Illustration.

Oil Prices Rise

Oil prices rose 1% but ended the week lower as strong US economic data raised concerns about extended rate hikes and fuel demand.

Brent crude for July 2024 delivery settled 76 cents higher at $82.12 a barrel, while the August 2024 contract rose 73 cents to $81.84. WTI crude gained 1.1%, or 85 cents, to $77.72.

In the previous session, Brent touched its lowest since February 7, and WTI hit its lowest since February 23.

For the week, Brent fell 2.1%, its fourth straight weekly loss and the longest losing streak since January 2, 2024. WTI posted a weekly decline of 2.8%.

US Natural Gas Falls to 1-Week Low

US natural gas prices fell 5% to a one-week low as forecasts for milder weather and ample supplies outweighed support from a sharp rise in European prices.

Front-month Nymex gas futures fell 13.7 cents, or 5.2%, to $2.52 per million British thermal units (mmBtu) – its lowest since May 16. For the week, gas prices fell about 4% after surging 63% in the previous three weeks.

Gold and Silver Prices Climb

Gold prices rose as the US dollar weakened, but posted their biggest weekly decline in five weeks amid dashed hopes for a rate cut by the Federal Reserve.

Spot gold on LBMA was up 0.2% at $2,332.77 an ounce, as the dollar index fell 0.4%, making gold cheaper for holders of other currencies. Gold for June 2024 delivery on New York’s COMEX fell 0.1% to $2,334.50.

On May 20, 2024, gold hit a record high of $2,449.89, but has fallen over $100 since then. For the week, gold was down about 3%, its biggest weekly decline since early December 2023.

Silver rose 0.5% to $30.25, after hitting an 11-year high in the previous session.

Copper Prices Slip

Copper prices fell on concerns about higher interest rates and weaker demand in top consumer China.

Three-month copper on the London Metal Exchange fell 0.8% to $10,331.50.

On May 20, copper hit a record high of $11,104.50, fueled by speculative buying, but ended the week down about 3%, its biggest weekly decline since the week ending February 9, 2024.

Demand in top consumer China has been dampened by high prices.

Additionally, stronger economic data from the US and Germany bolstered expectations for prolonged higher interest rates on both sides of the Atlantic, pushing copper prices lower.

Iron Ore Falls, Steel Rebars Rise

Iron ore futures on the Dalian Commodity Exchange fell but posted a second straight weekly gain as demand improved in top consumer China following a series of stimulus measures for the property sector.

The September 2024 iron ore contract on the Dalian exchange ended down 0.44% at 908 yuan ($125.33) a ton. For the week, iron ore gained 2.6%.

Meanwhile, the June 2024 iron ore contract on the Singapore Exchange rose 1% to $120.75. Iron ore posted a weekly gain of 2.9%.

On the Shanghai Futures Exchange, steel rebar rose 0.19%, hot-rolled coil added 0.1%, while stainless steel and galvanized coil fell 0.74% and 0.1%, respectively.

Japanese Rubber Prices Post Longest Weekly Gain in 4 Months

Rubber prices in Japan rose for a third straight session and posted their longest weekly winning streak in four months, tracking gains in top producer Thailand and a weaker yen.

The October 2024 rubber contract on the Osaka Exchange (OSE) rose 3.4 yen, or 1.04%, to 331.3 yen ($2.11) per kg – its highest since April 9, 2014. For the week, rubber gained 2.89%, marking a third straight weekly gain and the longest such streak since late January.

Meanwhile, the September 2024 rubber contract on the Shanghai Futures Exchange rose 100 yuan to 15,025 yuan ($2,073.84) per ton.

Rubber for June 2024 delivery on Singapore’s SICOM gained 1.2% to 173.9 US cents per kg.

Coffee Prices Climb

Robusta coffee prices rose nearly 2% and posted an 11% weekly gain, supported by speculative buying, although doubts grew about the sustainability of the rally as supplies improved.

July 2024 robusta coffee on the Liffe rose $73, or 1.9%, to $3,892 a ton, after falling 2.5% in the previous session.

Arabica coffee for July 2024 delivery on ICE rose 1.2% to $2,182.50. For the week, arabica coffee gained 4.8%.

Sugar Prices Sweeten

Raw sugar futures for July 2024 delivery on ICE rose 0.15 cent, or 0.8%, to 18.41 cents per lb. For the week, sugar prices gained 1.5%.

Meanwhile, the August 2024 white sugar contract on the London market climbed 1.1% to $545.90 a ton.

Output in Brazil’s key center-south region in the first half of May 2024 is expected to rise 6.3% from a year earlier to 2.7 million tons, analysts at S&P Global Commodity Insights said.

The US Department of Agriculture projects sugar production for the 2024/25 season (October 2024 to September 2025) to rise to a record 186 million tons, while demand is seen at an all-time high of 178.8 million tons.

Wheat, Corn, and Soybean Prices Surge

US wheat futures held steady but posted a weekly gain of 7% on concerns about lower output in Russia and other key exporters.

On the Chicago Board of Trade, July 2024 wheat fell 3/4 cent to $6.97-1/4. Corn for July 2024 delivery rose 3/4 cent to $4.64-3/4, posting a weekly gain of 2.7%. Soybean futures for the same month climbed 8-3/4 cents to $12.48, up 1.6% for the week.

Palm Oil Prices Ease

Palm oil prices in Malaysia fell as higher production outweighed a weaker ringgit and expectations of improved demand after other vegetable oils posted stronger gains than palm oil this week.

The August 2024 palm oil contract on the Bursa Malaysia Derivatives Exchange fell 8 ringgit, or 0.21%, to 3,886 ringgit ($825.05) a ton, after rising to 3,932 ringgit earlier in the session.

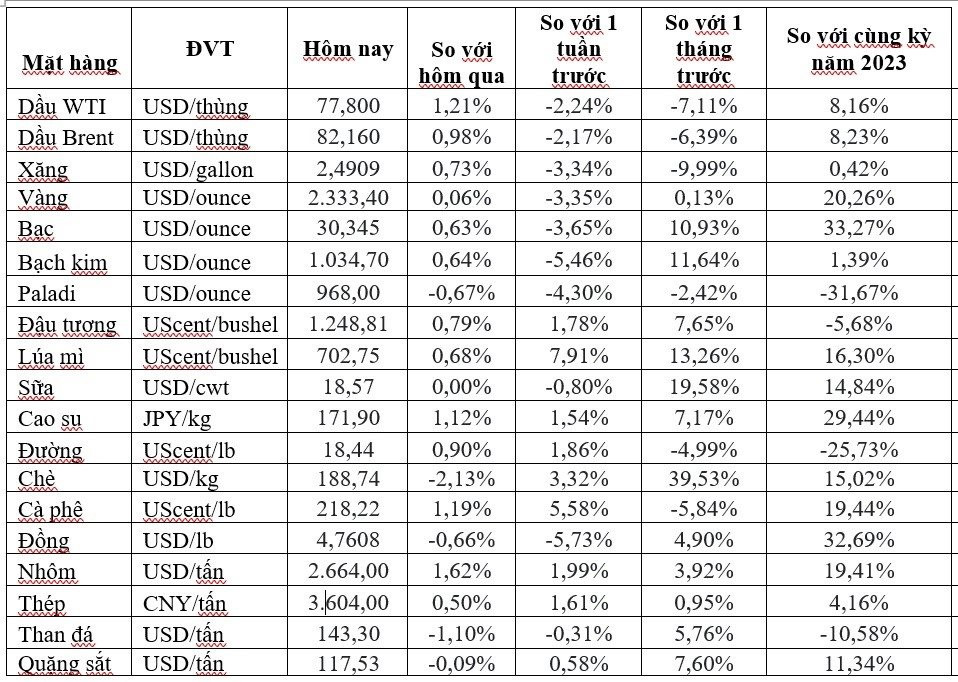

Prices of Key Commodities on May 25