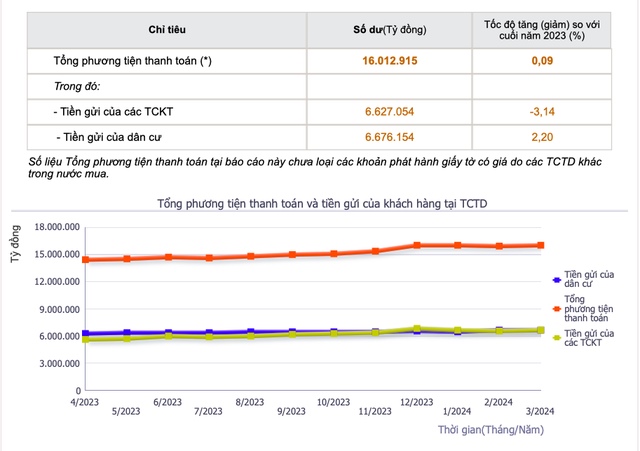

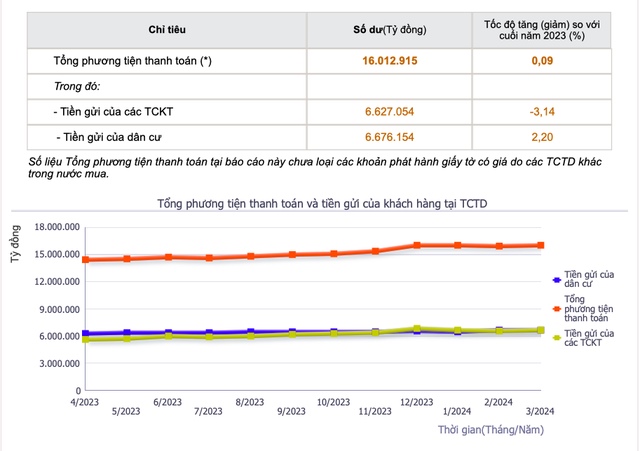

According to the latest data from the State Bank of Vietnam, nearly VND 39 trillion in new deposits from residents flowed into credit institutions in March 2024. In the first three months, deposits from residents increased by more than VND 143 trillion, bringing the total deposits from residents to over VND 6.67 million billion, up 2.2% from the end of last year. This figure is positive compared to the 3.14% decrease in deposits from economic organizations into banks during the same period.

Notably, March was also the time when commercial banks started to increase savings interest rates to attract deposits from residents, after a few months of decline previously.

State Bank data shows that deposits from residents increased while deposits from economic organizations into the banking system continued to decrease. |

In addition, the resumption of credit growth is also a reason for banks to increase deposit interest rates to raise capital for lending activities.

State Bank data shows that credit started to grow positively in March after two months of decline at the beginning of the year. By mid-June, loan growth reached 3.79% compared to the end of last year, but capital mobilization from residents only increased by 2.2% while capital from economic organizations decreased by 3.14%…

This situation forces commercial banks to continue to adjust and increase deposit interest rates to retain customers and attract idle capital from residents.

On June 22, with a deposit of VND 500 million coming due, Mr. Thanh Hoang, a resident of Binh Thanh District, Ho Chi Minh City, decided to continue his savings but chose a different bank, opting for one that had recently increased its interest rates to get a higher return.

“Some banks have just increased their interest rates to 6% per annum for long-term deposits over 12 months, so I decided to go for a longer-term deposit instead of the shorter 1-3 month terms I previously preferred,” said Mr. Hoang.

According to our reporter’s findings, the 6% per annum interest rate mentioned by Mr. Hoang has just been offered by Cake by VPBank. Specifically, in the latest updated interest rate table of this digital bank, customers depositing for a term of 12 months will enjoy an interest rate of 5.8%, and those depositing for a longer term of 24-36 months will receive an interest rate of up to 6% per annum.

Thus, with a deposit of VND 500 million, if Mr. Hoang chooses to deposit for a term of 12 months at Cake by VPBank, he can earn interest of VND 29 million per year. If he opts for a longer term of 24-36 months, his annual interest income will be VND 30 million.

State Bank data continues to show an increase in deposits from residents, while deposits from economic organizations into the banking system remain on a downward trend. |

A survey of the 6-month term deposits reveals that VPBank has just increased its interest rate by 0.3 percentage points to 4.6% per annum compared to a week ago. Other banks such as BVBank, VietABank, and VIB have also made adjustments, increasing their rates by 0.1 to 0.2 percentage points from their previous interest rate tables. Oceanbank has raised its rates quite significantly, by 0.4 percentage points compared to the beginning of the month. At present, the highest interest rate for this term is offered by BacABank, BaoVietBank, Oceanbank, and BVBank, ranging from 4.8 to 4.9% per annum.

For the 12-month term, some banks have also adjusted their interest rates, including VPBank at 5.1% per annum, BVBank at 5.5%, VietABank at 5%, Oceanbank at 5.5%, and NCB at 5.3% per annum, reflecting increases of 0.1 to 0.3 percentage points compared to a few weeks ago.

Thai Phuong, Photo: Binh An

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Fighting Cross-Ownership: Impossible to “Take Tangibles to Treat Intangibles”

The recent amendment to the Credit Institutions Act, passed by the National Assembly during an extraordinary session, has introduced several measures to address cross-ownership, manipulation, and domination of credit institutions. However, it is challenging to “make the intangible tangible”! To prevent cross-ownership, it is crucial to enhance the effectiveness of inspections and supervision.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.