Cautious targets, achieving 46% of the plan after Q1

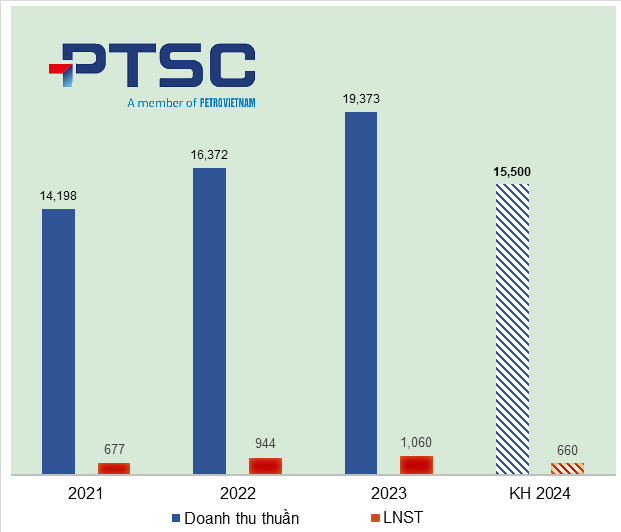

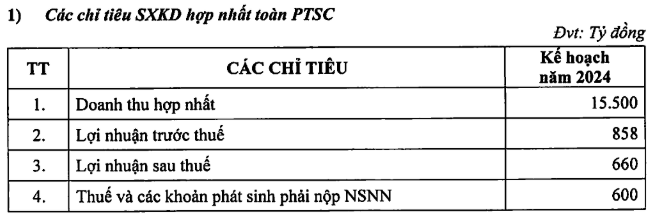

At the meeting, PVS set a consolidated revenue target of VND 15.5 trillion for 2024, a 20% decrease from the previous year’s performance; and a profit-after-tax target of VND 660 billion, a 38% decrease compared to the same period.

Source: PVS

|

This is considered a cautious target, as PVS achieved its highest profit in 5 years in 2023 (nearly VND 1.1 trillion in profit-after-tax), despite facing numerous challenges and difficulties. The company stated that in 2023, the macroeconomic environment and international markets experienced complex and unpredictable fluctuations due to geopolitical conflicts. Domestically, investing in new projects for exploration, exploitation, and increasing reserves also encountered difficulties, and it was only towards the end of the year that there were positive signals from the implementation of the chain of gas-power projects in Lot B – O Mon.

|

Business results and plans of PVS in 2024

Source: VietstockFinance

|

2024 is also forecasted to be a challenging year for PVS – as shared by Mr. Pham Tuan Anh, representative of the major shareholder PVN (51.38%).

However, it is important to note that PVS often sets conservative targets and outperforms its plans, such as in 2023, where it exceeded the revenue plan by 27% and the profit-after-tax target by 0.9%. In Q1/2024, PVS achieved more than VND 3.7 trillion in revenue, almost unchanged from the same period; and a net profit of nearly VND 301 billion, a growth of 40%. Compared to the set plan, PVS has achieved 24% of the revenue plan and 46% of the annual profit target in just the first quarter.

| Business situation of PVS |

Another notable piece of information is that the meeting approved the merger of a subsidiary into PVS, namely PTSC Underground Survey Services Co., Ltd. (KSCTN). The company has a charter capital of VND 300 billion and specializes in providing underground survey services for oil and gas exploration, exploitation, and related activities in Vietnam and internationally. However, from 2015 onwards, the domestic demand for this field has decreased significantly, while fluctuations in oil and gas prices and geopolitical conflicts have negatively impacted the company’s operations.

Moreover, the underground survey and construction field requires high experience and technical expertise, and the shift towards renewable energy also demands the replacement of outdated equipment. The demand is predicted to remain low, while the company’s financial capacity, capital arrangement capabilities, and market development are limited. Still, as it falls within the core service group, PVS decided to implement the plan to dissolve KSCTN and merge it into the General Company. The timeline for this process is set for 2024.

PVS’s 2024 Annual General Meeting of Shareholders. Screenshot

|

Vessel and port segment benefits from Lot B and Lac Da Vang

During the discussion, General Director Le Manh Cuong stated that the vessel and port base segment is a crucial investment area for the company. Figures from 2023 show a 42% year-on-year growth in specialized vessels and a 4% increase in ports. The port bases in Vung Tau are undergoing upgrades and equipment enhancements.

“The ports are considered bases for providing various services for traditional oil and gas and offshore renewable energy. With upcoming oil and gas projects such as Lot B, Lac Da Vang, and the orientation towards offshore renewable energy, the prospects for the vessel and port segment are very promising. PVS clearly recognizes this potential and has an investment roadmap for vessels and port base expansion. This will be a critical area for PVS, and investing in port and port bases is mandatory to boost capacity and productivity in renewable energy,” said Mr. Cuong.

Focusing on the wind power export project to Singapore

Regarding the wind power export project, Mr. Cuong shared that in late 2024 – early 2025, they would proceed with deploying survey equipment to the field. The survey process takes a minimum of one year, after which technical and economic calculations will be made based on the data to make the final investment decision.

“The project has received special attention and will have a follow-up mechanism. It holds a bright future, helping PVS not only participate but also shape the supply chain for similar projects worldwide,” said the General Director of PVS.

Concerning domestic projects, Mr. Cuong revealed that PVS currently has no plans to participate in any and is solely focused on the wind power export project to Singapore. He emphasized that Vietnam’s wind power potential is evident, and the picture is becoming clearer with policies, regulations, and the Power Development Plan 8.

“However, as the implementation mechanisms and policies are still being refined, potential investors, including PVS, require more time to consider before making investment decisions.”

Expected capital increase of VND 16,000 – 17,000 billion by 2030

Regarding the capital increase roadmap, Mr. Cuong stated that PVS currently needs a large amount of capital to continue investing.

“Recently, PVS was awarded the FSO floating storage and offloading contract by Murphy Oil, with an investment value of hundreds of millions of USD. With upcoming FSO projects, we need to concentrate our capital. The capital requirements from now until 2030 have been carefully calculated and involve various scenarios as we prepare for the medium and long term, ensuring we choose the appropriate option that meets the requirements of all stakeholders,” he added.

Mr. Cuong explained that the investment project segment would require a substantial amount of capital. For the investment in production and business capacity (as a contractor) to increase output and productivity, the expected investment is VND 10,000 billion. The capital structure will be considered to determine the specific sources, possibly including financial leverage. For the investment project segment (as an investor), the capital requirement could be even higher, with scenarios aiming for over VND 60,000 billion.

“As an investor, the level of financial leverage will be higher, typically around 20-30% equity,” he noted.

With these requirements, Mr. Cuong revealed that the scenario being developed aims for VND 16,000 – 17,000 billion by 2030. There are also other scenarios that will be presented to the competent authorities before implementation. The capital increase can be carried out through various methods such as paying dividends in shares, issuing additional shares to existing shareholders, and utilizing sources from available profits or accumulated depreciation of assets.

|

Shareholders face difficulties in attending PVS’s AGM The 2024 Annual General Meeting of Shareholders of Vietnam Petroleum Technical Services Joint Stock Corporation (PTSC, HNX: PVS) was held online on June 17, 2024. However, many shareholders encountered difficulties in attending due to the company’s failure to send out invitations. Specifically, some shareholders did not receive their account information for the meeting, with the common issue being that they “did not receive an invitation letter or email” despite holding PVS shares as of the ex-rights date, April 26, 2024 (record date: May 2, 2024). Vinh, an investor in Ho Chi Minh City, shared that he had purchased nearly 2,000 PVS shares at the beginning of March 2024 and held them past the ex-rights date for the meeting. However, he did not receive any invitation. A similar situation occurred with investor Tru Do. He stated that as of the record date, he held more than 300 shares but did not receive an invitation either. “One of my friends, who owns 20,000 shares, also did not receive an invitation, even though he really wanted to attend,” said the investor from Thai Binh province. Nghia, another shareholder in Ho Chi Minh City, confirmed that he, too, had not received an invitation. However, he was able to attend by clicking on the “forgot password” option on the meeting’s website. Nonetheless, Nghia mentioned that this process was time-consuming, and some of his friends could not attend despite using the same method. |

Top Investment Channels for 2024: Safe and Profitable

2023 is a year full of volatility in the global financial market. Against this backdrop, many investors are interested in gold as a store of assets.