REE Energy, a wholly-owned subsidiary of REE Corporation (HOSE: REE), has recently announced its plan to divest from Su Pan 2 Hydropower Joint Stock Company (UPCoM: SP2). REE Energy is owned by veteran entrepreneur Nguyen Thi Mai Thanh.

From May 29 to June 7, 2024, REE Energy intends to sell all of its 5.956 million SP2 shares, representing 28.71% of the charter capital, through matched orders and put-through transactions.

Su Pan 2 Hydropower Plant in Lao Cai Province. Image source: SP2

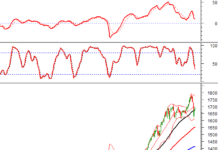

Currently, SP2’s share price stands at VND 16,500 per share. Based on this price, REE Energy is expected to retrieve approximately VND 100 billion from the sale. In April 2023, REE Energy, led by Madame Nguyen Thi Mai Thanh, acquired this stake from two individuals, Mr. Nguyen Phong Danh (3.1 million shares) and Mr. Nguyen Truong Tien Dat (2.8 million shares), for a total of over VND 97 billion through a put-through transaction.

After 13 months of investment, REE Energy is likely to break even on this deal, with a modest profit of approximately VND 1 billion based on market prices. Prior to this, REE Energy had planned to transfer its entire SP2 stake to Mr. Vu Ngoc Duong (DOB: 1964, residing in Thanh Xuan District, Hanoi). The 2024 Annual General Meeting of SP2 approved this transaction, waiving the requirement for a public offer of SP2 shares.

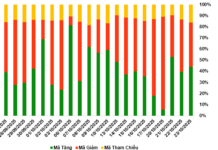

SP2’s shareholder structure is concentrated, with low liquidity on the exchange. On average, only more than 5,000 shares have been traded in the last 10 sessions. In addition to REE Energy, SP2 has three major shareholders: An Xuan Energy Joint Stock Company (25.09%), Vietnam Industrial Investment Joint Stock Company (16.33%), and Mr. Mai Dinh Nhat, a member of the Board of Directors (10.18%).

Su Pan 2 Hydropower Plant in Lao Cai Province, operated by SP2, has an installed capacity of 34.5 MW with three units and a total investment value of VND 1,237 billion. The annual commercial electricity output is approximately 140 million KWh, contributing insignificantly to the national power grid.

In terms of financial performance, SP2 recorded a 23% year-on-year decline in revenue to VND 151 billion in 2023. Net profit decreased more sharply by 57% to VND 23.9 billion, failing to meet the targets set by the Annual General Meeting. The company attributed this to the El Nino weather phenomenon, which caused prolonged droughts and reduced water flow into the reservoir.

For 2024, SP2 has set a modest revenue growth target but aims to increase net profit significantly to VND 30.92 billion, a nearly 30% jump. However, in the first quarter of 2024, SP2 reported a net loss of over VND 8.5 billion, despite a slight increase in revenue to VND 19.8 billion compared to the same period last year.