At the seminar, VAMC and KAMCO agreed on several solutions to support VAMC in handling bad debts in the future, including: providing funding sources from the Korean government for technical assistance to VAMC; providing documents related to debt securitization for VAMC to initially approach; and sending experts to support VAMC in the 2024-2025 period to concretize the solutions that the two sides agreed upon at the seminar.

KAMCO also expressed the interest of Korean investors in the bad debt market in Vietnam and proposed that VAMC cooperate in providing a list of borrowers and collateral so that Korean investors can study and approach within the framework of Vietnamese law.

Experience in handling bad debts in South Korea

Since the end of 1997, when the financial crisis occurred in South Korea, enterprise and financial restructuring became a national issue in South Korea. In particular, the successful handling of a large amount of non-performing loans (NPLs) by South Korean banks was a key factor in the South Korean government’s ability to stabilize the financial market and the foundation for the following economic reform solutions in South Korea.

In early 1998, the Bank of Korea (BoK) conducted a reassessment of non-performing loans of the entire national credit system. To address the issue of rapidly increasing non-performing loans, the South Korean government enacted a law to improve the functions and tasks of the Asset Management Corporation under the Korea Development Bank (KDB), transforming it into the Korea Asset Management Corporation (KAMCO), which is authorized to buy and sell non-performing loans of the entire South Korean credit system.

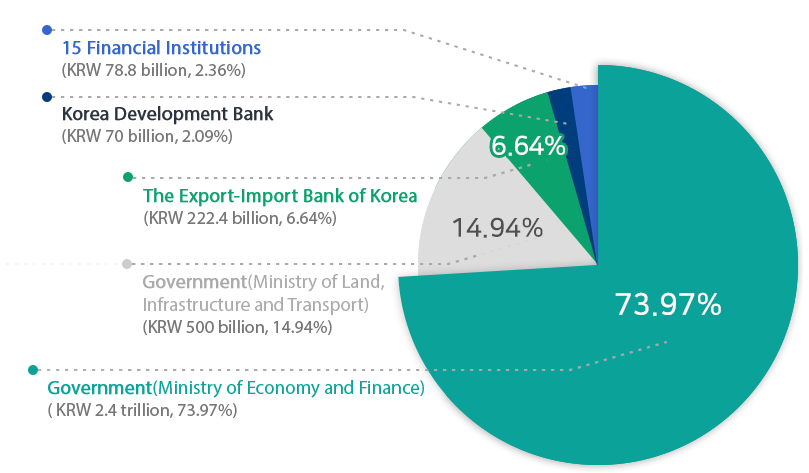

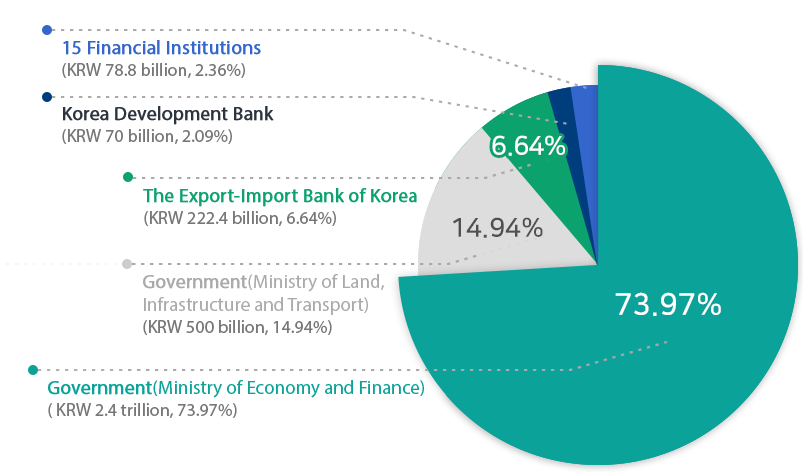

KAMCO is owned and managed by three entities: the Ministry of Economy and Finance (contributing 42.8% of capital), KDB (28.6%), and other financial institutions (28.6%), according to a 2017 report. As of 2023, KAMCO has a chartered capital of 7 trillion won (nearly $5.1 billion) and mobilized capital of 3.3 trillion won (nearly $2.4 billion). The shareholder structure shows that the Ministry of Economy and Finance holds 73.97%, the Ministry of Land, Infrastructure, and Transport holds 14.94%, the Korea Eximbank holds 6.64%, KDB holds 2.09%, and 15 other financial institutions hold 2.36%.

|

KAMCO Shareholder Structure as of early 2023

Source: KAMCO

|

KAMCO is in charge of managing the Non-Performing Asset (NPA) Fund with a term of 5 years to resolve non-performing assets of the entire system. The NPA Fund has raised a total of 21.6 trillion won, including: 20.5 trillion won from the issuance of government-guaranteed bonds, 500 billion won borrowed from KDB, and 600 billion won from other financial institutions. NPA bonds were issued during the period from November 1997 to December 1999.

KAMCO purchases non-performing loans from financial institutions based on certain criteria and through various methods such as analysis, valuation, and negotiation of the final selling price. The disposal of non-performing loans was carried out from the end of 2008 in various forms, from international bidding to bulk and retail sales, and enterprise restructuring.

In the period of 1997-2003, KAMCO recovered 110.1 trillion won, equivalent to a recovery rate of 46.8% on the value of the debt. Thanks to the simultaneous use of bad debt handling measures, the bad debt ratio decreased from 17.7% in 1998 to 14.9%, 10.4%, 5.6%, and 3.9% in 1999, 2000, 2001, and 2002, respectively. In 2014, KAMCO handled 25 trillion won in bad debts.

In addition, since November 1997, the South Korean government has also mobilized public funds totaling 6 trillion won (about $58 billion) to promote enterprise and financial restructuring. The public funds were divided into two funds with special purposes, including the Non-Performing Loans Fund (NRF) and the Deposit Insurance Fund (DIF).

KAMCO and the Korea Deposit Insurance Corporation (KDIC) issue bonds to raise funds for the NRF and DIF. These bonds are all government-guaranteed. The Ministry of Economy and Finance, in consultation with the Financial Supervisory Commission, is responsible for formulating policies and coordinating the management of public funds.

KAMCO manages the NRF with mobilized capital of 20.5 trillion won, and KDIC manages the DIF with 43.5 trillion won. The main purpose of the NRF is to buy back non-performing loans from financial institutions (mainly banks) and handle them through resale, issuance of asset-backed securities (ABS) or mortgage-backed securities (MBS), or other techniques such as debt-equity swaps, debt restructuring, and refinancing for companies with temporary financial difficulties.

The recovery rate of the NRF is 87.3%, and the NRF uses the recovered money to continue buying non-performing loans. The total amount of money that the NRF has used to purchase non-performing loans is 30 trillion won.

On the other hand, DIF mobilizes capital to restructure the capital of financial institutions and make payments to depositors in insolvent financial institutions. DIF has spent about 48 trillion won on this purpose. In addition, DIF also uses money to buy non-performing loans, and in this case, DIF plays the role of KAMCO (DIF has spent 4 trillion won buying bad assets from banks).

KAMCO divides the purchased assets into two types: ordinary assets and special assets. Ordinary assets are non-performing loans that are uncertain to be repaid. Special assets are non-performing loans to companies that are in the process of enterprise restructuring, so the loans are restructured with lower interest rates and longer repayment periods. These types of assets are further divided into secured and unsecured loans.

After the purchase, KAMCO will group these non-performing loans and sell them to investors through international auctions or KAMCO will issue asset-backed securities based on the purchased non-performing loans. KAMCO can also seize the collateral of secured assets. Sometimes, KAMCO holds non-performing loans and tries to restructure the debt, refinance, or convert debt into equity if KAMCO believes that the company can recover.

Thu Minh

Vietnam ready to welcome record international visitors

In January of this year, Vietnam welcomed over 1.5 million international visitors, the highest number since the country reopened its tourism in March 2022.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.