According to the latest analysis report from SSI Research, Khang Dien House Trading and Investment Joint Stock Company (stock code KDH) has been continuously increasing its inventory.

Khang Dien has consistently accumulated project land through M&A. By the end of 2023, the company attracted attention by recording the highest inventory value in its history, reaching nearly VND 18,800 billion. This placed the company in the top 4 listed real estate companies with the highest inventory, surpassing Nam Long, Dat Xanh, and Phat Dat.

By the end of Q1/2024, Khang Dien’s inventory and construction-in-progress (CIP) value had reached VND 21,400 billion, an increase of VND 1,700 billion compared to the beginning of the year.

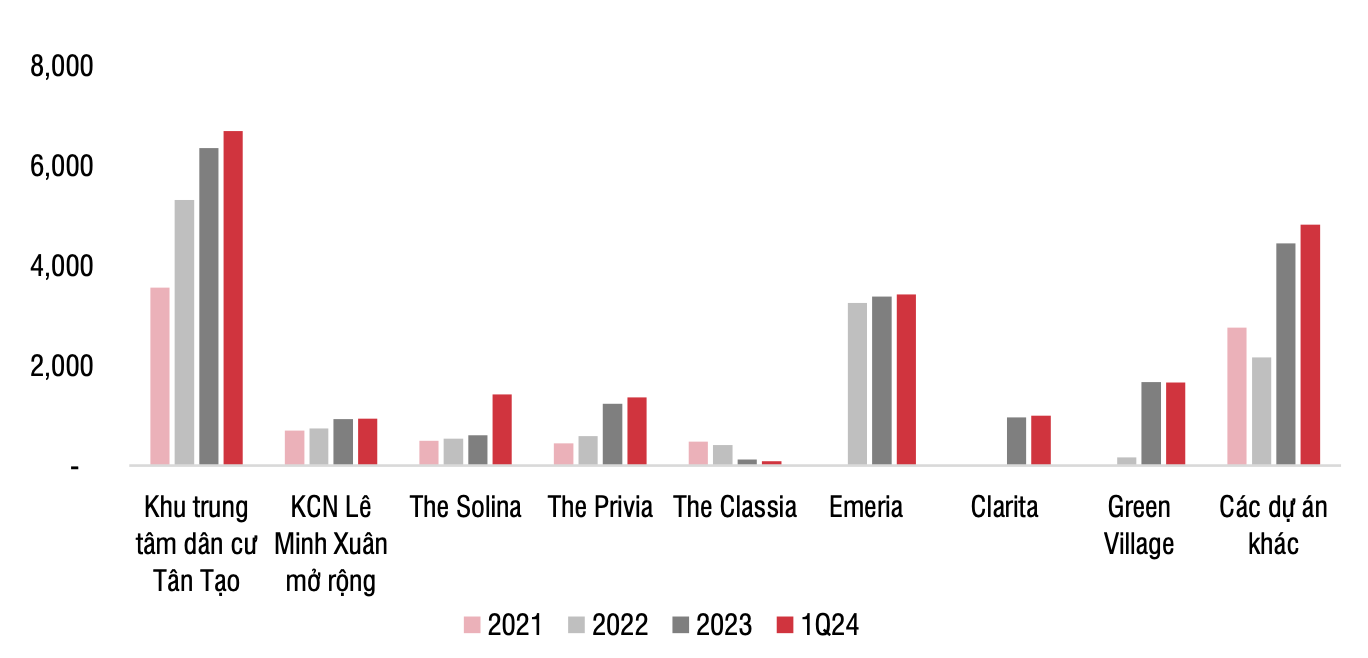

The following projects constitute a significant proportion of Khang Dien’s total CIP portfolio:

+ Tan Tao Urban Area project (VND 6,700 billion)

+ Green Village project (Phong Phu 2; VND 1,670 billion)

+ Emeria project (VND 3,420 billion)

+ The Solina project (VND 1,420 billion) and Binh Trung project (VND 3,740 billion)

Notably, The Solina project, with a land area of 16.4 ha in Binh Chanh district, Ho Chi Minh City, witnessed a significant increase in investment costs, rising from only VND 610 billion in Q4/2023 to VND 1,420 billion in Q1/2024 (more than a 2.3-fold increase).

SSI Research predicts that Khang Dien may have paid land use rights fees for this project.

The Solina project, formerly known as Corona City, is located in Residential Area 11A, Binh Hung, Binh Chanh, Ho Chi Minh City. The project covers an area of 16.42 ha and comprises apartments, townhouses, and villas. The project was approved for planning by the Ho Chi Minh City People’s Committee in February 2015, with Binh Chanh Construction Investment Joint Stock Company (BCCI) as the investor. In 2018, KDH merged with BCCI through a share swap, thereby officially acquiring all BCCI’s projects and land funds.

According to the introduction, this project has great potential due to its proximity to the intersection of National Highway 50 and Nguyen Van Linh Boulevard. This prime location in Saigon South City offers easy access to the city center, Phu My Hung urban area, and the Mekong Delta provinces. The project is also adjacent to the city’s planned educational zones, including Van Hien University, Ho Chi Minh City University of Economics, and the University of Economics and Finance, as well as the University Village. Once the universities are built, they will form a large community with accompanying services and amenities.

Image: Khang Dien’s Inventory Value

Some other key projects of Khang Dien include:

(i) The Classia (District 9, Ho Chi Minh City): Comprises 176 townhouses/villas with a total land area of 4.3 ha. Each unit averages approximately 115 sq. m. and 4 stories, with prices ranging from VND 150 million to VND 180 million per sq. m. of land (~USD 5,900 – 7,000/sq. m.). According to SSI Research, as of the end of Q1/2024, more than 160 units had been sold.

(ii) The Privia (Binh Tan District, Ho Chi Minh City): With a total land area of 1.84 ha, this project will develop 1,043 apartments at 158 An Duong Vuong, An Lac Ward. The average apartment size in this project is 60 sq. m., with an estimated starting price of VND 50 million per sq. m. (~USD 1,970/sq. m.).

The official sales launch began on November 25, 2023, and Khang Dien achieved impressive sales performance, completing sales within three months. In Q1/2024, the total investment cost for the project was VND 1,370 billion, an increase of 108% compared to Q3/2023 (before the official sales launch on November 25, 2023). SSI Research estimates that the company will hand over the apartments to buyers in Q4/2024.

Khang Dien’s strategy of investing in land acquisition is commendable, positioning the company as one of the leading owners of clean land funds. This is also considered an advantage and a long-term growth driver for Khang Dien as clean land in Ho Chi Minh City becomes increasingly scarce.

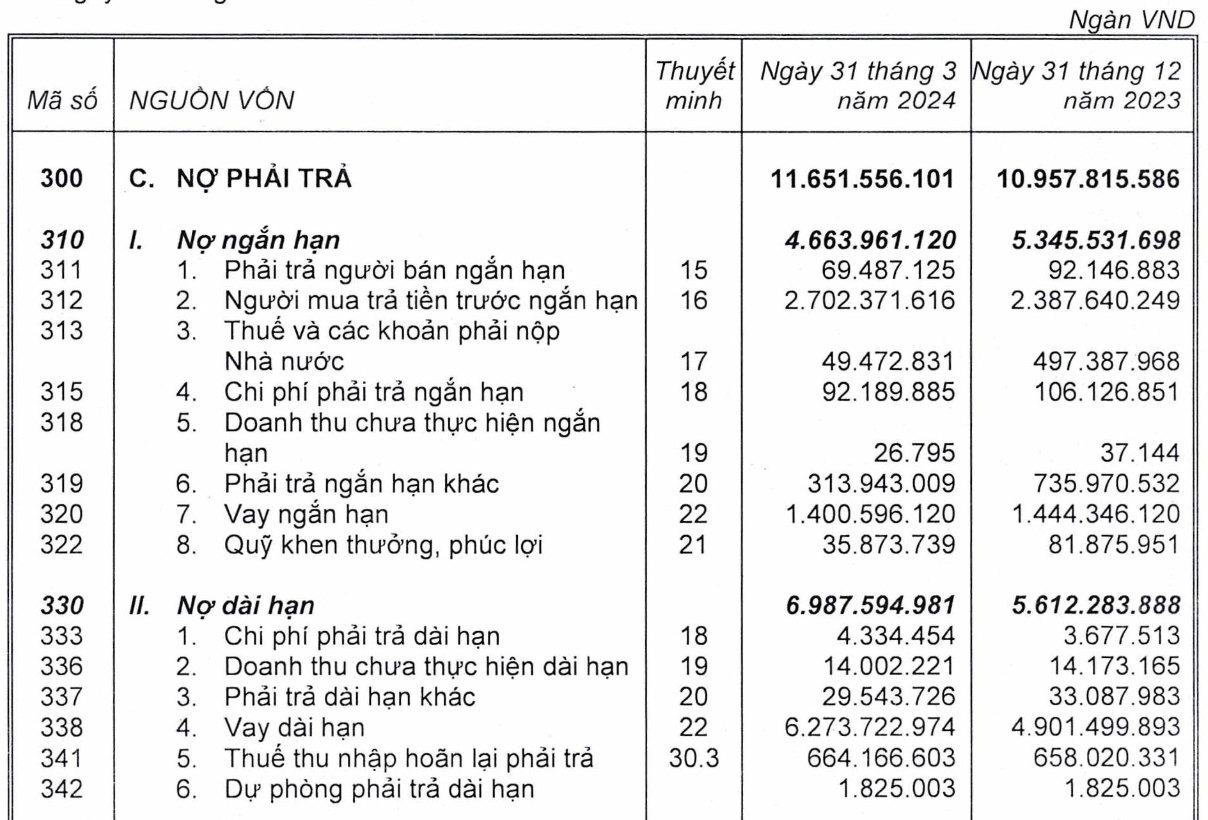

However, this strategy comes at a cost, as the company takes on more debt. According to the report, along with higher inventory values, the net debt/equity ratio stood at 32.9%, higher than the 16.8% recorded in Q4/2023, as the company increased borrowing to finance its inventory investments.

As of March 31, 2024, Khang Dien significantly increased its long-term debt, from VND 4,901 billion to nearly VND 6,274 billion.

Image: KDH’s Long-Term Debt Increase