According to preliminary statistics from the General Department of Vietnam Customs, the import turnover of various types of phones and accessories in Vietnam in April reached 789.72 million USD, a slight decrease of 1% compared to March 2024.

Thus, by the end of April 2024, the import turnover of this commodity reached over 3.079 billion USD, a significant increase of 22.4% compared to the same period last year, making it the 5th largest import commodity in Vietnam.

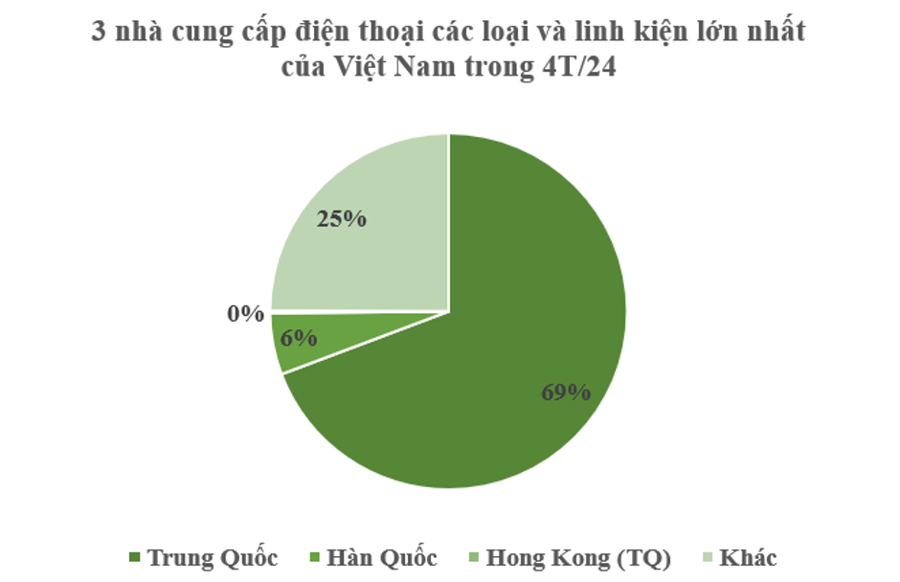

In terms of market sources, there are 8 countries and territories supplying various types of phones and accessories to Vietnam, with China, South Korea, and Hong Kong being the three largest markets.

Specifically, China leads in turnover with over 2.66 billion USD, a significant increase of 25% compared to the same period in 2023. South Korea is the second-largest market, with over 134.5 million USD in the first four months, however, this is a 21% decrease compared to the previous year. Notably, the Hong Kong market recorded a growth rate of up to 275%, equivalent to 3.75 times that of the same period last year, reaching over 25.3 million USD.

In addition to the three main markets mentioned above, suppliers of various phone types and accessories to Vietnam also include India, the UK, Taiwan, the US, and Japan.

In terms of exports, in the first four months of the year, phones and accessories brought in a turnover of more than 18.1 billion USD for the country, an increase of 5% compared to the same period last year, making it the 2nd largest export commodity after computers, electronic products, and accessories.

In the global market, Vietnam is the second-largest exporter of smartphones after China. Specifically, before 2010, both India and Vietnam had a market share of less than 1% in the export of smartphones. However, since 2022, Vietnam’s market share has increased to 12%, while India ranks 7th with an export share of over 2.5%. Vietnam’s remarkable rise is attributed in part to its rapid growth in the US market. From 2018 to 2022, Vietnam’s market share of smartphone exports to the US doubled from 9% to 18%.

China dominates the global smartphone export industry. According to statistics, this country accounts for nearly half of the global market share. However, in 2022, the number of smartphone exports from China fell to the lowest level in a decade due to the impact of the Covid-19 pandemic and slowing consumer demand.

Ranking 3rd in export is Hong Kong, China. Thanks to its strategic location, good commercial infrastructure, and business-friendly environment, Hong Kong is considered an important gateway for smartphone manufacturers aiming to access the international market. Currently, this region accounts for 9.6% of the global smartphone export market share.

Canalys, a research firm headquartered in Singapore, estimates that 1.13 billion smartphones were shipped in 2023 and is expected to exceed 1.17 billion units this year. Output will also reach 1.25 billion units in 2027, with a compound annual growth rate (CAGR) of 2.6% from 2023 to 2027.

In the domestic market, according to market research firm Statista, Vietnam’s smartphone market is expected to reach 4 billion USD in 2024, with a compound growth rate of 1.45% from 2024 to 2028.

In 2024, smartphone sales in Vietnam are expected to reach 21.4 million units. Since the beginning of the year, a number of phone models have been well-received, including the Samsung Galaxy S24 Series, Honor X9b 5G, and Xiaomi Redmi 12 Series.