Based on the above-mentioned ratio and the current circulating stock of over 40 million shares, DVP is expected to pay out approximately VND 180 billion for this dividend, with a planned payment date of August 21.

Previously, DVP also paid an interim dividend for the first period of 2023 on January 12, 2024, at a rate of 25%, equivalent to a payout of around VND 100 billion. Thus, if the second dividend for 2023 is successfully implemented, the total dividend ratio for the past year will reach 70%, with a value of over VND 280 billion, equivalent to the rate approved at the 2024 Annual General Meeting of Shareholders.

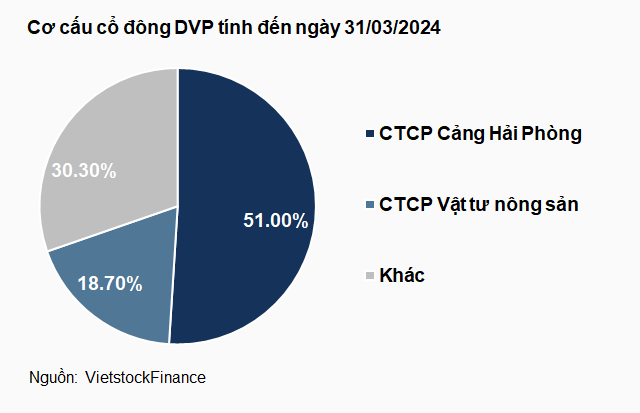

As the parent company and direct owner of 51% of DVP’s capital, Hai Phong Port Joint Stock Company (UPCoM: PHP) stands to benefit significantly, potentially receiving a total of nearly VND 143 billion. The majority of this amount will then flow to the Vietnam Maritime Corporation – Joint Stock Company (UPCoM: MVN), which directly owns 92.56% of PHP’s capital, thereby recognizing a 47.21% interest in DVP’s capital.

In addition, DVP also has another major shareholder, Agricultural Products Materials Joint Stock Company, which owns 18.7% and is expected to receive more than VND 52 billion. According to audited financial statements for 2023, there is a special relationship between the two companies as Mr. Nguyen Tien Dung serves as both Vice Chairman of DVP’s Board of Directors and Chairman of the Board of Directors of Agricultural Products Materials Joint Stock Company.

A dividend of up to 70% is exceptionally high compared to DVP’s historical dividend payouts. This is supported by strong net profits of nearly VND 329 billion in 2023, a 16% increase from 2022 and the highest since its listing on HOSE in 2009.

In reality, DVP’s profit growth was boosted by a rare incident. In the first quarter of 2023, the company received compensation for damages of $5.5 million, equivalent to nearly VND 129 billion, following an accident where the STS01 crane at Dinh Vu Port’s No. 2 bridge crane was damaged by the Tiger Maanshan ship (Hong Kong) on August 10, 2022. Conversely, DVP also had to spend nearly VND 67 billion on repairing the STS01 crane and other expenses, but still made a significant profit overall.

Additionally, DVP’s net profit for 2023 was supported by other income, including penalties for late delivery of over VND 5 billion for two Tukan pedestal cranes, dividends for 2022 from SITC-Dinh Vu Logistics Company Limited totaling nearly VND 61 billion, interest income, and a difference in the recovery of investment capital from Dinh Vu Logistics Joint Stock Company of over VND 5 billion.

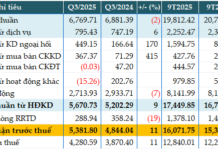

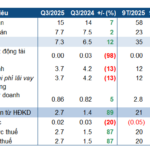

| DVP’s business results by quarter for the period 2021-2024 |

Given the exceptional results in the first quarter of 2023, it is not surprising that DVP’s net profit for the first quarter of 2024 decreased by 42% compared to the previous year, amounting to approximately VND 61 billion.

Collision of STS01 crane and Tiger Maashan ship on August 10, 2022 (red circle) – Source: People’s Police Newspaper

|

In the market, DVP shares have witnessed an impressive upward trend since its listing on HOSE in December 2009. As of the close on June 18, DVP recorded a 55% increase with an average trading volume of over 23,000 shares per day over the past year.

| Price movement of DVP shares since the beginning of 2024 |

Huy Khai