Services

On May 8th, VIS Rating – Vietnam’s leading Credit Rating Agency, established by the international credit rating organization Moody’s and reputable domestic financial institutions, announced the long-term Issuer Rating for LPBank at A+ with a “Stable” outlook.

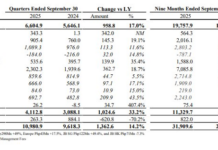

VIS Rating assessed LPBank’s asset quality as good due to its ability to control non-performing loan ratios. In the past three years, LPBank’s non-performing loan ratio has remained low compared to the industry average, while its average loan loss provision ratio has been higher than the industry average.

LPBank Head Office: 210 Tran Quang Khai and 17 Tong Dan, Trang Tien Ward, Hoan Kiem District, Hanoi, Vietnam

|

VIS Rating’s positive assessment affirmed LPBank’s profitability as good. This reflects improvements in business operating efficiency and cost optimization, as well as VIS Rating’s expectations for stable profitability over the next 12-18 months. In the past five years, LPBank’s return on average assets (ROAA) has significantly improved, surpassing the industry average by the end of 2023. This improvement is mainly attributed to the restructuring and optimization of its network system, capital cost optimization, and enhanced digitization and automation of business processes, resulting in reduced processing time and increased labor productivity. This assessment also underscores the strength, effectiveness, and safety of LPBank’s sustainable business orientation.

VIS Rating positioned LPBank’s capital adequacy as good, reflecting a higher Tier 1 Capital ratio (including equity capital and retained earnings) due to recent capital increases. LPBank’s capital adequacy ratio (CAR) remained above the industry average in 2023. VIS Rating expects LPBank’s capital adequacy to remain stable over the next 12-18 months due to its ability to generate internal capital from retained earnings to support asset growth.

Finally, VIS Rating assigned a “Stable” outlook to LPBank’s long-term Issuer Rating. This outcome confirms that LPBank’s credit profile is expected to remain safe over the next 12-18 months.

Previously, in August 2023, the international credit rating organization Moody’s Investors Service (Moody’s) affirmed LPBank’s long-term foreign currency and local currency issuer and local currency senior unsecured debt ratings at B1 with a stable outlook. Additionally, LPBank’s long-term local and foreign currency counterparty risk assessments and long-term local currency deposit ratings were also affirmed at Ba3. The maintenance of LPBank’s ratings reflects Moody’s expectations of the bank’s stable and efficient operations, including its capital, asset quality, profitability, and liquidity indicators.

LPBank is among the top 500 banks with the highest brand value globally and is one of 14 Vietnamese banks recognized as Domestic Systemically Important Banks (D-SIBs) in 2024. During the 2024 – 2028 period, LPBank is committed to implementing a strategy of comprehensive and effective transformation, sustainable and prudent business operations, and flexibility in application, product, and service design to ensure maximum benefits for its customers, shareholders, and partners.