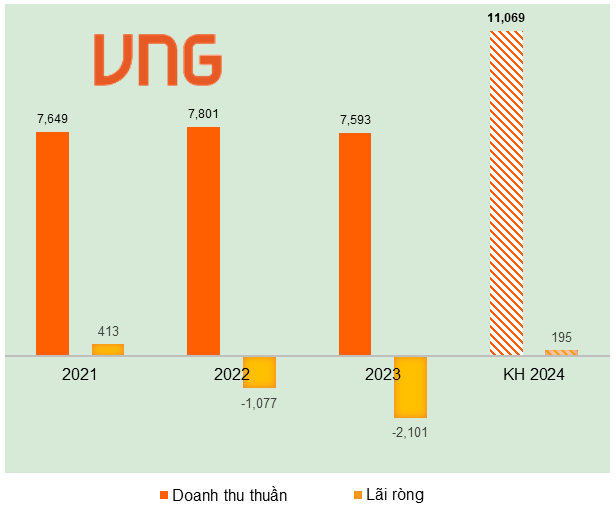

Specifically, in 2023, VNZ incurred a net loss of over VND 2,000 billion after the audit (up from a loss of over VND 540 billion before the audit). The previous year, VNZ also recorded a net loss of nearly VND 1,100 billion.

According to the documents of the 2024 Annual General Meeting of Shareholders, VNZ sets a revenue target of over VND 11,000 billion, up 46% compared to the 2023 performance, which is also a record high if achieved. At the same time, the company aims to return to profitability with a net profit target of VND 195 billion.

|

Results of past years and 2024 plan of VNZ

Source: VietstockFinance

|

The company stated that in 2024, it will continue to diversify its products and services while expanding its market reach. In addition to investing in its core products and services such as electronic games, advertising, media services, data centers, and cloud computing, VNZ will increase investment in AI (artificial intelligence) and other new technologies to enhance productivity and service quality.

To support continued investment in multiple areas, the VNZ Board of Directors proposes to retain earnings from accumulated profits and not pay dividends for 2023.

Furthermore, the company plans to propose an employee stock ownership plan (ESOP). The number of shares expected to be issued in 2024 is 641,064, with an offering price of VND 30,000/share. These shares will be subject to a one-year lock-up period from the end of the offering. The expected timeframe for implementation is from Q3 2024 onwards, and the proceeds (estimated at over VND 19 billion) will be used to supplement the company’s working capital.

Currently, VNZ remains the market leader in terms of share price. On the morning of 03/06/2024, VNZ‘s share price stood at VND 521,000/share, 17 times higher than the ESOP offering price.

| Price movement of VNZ shares since the beginning of 2024 |

Another agenda item for the upcoming annual meeting is the resignation of Ms. Nguyen Thi Thu Trang – Head of the Supervisory Board, and Ms. Truong Thi Thanh – Member of the Supervisory Board, due to personal reasons; and the election of two new Supervisory Board members for the term 2022-2025.

The two candidates are Mr. Pham Van Do La and Mr. Vu Thanh Long. Mr. Do La has been serving as Head of the Legal Department at VNZ since 2012, while Mr. Long is the Head of the Legal Department of Zion JSC – a member of the VNZ Group and the owner of the ZaloPay e-wallet.

The 2024 Annual General Meeting of Shareholders of VNZ will be held online at 9:30 am on 21/06/2024.