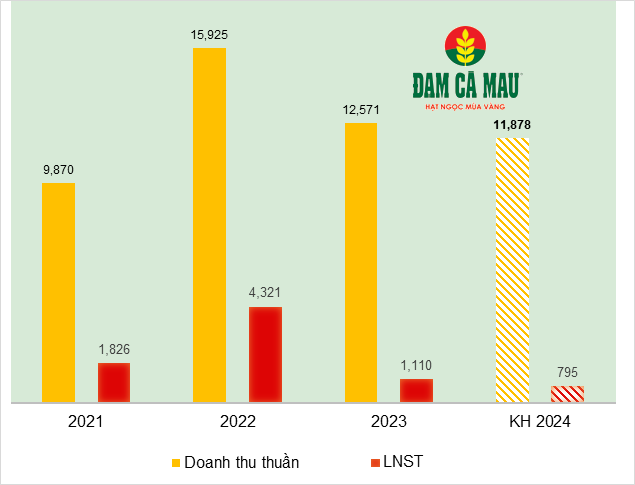

Specifically, DCM’s Board of Directors plans to present to the AGM a revenue target of nearly VND 11,900 billion, a 6% decrease compared to the previous year’s performance. The planned after-tax profit is nearly VND 795 billion, a reduction of over 28%. The budget contribution target is nearly VND 228 billion.

|

Results of past years and 2024 plan of DCM

Source: VietstockFinance

|

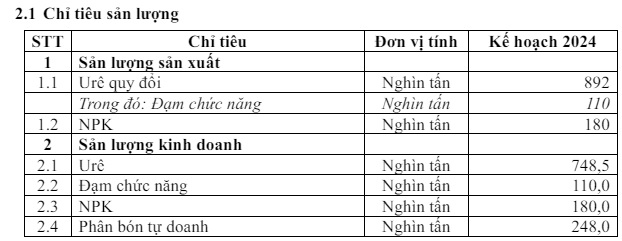

DCM’s plan is considered relatively cautious. According to the company, in 2024, the global economy is expected to face many challenges as the drivers of global growth have reached their limits. Inflation is forecasted to decrease, but geopolitical conflicts still pose risks, especially for the energy and food industries. However, the Vietnamese economy is predicted to be quite optimistic, and the company believes that this is the time to accelerate and achieve the goals set out in the 5-year plan for 2021-2025.

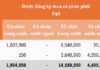

In terms of output targets, the company proposes to produce 892,000 tons of Urea equivalent and 180,000 tons of NPK. For business output, the plan targets 789,000 tons of Urea, 110,000 tons of functional fertilizers, 180,000 tons of NPK, and 248,000 tons of self-employed fertilizers.

Source: DCM

|

Despite setting a cautious target, DCM’s Q1 2024 results are promising compared to the low base last year. In Q1, DCM achieved more than VND 2,700 billion in revenue, almost unchanged from the same period last year; net profit increased by over 51% to VND 346 billion. The company achieved 24% of its revenue plan and 44% of its after-tax profit target for the year.

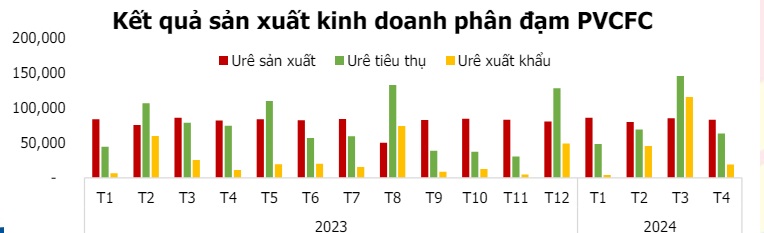

According to the April 2024 investor newsletter, DCM reported a slight decrease in Urea production compared to the previous month, reaching nearly 83,000 tons. Consumption decreased by 56%, reaching over 63,000 tons. In terms of consumption market, domestic Urea consumption reached over 44,000 tons, an increase of 46% compared to the previous month, while exports decreased by 83%, reaching 19,000 tons.

Source: DCM

|

Cumulative results for the first four months of the year show that Urea production reached 333,000 tons, and consumption reached 324,820 tons, equivalent to 37% and 43% of the annual plan, respectively. Meanwhile, NPK production reached over 63,000 tons, and consumption exceeded 8,400 tons, equivalent to nearly 34% and 5% of the full-year plan.

For the May 2024 plan, DCM targets Urea production and consumption of nearly 81,000 tons and 65,000 tons, respectively. For NPK, the company expects production and consumption to reach 24,800 tons and 30,000 tons, respectively.

Source: DCM

|

In terms of investment targets, DCM plans to invest nearly VND 1,600 billion this year, with nearly 58% coming from equity capital. The entire amount will be used for basic construction and equipment purchases.

To achieve its plan, DCM sets out several key tasks for the year, such as efficient plant operation, diversification of raw material sources, and product groups. Notably, the company will accelerate investment projects to expand its business activities, including industrial gas products from existing off-gas sources and research on “green” products such as food-grade CO2, green hydrogen, green ammonia, and green methanol, in line with the energy transition trend.

Regarding the profit distribution plan, the company proposes a dividend payout of 20% for 2023 and 10% for 2024.

DCM completes the acquisition of a fertilizer company with a charter capital of nearly VND 2,100 billion

The 2024 AGM will be held on June 11 at the company’s office at 173-179 Truong Van Bang, Thanh My Loi Ward, Thu Duc City, Ho Chi Minh City.