The Foreign Investment Agency, Ministry of Planning and Investment (MPI), announced that as of May 20, 2024, Ba Ria – Vung Tau province leads the country in registered Foreign Direct Investment (FDI) with 1.5 billion USD. This figure has increased twelvefold compared to the same period last year. The main reason for this significant jump is a 730 million USD project invested by South Korean chaebol Hyosung.

This project, located in Phu My 2 Industrial Park, Phu My town, involves the production of bio-fibers (raw material for spandex fabric) from raw sugar. With Hyosung’s investment, this will be the first site in Asia to utilize advanced technology in producing this type of raw material.

According to the provincial Investment Promotion Center, as of March 2024, the project encountered some obstacles and required the Ministry of Industry and Trade’s opinion on its alignment with the orientation of the chemical industry development in the next phase. The People’s Committee of Ba Ria – Vung Tau province is expediting the review and completion of the documents to submit to the Ministry of Industry and Trade and the Provincial Party Committee for guidance on the mentioned issues. This will help the enterprise promptly complete the project’s investment certificate application.

In Vietnam, Hyosung is a relatively low-key chaebol compared to the likes of Samsung, LG, Huyndai, and Lotte, as it specializes in producing fibers for the textile and automotive tire industries, as well as transformers, chemicals, industrial materials, heavy industry, and information technology.

Nevertheless, Hyosung is recognized as the third-largest South Korean investor in Vietnam, after Samsung and LG.

Mr. Lee Sang Woon, Vice Chairman and CEO of Hyosung Group, shared that almost all of the group’s factories in South Korea have been transferred to Vietnam.

Specifically, in Ba Ria – Vung Tau, Hyosung Vietnam has a polypropylene (PP) manufacturing plant and an underground LPG storage facility, with a total investment of nearly 1.4 billion USD, located in Cai Mep Industrial Park.

In addition to the aforementioned 730 million USD project, in 2023, Hyosung Vietnam also received approval from the Management Board of Industrial Parks of Ba Ria – Vung Tau province for its carbon fiber factory project in Phu My 2 Industrial Park, Phu My town, with a total expected investment of 540 million USD, of which the first phase is about 120 million USD.

Hyosung is currently the third-largest ATM manufacturer in the world. Recently, Mr. Lee Sang Woon expressed the group’s desire to invest in a made-in-Vietnam ATM factory and sought support for this initiative. Additionally, the group also intends to invest in a large data center in Ho Chi Minh City’s high-tech park.

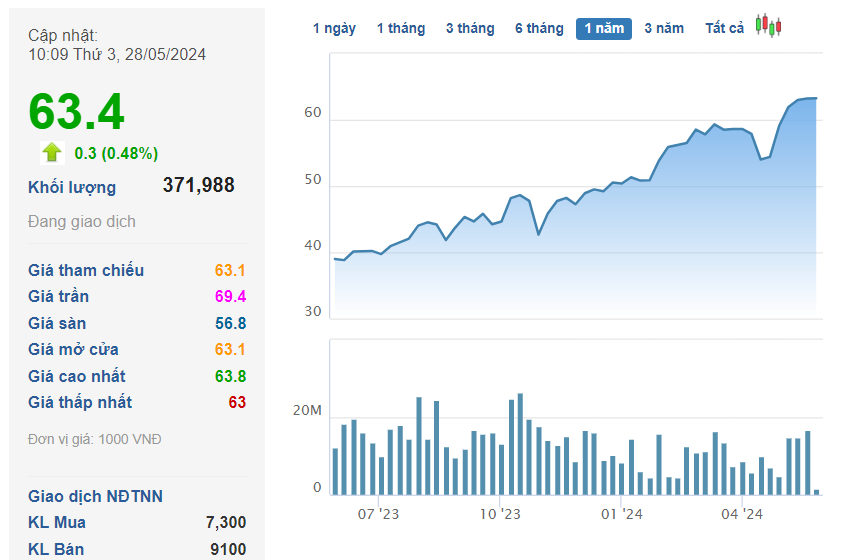

Hyosung’s investments benefit not only Ba Ria – Vung Tau province but also Total IDC JSC (Idico), contributing to a 60% increase in IDC’s share price over the past year. As a result, its market capitalization has surged to nearly VND 21 trillion, ranking second on the HNX after the Petroleum Technical Services Corporation (PVS).

The carbon fiber factory project is located in Phu My 2 Industrial Park, Phu My town, which is developed by Idico. Idico is a long-term partner of Hyosung and has revealed that from 2007 to 2023, Hyosung invested approximately 4 billion USD in projects in Nhon Trach 5 IDICO Industrial Park (on a leased land area of about 130 hectares) and in other provinces such as Ba Ria – Vung Tau, Quang Nam, and Bac Ninh.

IDC is one of the largest industrial park developers in Vietnam, with 554 hectares of land for lease in the provinces of Long An, Ba Ria Vung Tau, and Thai Binh. With a focus on industrial real estate development, IDC plans to expand its industrial land area by an additional 2,430 – 2,820 hectares in the coming years.

In the first quarter of 2024, IDC recorded remarkable growth, with revenue exceeding VND 2,467 billion, a surge of 115% year-on-year, thanks to a one-time infrastructure lease revenue of nearly VND 1,308 billion from industrial park contracts, a 6.3-fold increase compared to the same period last year. Its net profit reached VND 695 billion, a remarkable 4.7-fold increase.

At the recent Annual General Meeting of Shareholders, Mr. Phan Van Chinh, Vice Chairman of the Board of Directors, emphasized that this is a golden opportunity to develop industrial park projects. For 2024, IDICO aims to lease 145 hectares of industrial land, representing new investment attraction in the year, and approximately 50,000 square meters of factory space.

Regarding the shareholder structure, IDC reported that SSG Group Joint Stock Company holds over 74 million shares (22.5% of capital), and Bach Viet Production and Trading Joint Stock Company holds 39 million shares (11.9% of capital).

For the third consecutive year, in 2023, IDC maintained a cash dividend of 40% for its shareholders. At the recent Annual General Meeting of Shareholders, Ms. Nguyen Thi Nhu Mai, Chairwoman of the Board of Directors of IDC, affirmed that the company would maintain a dividend rate of 30-40% for the next three years, based on the target of leasing 120-150 hectares of land per year and achieving a business cash flow of VND 3,000 – 4,000 billion per year.