On June 3rd, foreign investors net bought over 1.7 million STB shares. STB’s market capitalization increased to VND 56,085 billion.

| STB share price movement since the beginning of the year |

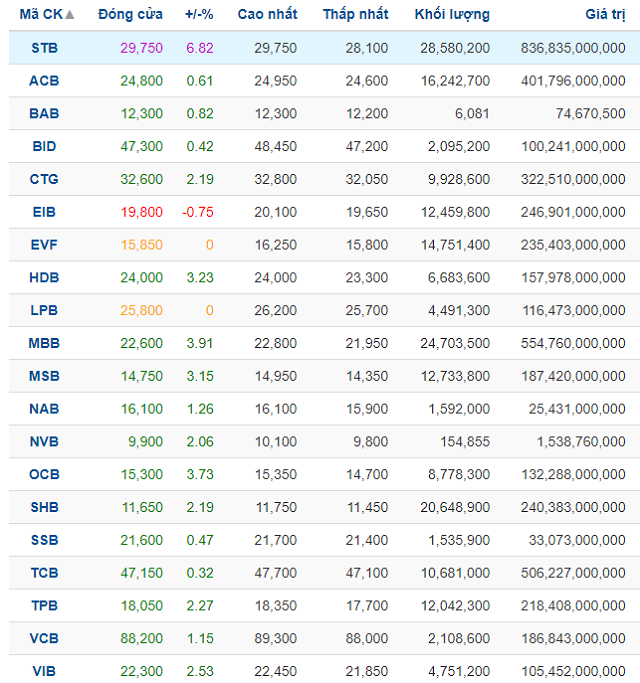

Also on June 3rd, a series of other bank stocks surged, including MBB, MSB, and TPB, all recording gains of more than 3%. In addition, CTG, OCB, VPB, VIB, HDB, SHB, and NVB shares also rose by more than 2%.

The trading volume of “king stocks” also saw large numbers such as MBB (24.7 million shares), SHB (20.6 million shares), ACB (over 16 million shares), and EIB (12 million shares), among others.

|

Bank stock transactions on June 3rd

Source: VietstockFinance

|

The surge in STB shares was partly a reaction to positive news from the update report of KB Vietnam Securities Co., Ltd. (KBSV) on May 31, 2024.

According to the information from the 2024 Annual General Meeting, Sacombank has successfully sold its non-performing loan related to the Phong Phu Industrial Park. Currently, Sacombank has received 20% of the total sale value, with 40% expected to be received in 2024 and the remaining 40% in 2025.

KBSV expects Sacombank to recognize other income of about VND 1,336 billion in 2024 from this transaction, after making provisions for the entire VAMC bond debt.

Sacombank set a plan to achieve a credit balance of VND 535,800 billion, up 11% year-on-year, with a bad debt ratio of below 2% and pre-tax profit of VND 10,600 billion, up 10.47% year-on-year.

In KBSV’s opinion, Sacombank’s business results will be more favorable than planned based on the following factors: NIM maintained at a good level thanks to improved funding costs; asset quality remains well controlled; and income from the sale of the Phong Phu Industrial Park.

KBSV set a target price for 2024 for STB shares at VND 40,000/share, up 41.6% compared to the price on May 30, 2024.

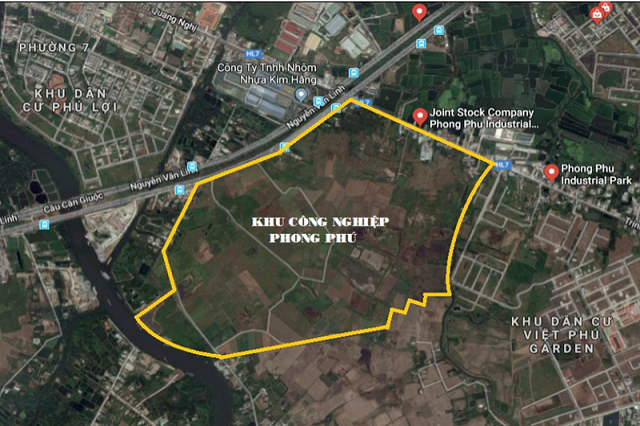

Phong Phu Industrial Park

According to our understanding, the Phong Phu Industrial Park is developed by Phong Phu Industrial Park Joint Stock Company. This asset secured a loan from the Southern Bank in the 2011-2012 period before its merger with Sacombank.

The Phong Phu Industrial Park project is located in Phong Phu commune, Binh Chanh district, Ho Chi Minh City, adjacent to the Phu My Hung urban area, 3.7km from the intersection of Nguyen Van Linh and National Highway 1A, and 3km from the intersection of Nguyen Van Linh and National Highway 50.

Location of Phong Phu Industrial Park

|

The total debt as of December 31, 2021, was VND 16,196 billion, including principal debt of over VND 5,134 billion and accrued interest of over VND 11,061 billion.

Since the beginning of 2023, Sacombank has auctioned this asset several times. The starting price for the auction on December 22, 2022, was VND 7,934 billion, a significant decrease from the price of VND 14,577 billion in March 2022. In May 2022, the starting price was reduced to VND 11,810 billion, and in September 2022, it was VND 9,600 billion.

Han Dong