The focus now is on whether the 2023 oil market scenario will repeat itself in 2024 and whether the transition to “green energy” can drastically change the global energy landscape. This article analyzes the current situation, experiences of major countries and regions such as the EU, the US, Russia, China, and the Middle East, to draw implications for Vietnam.

The forecast for global oil demand growth in 2023 remains unchanged at 2.44 million barrels per day, slightly up to 2.5 million barrels per day. This is the latest report released ahead of the November 2023 meeting of ministers from the Organization of the Petroleum Exporting Countries (OPEC) and partners (OPEC+). OPEC+ agreed that from December 2023, oil production would be cut by 2 million barrels per day (equivalent to 5% of global demand) to support the global energy market (OPEC, 2024).

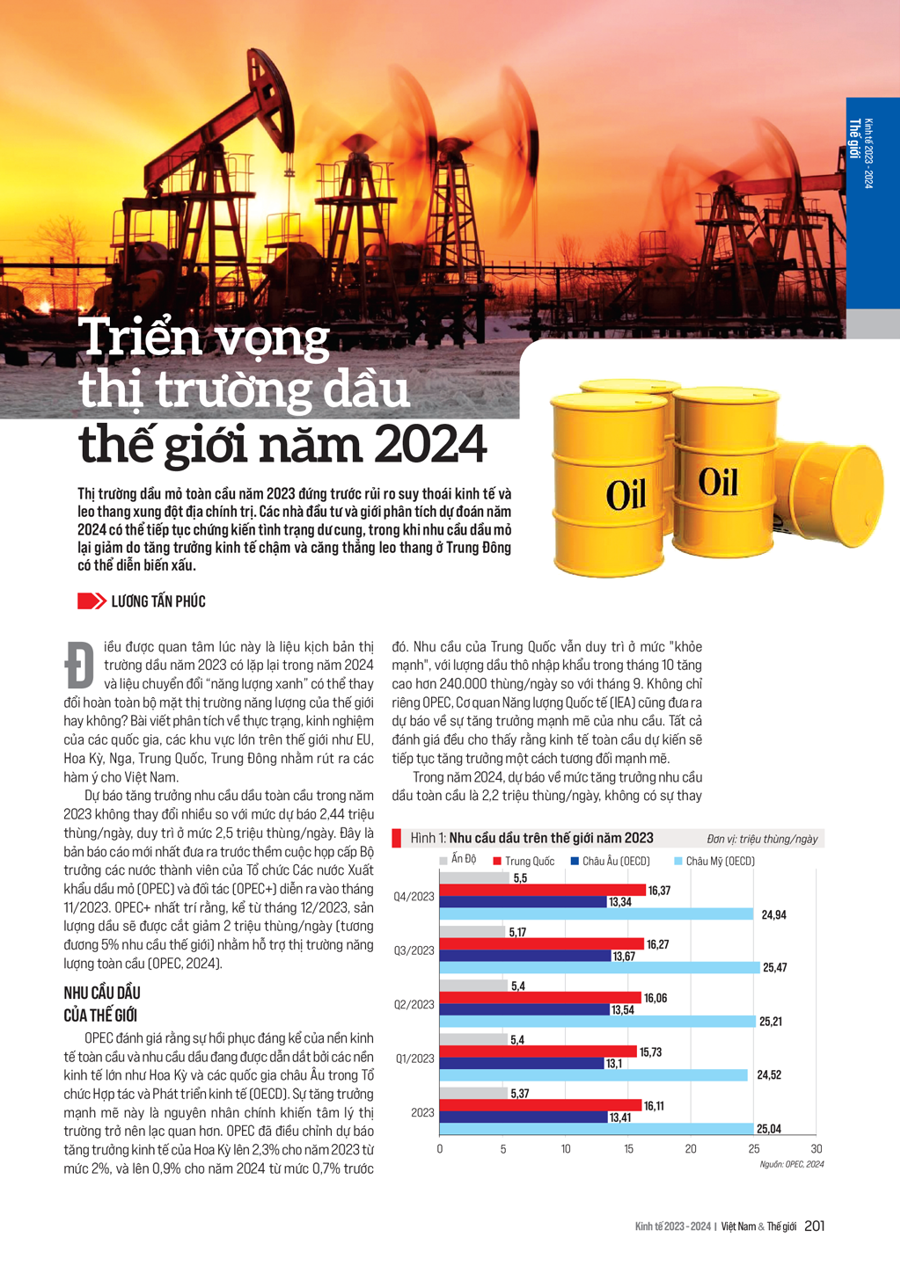

GLOBAL OIL DEMAND

OPEC assessed that the significant recovery of the global economy and oil demand is led by large economies such as the US and European countries in the Organization for Economic Cooperation and Development (OECD). This robust growth is the main reason for the more optimistic market psychology. OPEC adjusted its US economic growth forecast to 2.3% for 2023, up from 2%, and to 0.9% for 2024, up from 0.7% previously. China’s demand remains at a “healthy” level, with crude oil imports in October increasing by more than 240,000 barrels per day compared to September. Not only OPEC, but the International Energy Agency (IEA) also forecasts strong demand growth. All assessments indicate that the global economy is expected to continue to grow relatively strongly.

In 2024, the forecast for global oil demand growth is 2.2 million barrels per day, with no significant change from the previous assessment. Oil demand is expected to be supported by robust global GDP growth, driven by continuous improvements in economic activity in developed countries. OECD oil demand is projected to increase by 0.3 million barrels per day, reaching 46.1 million barrels per day. Latin America, part of the OECD, is seen as leading the growth, while Europe and the Pacific are expected to recover from the 2023 recession, mainly supported by transport fuel demand, especially gasoline and jet fuel/naphtha.

In non-OECD countries, oil demand is expected to increase by 1.9 million barrels per day, reaching 58.3 million barrels per day. Continuous improvements in economic activity, stable production, and mainly transport activity in China, the Middle East, India, and Latin America are expected to account for most of the oil consumption. Regarding oil products, transport fuels – jet fuel/naphtha, gasoline, and diesel – are expected to be the main drivers of demand growth. Derivatives are also expected to support oil demand in the non-OECD region. However, this forecast depends on global economic developments, especially the uncertainties in the OECD’s chemical industry.

GLOBAL OIL SUPPLY SITUATION

The International Energy Agency (IEA) has issued a warning about the energy supply-demand imbalance in the global market. According to the IEA, energy demand is increasing due to the global economic recovery, while oil production remains low as oil-producing countries implement reduced output policies. Moreover, these countries are decreasing investments in new exploration projects. As a result, oil prices are surging, and some nations are increasing their output to meet the demand, leading to a supply-demand imbalance. The IEA cautions that this situation could negatively affect the global economy, especially developing countries.

In October 2023, Russia’s oil production increased by approximately 55,000 barrels per day compared to the previous month, reaching an average of 10.9 million barrels per day. This output includes 9.5 million barrels of crude oil and 1.4 million barrels of liquefied gas from oil and condensate. In 2023, Russia’s oil production is expected to decrease by 0.4 million barrels per day, averaging 10.6 million barrels per day. In 2024, Russian liquid fuel production is projected to remain stable compared to the previous year, stabilizing at an average of 10.6 million barrels per day.

Despite developing many projects in oil fields, especially key projects at Rosneft, Russneft, Lukoil, Gazprom, Neftisa, and TenderResurs, forecasts still indicate a decline in crude oil production due to decreasing extraction from long-producing fields. Currently, Russia continues to supply 80% of energy to friendly countries such as China, Saudi Arabia, and India to boost revenue and diplomatic relations. However, Russia faces pressures from the EU regarding emission regulations and climate measures, urging a reduction in the use of fossil fuels and a transition to renewable energy sources…

ANALYSIS AND IMPLICATIONS FOR VIETNAM

Firstly, OPEC decided to maintain oil production since the move to cut 5% of global output in late 2022. Saudi Arabia is concerned that the energy consumption and export plans of the US and the EU could lead to a broad decline in oil prices, affecting them in the future. The decision to maintain output was made despite pressure from the US to pump more oil to support the global economy. US President Joe Biden is also considering all possible measures to improve foreign relations with OPEC countries. This reduction will remain in effect until the end of 2024 but will be subject to review in March 2024.

Crude oil prices have continuously declined for several weeks, even though OPEC+ has implemented a plan to cut production. Historically, prolonged recessions of about 1-2 years have been accompanied by unstable oil price fluctuations, and OPEC+’s output has significantly decreased, particularly during the crises of 1973, 1979, 1990, and 2007. This situation raises the risk of history repeating itself, as output cuts may become ineffective in maintaining stable oil prices in the medium term. However, the IEA also predicts that the oil market will shift from a supply deficit to a surplus from early 2024 due to slowing demand growth.

Secondly, although crude oil prices have decreased, Russia’s export revenue has reached record levels, peaking in October 2023, unaffected by sanctions from the US and other Western nations. Data from the Russian Ministry of Finance shows that exports reached €16.5 billion, equivalent to 1.6 trillion rubles. Although Russian oil port prices are limited by Western sanctions since December 2022, most of Russia’s oil is still sold at over $60 per barrel in October 2023…

IMPLICATIONS FOR VIETNAM

Firstly, Vietnam needs to strengthen its self-reliance and adaptability to new challenges, especially as the country plays a crucial and central role in the strategies of major powers. A neutral policy not only helps Vietnam diversify its markets and sources of supply but also builds a collective security foundation based on peaceful principles. This can optimize Vietnam’s economic, political, and security interests in a volatile international environment.

Secondly, Vietnam’s oil exploration and integration into the international oil market may face difficulties, given the ongoing geopolitical conflicts in Eastern Europe and the Middle East. To overcome these challenges, the government needs to establish sustainable energy transition policies to minimize prolonged negative impacts on Vietnam’s economy…

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam