Masan Consumer’s MCH stock continued its “blooming” streak, gaining 2.95% to reach a peak of VND 185,100/share on May 28’s trading session close. Since the beginning of the year, MCH’s market price has surged 112% from its two-digit figure at the start.

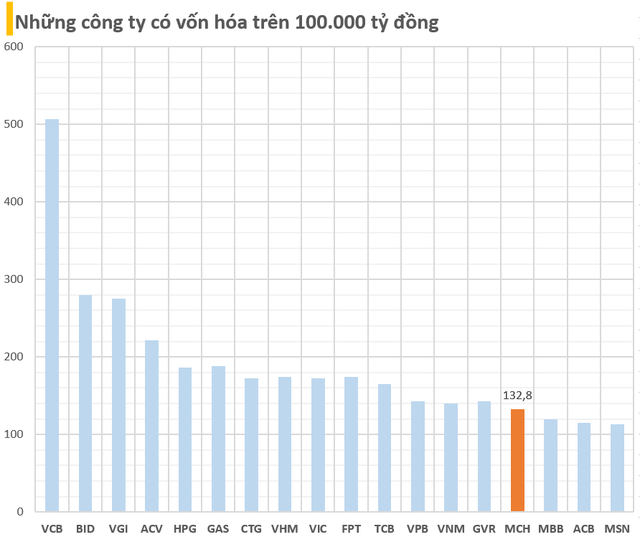

With the current stock price, Masan Consumer’s market capitalization stands at VND 132,810 billion (approximately $5.2 billion), a rise of over VND 70,000 billion compared to the beginning of the year. This valuation propels the company, part of the Masan Group ecosystem, ahead of several giants on the stock exchange, including MB, ACB, The Gioi Di Dong, and Masan Group itself.

MCH’s upward trajectory is fueled by recent positive news, including strong financial results and plans for additional capital raising, as well as an upcoming IPO on the HoSE, as announced by the company’s leadership at the 2024 Annual General Meeting. Masan Consumer manufactures a diverse range of food and beverage products, spanning from spices, noodles, and chili sauce to instant coffee and beer.

Currently, Masan Consumer boasts five prominent consumer brands with sales revenues ranging from $150 million to $250 million and extensive market reach. These brands, CHIN-SU, Nam Ngu, Omachi, Kokomi, and Wake-Up 247, have become household names for millions of Vietnamese. According to Mr. Truong Cong Thang, CEO of Masan Consumer, more than 98% of Vietnamese households own at least one product from the company.

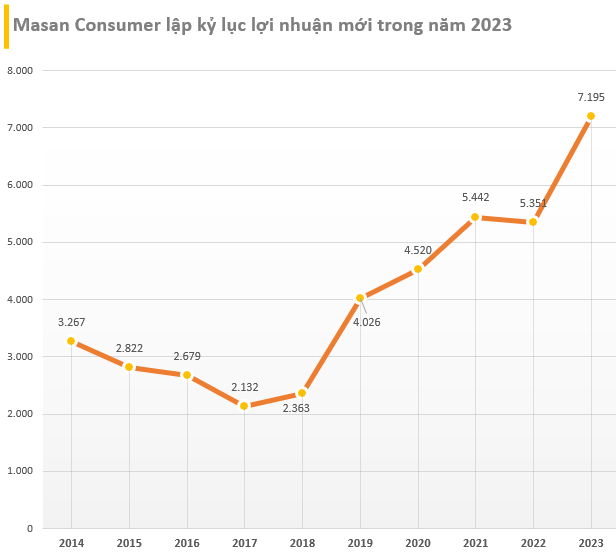

Diving into their financial performance, in 2023, Masan Consumer achieved a new record profit level, posting a tax-exempt profit of VND 7,195 billion, a 30% increase compared to 2022. The EPS for 2023 stood at VND 9,888/share, a significant improvement from the 2022 figure of VND 7,612/share.

Notably, the company’s gross profit margin crossed the 50% threshold for the first time. Specifically, gross profit for the fourth quarter reached VND 4,017 billion, with a gross profit margin of 47.29%, a notable increase from the 41.48% margin in Q4/2022.

This impressive growth continued into Q1/2024, with the company reporting remarkable improvements in its financial results. For this quarter, Masan Consumer generated VND 6,727 billion in revenue and VND 1,505 billion in net profit, reflecting increases of 7.4% and 31.5%, respectively, compared to the same period last year.

Following a record-breaking year, Masan Consumer also approved a substantial dividend payout. The company will distribute a 100% cash dividend (VND 10,000 per share). Previously, in July 2023, it had paid an interim dividend of 45% and will disburse the remaining 55% in 2024.

In terms of potential, compared to listed companies in the F&B industry, Vietcap Securities assessed that Masan Consumer’s uncontrolled after-tax profit CAGR for shareholders at 16% from 2018 to 2023 significantly outperformed the single-digit growth rates of Sabeco and Vinamilk.

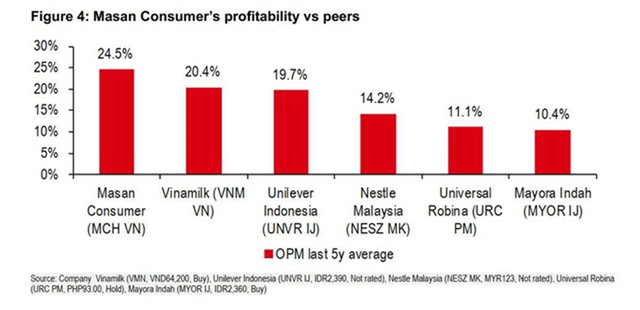

Earlier, HSBC’s report also commended Masan Consumer for its high-profitability ratios, stable revenue growth, and substantial outperformance compared to peers in the FMCG and packaged food sectors in the region. According to HSBC’s calculations, MCH’s profitability ratios are 4-5% higher than Vinamilk and Unilever Indonesia, significantly better than Nestle Malaysia, and twice that of Universal Robina and Mayora Indah.

From HSBC’s perspective, these achievements may be attributed to MCH’s recent recovery, with its current market capitalization surpassing that of Masan, its parent company. MCH’s 2023 EBITDA was 9% higher than that of Masan’s FMCG segment. MCH boasts a CAGR of 15.4%, and its EPS reached 10.7%.