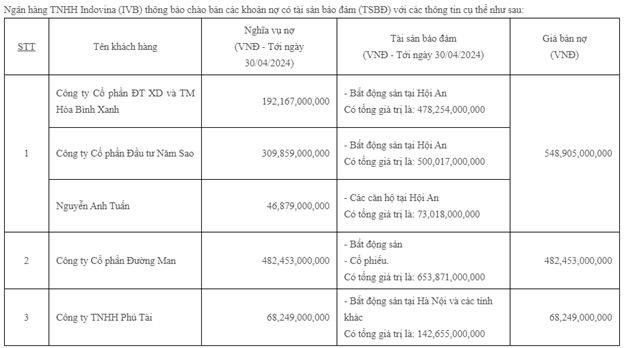

In its announcement on May 17, Indovina Bank stated that all debts are secured by stocks and real estate assets in Hoi An (Quang Nam Province), as well as real estate in Hanoi and other provinces.

Notably, in addition to the debt of more than VND 480 billion of Man Beer Joint Stock Company (a company owned by Mr. Nguyen Huu Duong, aka “Duong ‘bia'”), IVB offered a “combo” of 3 out of 5 debts with secured assets of real estate in Hoi An for nearly VND 549 billion.

Source: IVB

|

As of April 30, 2024, the debt of Hoa Binh Xanh Investment Construction and Trading Joint Stock Company exceeded VND 192 billion, while the debt of Nam Sao Investment Joint Stock Company reached nearly VND 310 billion. The secured assets of these two companies are real estate properties in Hoi An, valued at over VND 478 billion and VND 500 billion, respectively.

Mr. Nguyen Anh Tuan had a debt of nearly VND 47 billion (as of April 30, 2024), and the secured asset for this debt was also a real estate property in Hoi An, valued at more than VND 73 billion.

Thus, the total value of the secured assets for these three loans, in the form of real estate in Hoi An, amounted to over VND 1,051 billion.

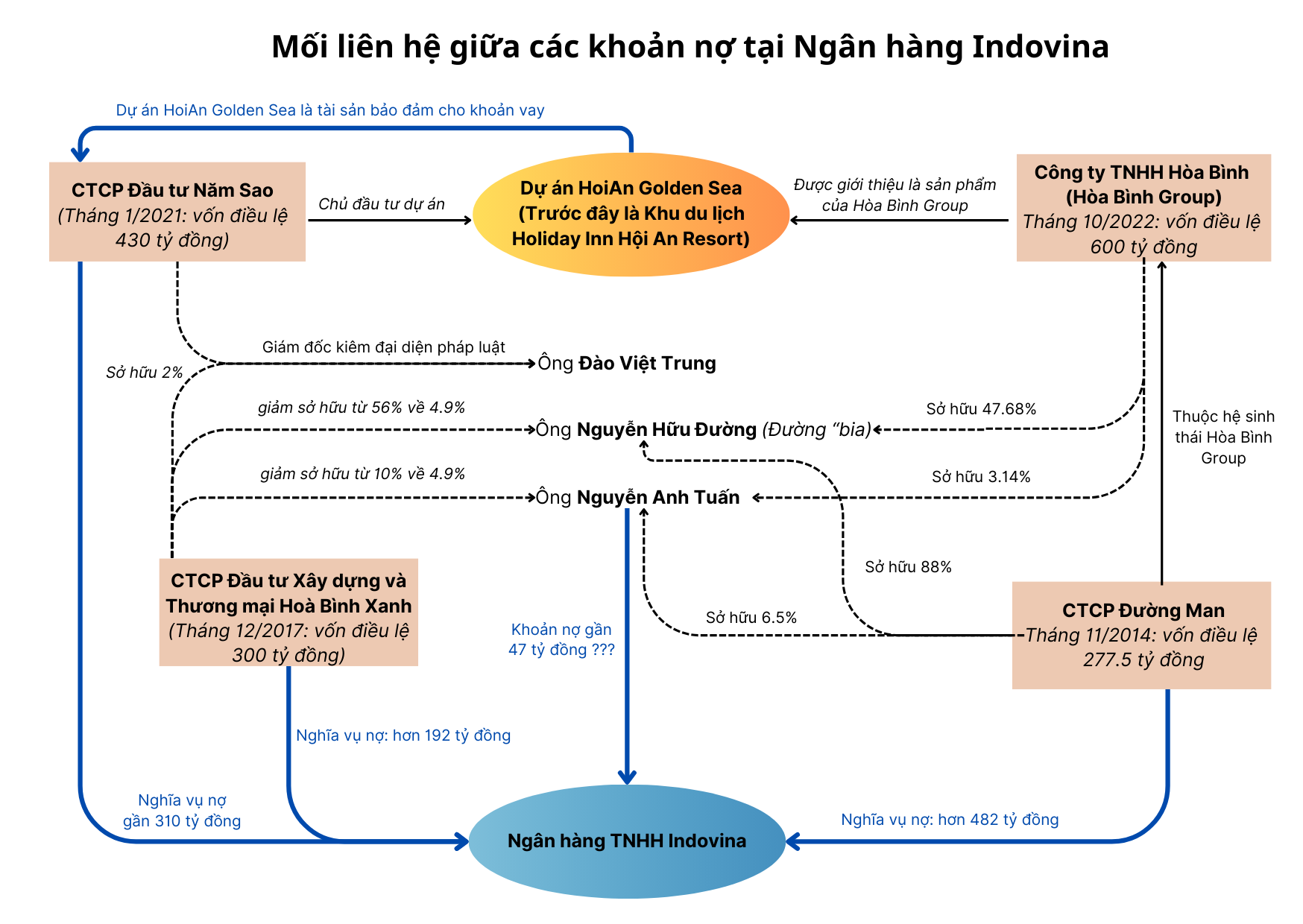

Do these three debts have anything in common, such as being linked to the same project?

According to the writer’s understanding, Nam Sao Investment Joint Stock Company was established on June 12, 2006, with its head office located in Cam An Ward, Hoi An City, Quang Nam Province.

In May 2017, Nam Sao had a charter capital of VND 60 billion, and Mr. Phan Xuan Tung served as the Chairman of the Board of Directors and legal representative. In December 2018, Mr. Nguyen Dinh Duy (born in 1967) took over this position.

In January 2021, Nam Sao increased its capital to over VND 430 billion, and Mr. Dao Viet Trung became the Director and legal representative of the company.

Nam Sao is the investor of the HoiAn Golden Sea project (formerly known as Holiday Inn Hoi An Resort) with a scale of nearly VND 2,000 billion and an area of nearly 7 hectares in Cam An Ward, Hoi An City, Quang Nam Province. The project comprises five apartment hotel buildings and eight beachfront villas in An Bang.

The construction of HoiAn Golden Sea commenced in 2019, and the completion was scheduled for 2021. However, the investor failed to meet the deadline and was granted an extension until the end of 2022. After a period of construction without fulfilling the commitment, on April 13, 2022, the People’s Committee of Quang Nam Province adjusted the completion schedule to July 2023.

On June 21, 2022, the People’s Committee further instructed the Department of Natural Resources and Environment to coordinate with the Department of Construction, the Department of Finance, and relevant sectors and localities to review the project’s land-related documents, financial obligations, and land-use rights certificates.

On May 6, 2024, Nam Sao sent a document to the People’s Committee of Quang Nam Province, reporting on the progress of the project and requesting assistance in resolving existing issues. Nam Sao stated that the HoiAn Golden Sea project had been halted for over three years due to the lack of a construction permit, which had caused numerous difficulties and financial burdens, as well as confrontations with secondary investors. Therefore, Nam Sao appealed to the People’s Committee and relevant authorities to help resolve the issues and obtain the necessary legal documents for the project.

The HoiAn Golden Sea project has been left abandoned and its construction halted for several years.

|

|

According to Báo Tuổi Trẻ Thủ Đô, Indovina Bank filed a lawsuit against Nam Sao Company regarding a “Dispute over a Credit Contract” related to the HoiAn Golden Sea project. On June 6, 2023, the People’s Court of Hoi An City accepted the civil case regarding the “Dispute over a Credit Contract” and the counterclaim on July 19, 2023, between the plaintiff, Indovina Bank, and the defendant, Nam Sao Company. Indovina Bank requested that Nam Sao repay the loan amount according to the 2018 loan contract. In case of non-payment, partial payment, or failure to repay the full amount, Indovina Bank reserves the right to request the enforcement agency to auction the secured assets to recover the debt. Nam Sao remains obligated to repay the debt until the full amount is settled. According to the content of the document issued by the People’s Court of Hoi An City to the People’s Committee of Quang Nam Province on April 2, 2024, in case Nam Sao fails to repay the debt, partially repays, or does not repay the full amount, Indovina Bank has the right to request the handling of the secured assets to recover the debt (based on the study of documents and evidence in the case file). The secured assets for the loans include six land plots with land-use rights certificates and ownership of houses, land, and assets attached to the land. These land plots were granted by the People’s Committee of Quang Nam Province in 2017 and are located in the Holiday Inn Hoi An Resort project, Cam An Ward, Hoi An City. The secured assets also include assets attached to these six land plots, a commercial service area combined with tourist apartments, a tourist apartment area, and all constructions belonging to the HoiAn Golden Sea project (formerly known as Holiday Inn Hoi An Resort). |

On the other hand, Hoa Binh Xanh Investment Construction and Trading Joint Stock Company was established on June 9, 2017, with its primary business line being the construction of civil engineering works. The company’s head office is located at 84 Doi Can Street, Doi Can Ward, Ba Dinh District, Hanoi, sharing the same address as Hoa Binh Group Joint Stock Company of Mr. Nguyen Huu Duong.

The initial chartered capital was VND 300 billion, with eight founding shareholders. Among them, Mr. Duong held 56% and served as the Chairman of the Board of Directors and legal representative. Other shareholders included Mr. Nguyen Anh Tuan with 10%, Mr. Nguyen Ngoc Tuyen with 10%, Mr. Tran Duc Duy with 10%, Ms. Nguyen Bich Vi with 5%, Ms. Nguyen Bich Van with 5%, Mr. Dao Viet Trung with 2%, and Mr. Le Van Luu with 2%.

In December 2017, the shareholder structure changed to six shareholders holding a total of 40.8%, while the remaining 59.2% was not disclosed. Notably, Mr. Duong’s ownership decreased to 4.9%, Mr. Nguyen Anh Tuan’s stake reduced to 4.9%, Ms. Nguyen Bich Vi held 4.5%, Ms. Nguyen Bich Van held 4.5%, Mr. Dao Viet Trung maintained 2%, and Mr. Tran Duc Duy increased his stake to 20%. The position of General Director and legal representative was successively held by Mr. Nguyen Dinh Duy (December 2017), Mr. Nguyen Anh Tuan (September 2019), and Mr. Tran Thong Nhat (October 2019).

Regarding Hoa Binh Group Joint Stock Company, its predecessor was Hoa Binh Corporation, established in 1993, operating in the production of beer, liquor, soft drinks, and raw materials for beer, as well as the manufacturing of mechanical products for the food industry, civil and industrial construction, and real estate business. The legal representative and General Director of the company is Mr. Nguyen Huu Duong.

As of October 27, 2022, Hoa Binh Group had a chartered capital of VND 600 billion, with nine shareholders. Among them, Mr. Nguyen Huu Duong held 47.68%, Ms. Vu Thi Tuyet Nhung held 44.82%, and Mr. Nguyen Anh Tuan held 3.14%.

On its website, Hoa Binh Group introduces the HoiAn Golden Sea project as one of its “superb” real estate projects and one of the three projects with gold-plated branding.

Screenshot from Hoa Binh Group’s website

|

HoiAn Golden Sea Project. Source: Hoa Binh Group

|

Based on the above information, it is highly likely that the HoiAn Golden Sea project serves as the secured asset in the form of real estate in Hoi An mentioned by Indovina Bank.

Source: Compiled by the writer

|