamaha experienced a significant decline of 21.6%.