Illustration

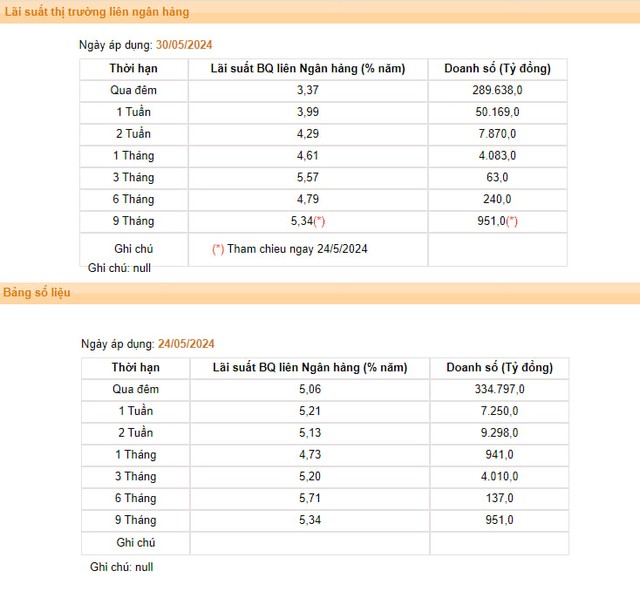

According to the latest data released by the State Bank of Vietnam (SBV), the average overnight interest rate for VND interbank lending (the main term accounting for approximately 90% of transaction value) fell to 3.37% per annum during the May 30 session, down from 4.03% and 4.79% recorded in the May 29 and May 28 sessions, respectively. Compared to the previous week’s closing, the overnight interbank rate decreased by 1.69 percentage points, marking the lowest level in seven weeks.

In addition to the overnight term, most other key terms also witnessed declines compared to the previous week. Specifically, the 1-week term decreased by 1.22 percentage points, the 2-week term fell by 0.84 percentage points, and the 1-month term dropped by 0.12 percentage points.

VND Interbank Interest Rates Surged Last Week (Source: SBV)

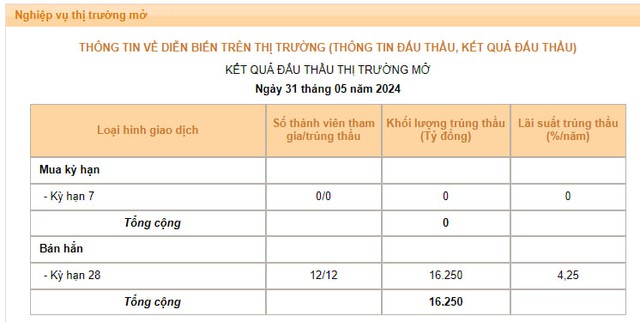

Beyond the plunge in interbank rates, the system’s liquidity also signaled increased abundance as the over-the-counter collateralized lending channel (OMO) experienced a drought during the last two trading sessions of the past week, while the volume of successful treasury bill bids soared. Consequently, the SBV withdrew VND39,704 billion on a net basis from the market through the open market operation (OMO) channel.

Volume of Successful Treasury Bill Bids Surged on May 31 (Source: SBV)

These developments indicate that the banking system’s liquidity has undergone rapid changes in a short period.

Previously, from mid-May to the beginning of last week, the VND liquidity of the banking system showed signs of tightening after the SBV continuously sold large amounts of USD to stabilize the exchange rate, withdrawing a substantial amount of VND. In this context, during the May 22 and May 23 trading sessions, respectively, nine and eight market members turned to the regulator’s liquidity support channel, with successful bids on the OMO channel reaching VND25,000 billion and VND43,063 billion—the highest levels in many years. Notably, banks increased their borrowing from the SBV despite the OMO rate being adjusted upward from 4.25% to 4.5% per annum from the May 22 session. The combination of these factors pushed the VND interbank interest rate in the May 23 session above 5% per annum for most terms—the highest level in a year.

The rapid cooling of interbank interest rates emerged as exchange rate pressure showed signs of easing last week. Specifically, the USD/VND interbank exchange rate cooled down last week, moving away from the SBV’s ceiling rate. At the end of the May 31 session, the interbank exchange rate closed at VND25,441/USD, a decrease of VND36 compared to the previous week’s closing rate.

In the market for transactions between banks and the public, banks simultaneously lowered their USD buying prices by around VND20-30 last week. Meanwhile, selling prices also decreased by VND3, following the movement of the central exchange rate.

Given the persistent exchange rate pressure, analysts believe that interbank interest rates are unlikely to decline further. In reality, the SBV continues to issue new treasury bills with interest rates maintained above 4%. This sends a message that the regulator is prepared to offer an attractive rate to encourage banks with surplus liquidity to turn to the treasury bill channel instead of lending at low rates in the interbank market.

For banks in need of support, the SBV is willing to lend through the OMO channel, but these banks must accept a relatively high-interest rate, currently standing at 4.5% per annum.

The simultaneous use of treasury bills and the OMO channel serves the dual purpose of ensuring liquidity for the banking system and alleviating pressure on the exchange rate by maintaining an appealing level of VND interbank interest rates.