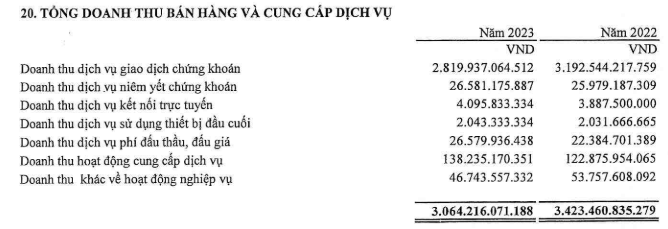

In 2023, the Exchange’s revenue exceeded VND 3,000 billion. Revenue decreased by 10% compared to the previous year.

Securities trading service revenue was the largest contributor to the Exchange’s revenue structure, with a value of up to VND 2,800 billion, equivalent to 92% of total revenue.

|

Revenue structure of VNX

Source: VNX Financial Statements

|

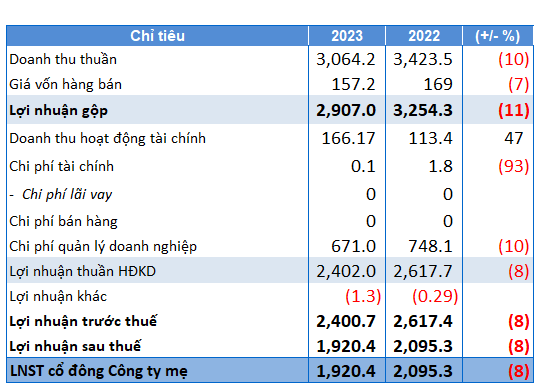

As the cost of goods sold was only VND 157 billion, VNX earned a gross profit of VND 2,900 billion. The Exchange’s gross profit margin reached 95%, equivalent to the previous year.

Financial income reached VND 166 billion, an increase of 47%, mostly from interest on deposits and loans. It is estimated that VNX earned over VND 440 million in interest per day. At the end of 2024, the Exchange and its two subsidiaries, HOSE and HNX, held a total of more than VND 1,900 billion in term deposits. These deposits likely generated significant financial income for the Exchange.

The Exchange did not record any borrowing costs or selling expenses. The most significant expense for the Exchange was enterprise management costs of VND 671 billion. The majority of this was securities supervision fees paid to the State Securities Commission.

At the end of 2023, VNX reported a net profit of over VND 1,920 billion, an 8% decrease compared to the previous year.

|

2023 Business Results of VNX

Unit: Billion VND

Source: VietstockFinance

|

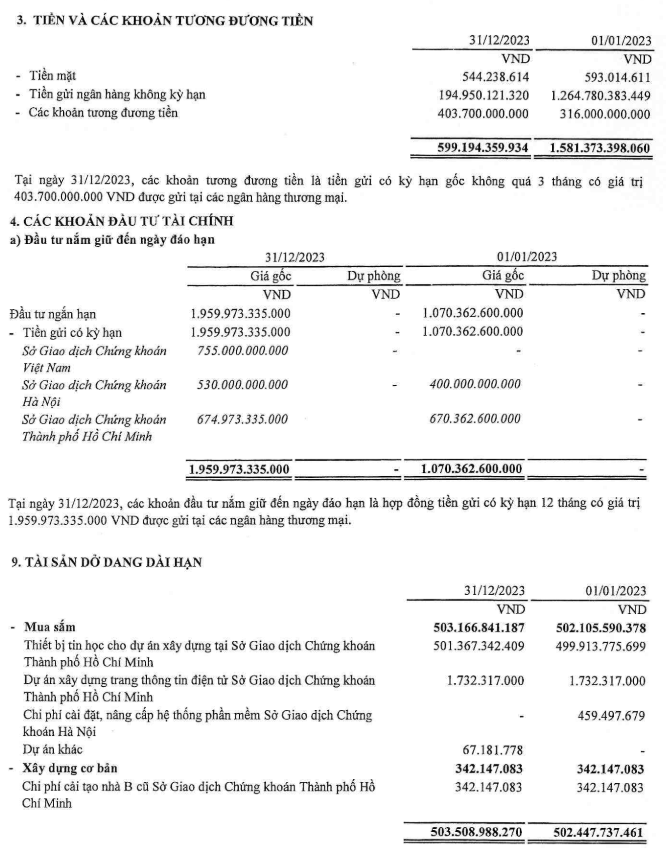

Holding VND 2,600 billion in cash and term deposits

The Exchange’s total assets amounted to nearly VND 4,000 billion, a slight decrease of 1% compared to the beginning of the year. In addition to the nearly VND 2,000 billion in deposits mentioned above, the Exchange held nearly VND 600 billion in cash and cash equivalents.

Another notable asset of the Exchange is the construction-in-progress expense of over VND 500 billion. This is for the purchase of computer equipment for a construction project at HOSE.

|

Asset items with large proportions in VNX‘s asset structure

Source: VNX Financial Statements

|

Achieving 41% of the 2024 profit plan after the first quarter

The Vietnam Stock Exchange (VNX) officially commenced operations on August 6, 2021, following a parent-subsidiary model, reorganizing the Ho Chi Minh City Stock Exchange and the Hanoi Stock Exchange. The Exchange is a parent company organized as a one-member limited liability company wholly owned by the State.

The Vietnam Stock Exchange has a charter capital of VND 3,000 billion and holds 100% of the charter capital of HOSE and HNX. At the end of 2023, the Exchange had 54 employees.

In 2024, VNX set a target of nearly VND 2,797 billion in total revenue and over VND 1,423 billion in after-tax profit. In the first quarter of 2024, the Exchange’s total revenue and after-tax profit were nearly VND 585 billion and nearly VND 575 billion, respectively.

The majority of VNX‘s revenue came from capital investment activities in its subsidiaries, with nearly VND 573 billion. HOSE contributed nearly VND 449 billion, while HNX contributed nearly VND 124 billion. In addition, financial activities brought in nearly VND 12 billion, and business activities generated VND 630 million.

Thus, after the first quarter, VNX had achieved 21% of its revenue target and 41% of its after-tax profit target.