Restructuring Plans for 2024

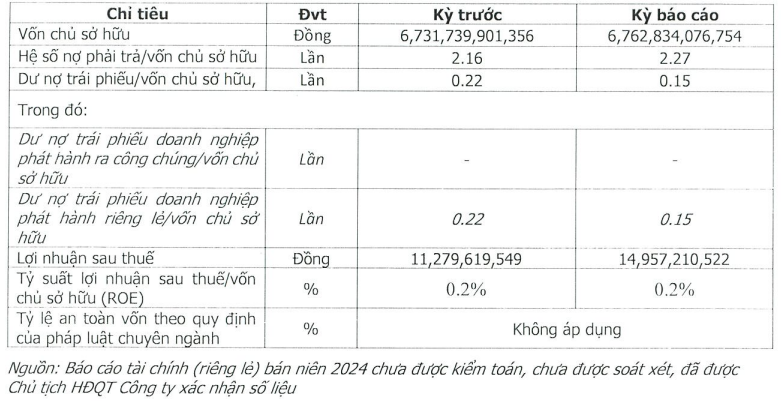

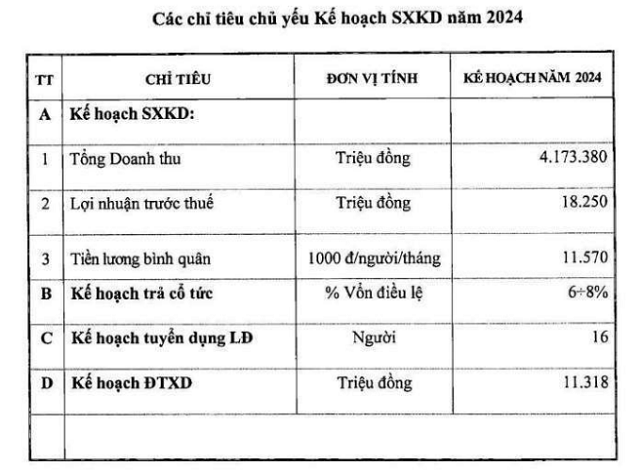

According to the 2024 Annual General Meeting documents, MTS aims to achieve a total revenue of nearly VND 4,174 billion and a pre-tax profit of nearly VND 18.3 billion, a decrease of 4% and 6%, respectively, compared to 2023. The company plans to invest a total of over VND 11 billion. In terms of dividends, MTS expects to pay out 6-8%.

Regarding the 2023 profit distribution plan, MTS proposed a dividend payout ratio of 7%, equivalent to a payout of VND 10.5 billion, which was approved by the General Meeting.

Source: 2024 Annual General Meeting documents of MTS

|

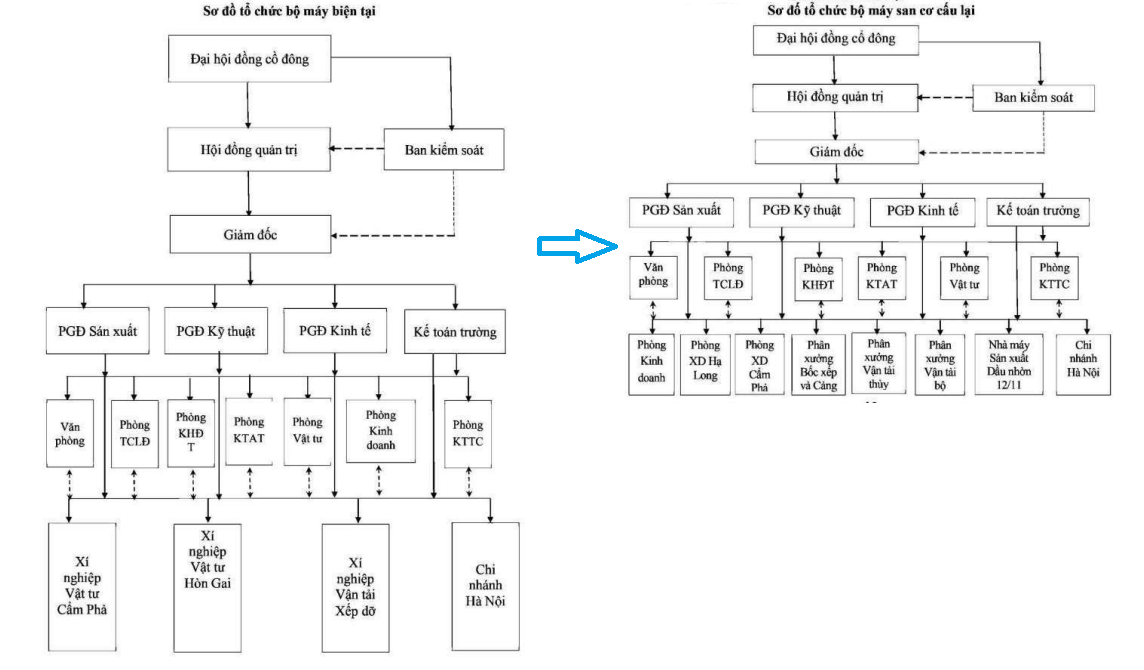

Notably, MTS has proposed a restructuring plan for the company, which, if approved, will bring about significant changes to its operational structure and future business plans.

MTS, as a logistics provider for TKV’s coal production and trading, operates in various industries, including fuel supply, equipment, lubricant manufacturing, cargo handling, water and land transportation, and personal protective equipment. However, with an annual production value of over VND 500 billion, profits of over VND 20 billion, and a workforce of 681 employees, streamlining the management structure is a logical next step.

Additionally, the company faces challenges due to uneven growth rates in the production of its products and services, limitations of the organizational model with affiliated enterprises, and the need to optimize indirect labor, enhance labor efficiency, and leverage technological advancements.

As a result, MTS will reorganize its structure, including the dissolution of three affiliated enterprises: Hon Gai Equipment Enterprise, Cam Pha Equipment Enterprise, and the Transportation and Cargo Handling Enterprise.

Concurrently, two departments, namely the Cam Pha and Ha Long Fuel Departments, will be established, along with three workshops for cargo handling and port operations, water and land transportation, and a lubricant manufacturing plant. These new entities will be based on the existing business departments and workshops. Additionally, MTS will rename the Director’s Office as the Office.

Employees and officers from the dissolved enterprises will be reassigned, and the former headquarters will be utilized for the new office and workshops.

Source: 2024 Annual General Meeting documents of MTS

|

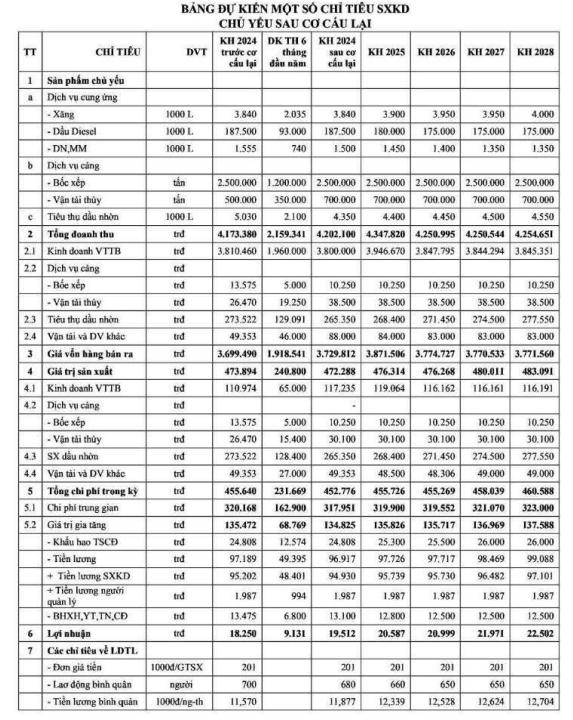

With these changes, MTS has also adjusted its production and business targets up to 2028. Specifically, for 2024, the post-restructuring plan projects a slight growth, with total revenue increasing from over VND 4,173 billion to over VND 4,202 billion. This includes contributions of VND 3,800 billion from equipment and supplies, over VND 10 billion from port services, nearly VND 39 billion from water transportation, over VND 265 billion from lubricant sales, and VND 88 billion from transportation and other services.

MTS anticipates a rise in pre-tax profits from over VND 18 billion to nearly VND 20 billion, representing an increase of almost 7%.

For the first half of 2024, the company expects to generate over VND 2,159 billion in total revenue and over VND 9 billion in pre-tax profits, equivalent to 51% and 47% of the annual targets, respectively.

Source: 2024 Annual General Meeting documents of MTS

|

Plans for Listing on HOSE

During the 2021 Annual General Meeting, shareholders approved the listing of MTS shares on the Hanoi Stock Exchange (HNX). Subsequently, the company initiated the listing process in 2023.

In May 2023, MTS continued to refine the supplementary documents for the listing registration dossier. On October 25, 2023, MTS received a communication from HNX regarding the suspension of the dossier’s processing due to Circular 57/2021/TT-BTC, which took effect on December 30, 2023. This circular stipulates that the Ho Chi Minh Stock Exchange (HOSE) will receive and review listing registration dossiers, organize trading of new shares, and handle organizations that meet the conditions for listing as prescribed in Decree No. 155/2020/ND-CP dated December 31, 2020, and have a chartered capital of VND 120 billion or more. As a result, MTS intends to submit its listing registration dossier to HOSE in 2024.

According to the financial statements over the years, MTS has maintained its owner’s equity at VND 150 billion. As of March 31, 2024, Vinacomin is the parent company of MTS, holding 51% of the shares, while Dai Van Phu One-Member Limited Liability Company is another major shareholder, owning 17.67%.

In other related news, on June 14, the Quang Ninh Provincial Tax Department issued an administrative sanction decision against MTS for under-declaration, resulting in a tax shortfall. Consequently, MTS was fined over VND 89 million for the violation and was required to pay nearly VND 541 million in remedial payments, totaling almost VND 630 million.

Earlier, on May 30, MTS was also sanctioned for under-declaring value-added tax, resulting in a payment of nearly VND 243 million, comprising a fine of over VND 25 million and a remedial payment of nearly VND 218 million.

Huy Khai