The Ministry of Labor – Invalids and Social Affairs has issued Circular 20/2023/TT-BLĐTBXH regulating the adjustment of salary and monthly income subject to social insurance contributions.

Accordingly, the subject of salary adjustment that has contributed to social insurance according to the provisions of Article 1 and Article 2 of Decree No.115/2015/NĐ-CP.

Specifically, employees who are subject to state-regulated salary regime, starting from January 1, 2016, and participating in social insurance, are entitled to social insurance once or death benefit, where beneficiaries will receive a one-time allowance from January 1, 2024 to December 31, 2024.

Employees who contribute to social insurance according to the employer’s salary regime, and receive a one-time pension, a one-time death benefit, or a one-time funeral allowance, from January 1, 2024 to December 31, 2024, are also subject to the adjustment.

As for the subject of adjusting monthly income that has contributed to social insurance according to the provisions of Article 2 of Decree No. 134/2015/NĐ-CP, it applies to voluntary social insurance participants who receive a one-time pension, a one-time death benefit, or a one-time funeral allowance, from January 1, 2024 to December 31, 2024.

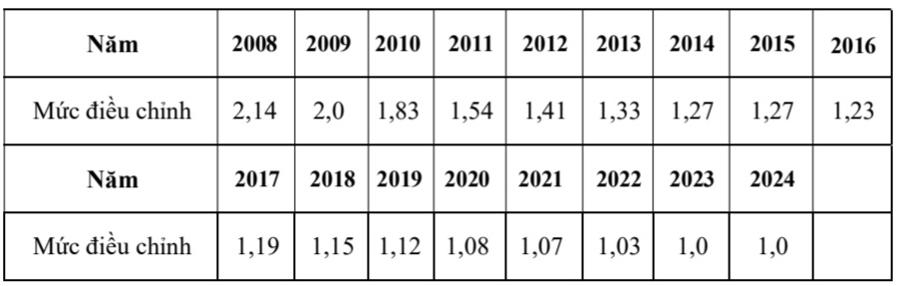

The Circular stipulates that the adjusted monthly salary subject to social insurance follows the formula: Adjusted monthly salary subject to social insurance = Total monthly salary subject to social insurance of each year x Adjusted salary rate of corresponding year.

For employees who have both mandatory and voluntary social insurance contribution periods, the monthly salary subject to social insurance follows the regulation.

The adjusted voluntary monthly income subject to social insurance follows the formula: Adjusted voluntary monthly income subject to social insurance = Total voluntary monthly income subject to social insurance of each year x Adjusted income rate of corresponding year.

In the case of employees who have both mandatory and voluntary social insurance periods, the adjusted monthly income subject to voluntary social insurance follows the regulation.

The mandatory monthly salary subject to social insurance is adjusted according to the provisions of Article 10 of Decree No. 115/2015/NĐ-CP and Article 2 of this Circular (adjusted salary rate of the corresponding year).

The average monthly salary and monthly income subject to social insurance, used as the basis for calculating pension, one-time pension, one-time death benefit, and one-time funeral allowance, are determined according to the provisions of Article 4 of Decree No. 115/2015/NĐ-CP and Article 4 of Decree No. 134/2015/NĐ-CP.

This Circular shall come into effect from February 15, 2024; the provisions of this Circular shall be applied from January 1, 2024.