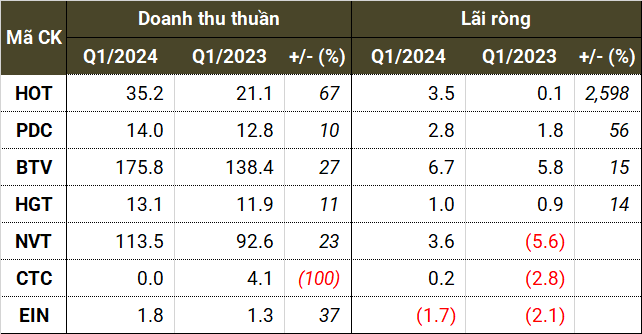

In Q1/2024, statistics from VietstockFinance showed that 13 enterprises operating in the accommodation and hospitality sector recorded a total revenue of 680 billion VND, up 15% compared to the same period last year, but incurred a loss of 47 billion VND, while in the same period last year, they only lost 17 billion VND.

The net profit of HGT, BTV, PDC, HOT, NVT, EIN, and CTC improved, with NVT and CTC turning profitable again, while EIN reduced its loss. In contrast, major players such as VNG and OCH suffered heavier losses. VTG, DAH, ATS, and SGH also reported declining performance.

|

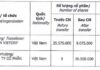

Q1/2024 financial results of enterprises with improved profits compared to the same period last year (in billion VND)

Source: VietstockFinance

|

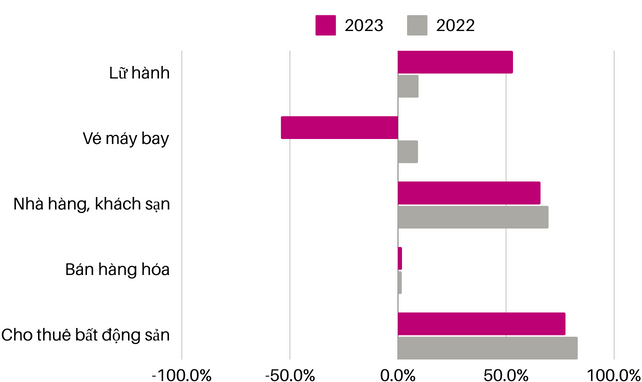

All operations of Ben Thanh Tourist Services Joint Stock Company (UPCoM: BTV) showed positive improvements. The company’s revenue in the first quarter reached 176 billion VND, a 27% increase, mainly due to the travel service segment contributing 36% of the revenue and growing by 57% to 64 billion VND. The gross profit margin for this segment surged from 9.6% to 53%, helping the company achieve a profit of 6.7 billion VND, a 15% increase.

A notable setback was the air ticket sales business, which operated below cost, generating 43 billion VND in revenue but incurring 66 billion VND in costs.

|

Gross profit margins for BTV‘s business segments (in %)

Source: Author’s compilation

|

Ninh Van Bay Tourism Real Estate Joint Stock Company (HOSE: NVT) returned to profitability after two consecutive quarters of losses, thanks to enhanced marketing and business activities targeting foreign customers. Revenue increased by 23% to 113 billion VND, the highest level in over a decade.

An improvement in the gross profit margin from 54% to 59% helped the owner of the Six Senses Ninh Van Bay project earn a profit of 3.6 billion VND, compared to a loss of 5.6 billion VND in the same period last year. Lower interest expenses also contributed to the company’s favorable results, accounting for approximately 9% of profit after cost of goods sold, down from 17% in Q1/2023.

The surge in tourist arrivals in Q1/2024 boosted the revenue of Hoi An Tourism and Service Joint Stock Company (UPCoM: HOT) to its highest level since the pandemic hit in 2020, reaching over 35 billion VND, a significant 67% increase. As a result, the company recorded a profit of 3.5 billion VND, compared to only 128 million VND in the same period last year. The Hoi An Hotel, in particular, brought in nearly 20 billion VND, double that of Q1/2023.

HOT took advantage of the favorable tourism market to improve its landscape, refine its service offerings, and invest in advertising and promotions through various media channels, leading to its fourth consecutive profitable quarter after a challenging period of 12 consecutive loss-making quarters.

| Profit after tax of HOT by quarter from 2019 to the present |

“The Culprit”: Interest Expense

|

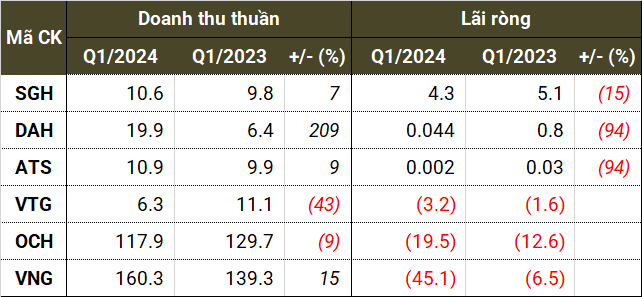

Q1/2024 financial results of enterprises with declining profits (in billion VND)

Source: VietstockFinance

|

Thanh Cong Tourism Joint Stock Company (HOSE: VNG) recorded a historical loss of 45 billion VND, despite a strong 15% increase in revenue to 160 billion VND. The company attributed this to higher depreciation and interest expenses associated with its new investment projects, which resulted in a decrease in gross profit margin and an increase in financial costs, impacting its overall profitability. Interest expenses in the recent quarter totaled 55 billion VND, the second-highest level in the company’s history, only surpassed by the 63 billion VND recorded in Q4/2023.

Looking back, the ratio of interest expense to gross profit from 2018 to pre-2020 was mostly between 3.5% and 18%. However, since the COVID-19 pandemic, this ratio has been maintained between 50% and 100%.

The burden of interest expense also haunted One Capital Hospitality Joint Stock Company (HNX: OCH). Amid a decline in revenue from its main sources, Givral cakes and Trang Tien ice cream, OCH‘s revenue decreased by 9% to nearly 118 billion VND, mainly relying on Sunrise Nha Trang and StarCity Nha Trang hotels. However, the company still incurred a loss of nearly 20 billion VND. The reason for this loss was the surge in interest expenses to 26 billion VND, more than six times the amount in the same period last year and the highest in six years.

Despite a threefold increase in revenue to nearly 20 billion VND, the net profit of Dong A Hotel Corporation (HOSE: DAH) remained negligible. Compared to 796 million VND a year ago, the company’s profit now stands at only 44 million VND due to a 3.6 billion VND provision for commercial benefits.

Prior to this, DAH had divested its entire stake in Green Island Joint Stock Company (book value of 80 billion VND, transferred at 65 billion VND) and Finance and Investment Sao Kim Joint Stock Company (book value of 36 billion VND). Subsequently, the company invested in Finance and Development Investment Van Phong Joint Stock Company (book value of 177 billion VND, holding 75%) and Cho Mo Joint Stock Company (book value of 155 billion VND, holding 19.9%).

Ba Ria – Vung Tau Tourism Joint Stock Company (UPCoM: VTG) extended its losing streak to four quarters. In this quarter, the company incurred a loss of 3.2 billion VND, higher than the 1.6 billion VND loss in Q1/2023. According to VTG, this was due to the temporary suspension of business operations by its subsidiary, Nghinh Phong Tourism Joint Stock Company, and its branch, Bien Dong Tourist Area, to facilitate the handover and renovation of Thuy Van beachfront road.

The Road to Eliminating Accumulated Losses Remains Challenging

The dual challenges of the pandemic and subsequent tight consumer spending have pushed down the profits of businesses in the tourism industry, even leading to prolonged losses.

Statistics show that 10 out of 13 enterprises mentioned above are still loss-making, with a total accumulated loss of 1.7 trillion VND. More than half of this amount belongs to NVT and OCH, at 709 billion VND and 646 billion VND, respectively.

In reality, NVT has been struggling with accumulated losses for over a decade. In 2017, the owner of the Six Senses Ninh Van Bay project recorded a loss of nearly 700 billion VND, and there are still no signs of an early recovery from this situation, especially with quarterly profits of only a few billion VND. On a positive note, NVT‘s performance has gradually improved compared to Q4/2022.

OCH is in a similar situation. The owner of Trang Tien ice cream began to record significant accumulated losses in 2014, after being forced to make a sudden provision for doubtful debts of over 844 billion VND. Although this amount has been reduced by more than half, fluctuations in business operations have caused the accumulated loss to persist at 646 billion VND.

The COVID-19 pandemic hit HGT and HOT hard, pushing them into losses. Despite owning several luxury hotels in prime locations in Hue, HGT has seen its accumulated losses deepen to 104 billion VND, while HOT stands at 54 billion VND. With current profits of only a few hundred million to a few billion VND, the path to eliminating accumulated losses for these two enterprises remains challenging.

Strong Momentum from Visa Waiver Policies

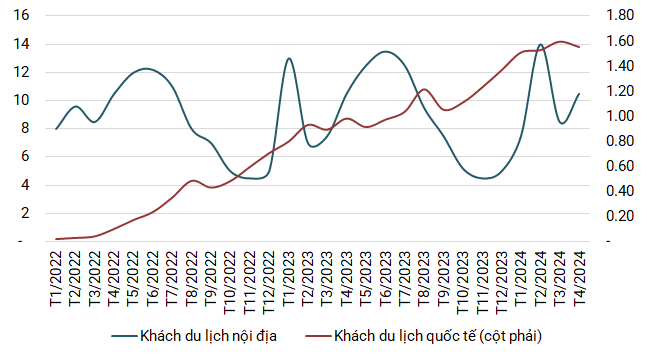

Data from the General Statistics Office showed that in Q1/2024, international tourist arrivals to Vietnam reached 4.6 million, a 76% increase compared to the same period in 2023 and a 50-fold increase compared to two years ago during the peak of the pandemic.

Major markets in Northeast Asia continued to be the main drivers. In particular, China recorded a 534% increase, followed by South Korea (52%), Japan (52%), and Taiwan (127%).

European markets also witnessed strong growth, including the UK (37%), France (40%), Germany (40%), Italy (80%), Spain (50%), and Russia (69%). These markets benefited from Vietnam’s unilateral visa waiver policy, allowing them to stay for up to 45 days.

|

International and domestic tourist arrivals from the beginning of 2022 to the present (in million people)

Source: Author’s compilation

|

Compared to Q1/2019, before the COVID-19 pandemic, potential markets such as India, Cambodia, and Indonesia saw significant increases of 304%, 335%, and 188%, respectively.

The World Travel and Tourism Council forecasts that international tourism could fully recover by the end of 2024. Some Asian travel platforms also expressed optimism, believing that Asia still has much room for recovery in 2024, especially for major tourism markets like China.

However, according to research by Arival, a Thai travel company, it may take until 2025 for the tourism industry to surpass pre-pandemic levels. The Asia-Pacific tourism industry is expected to reach a revenue of 67 billion USD in 2024 and 75 billion USD in 2025.