Gold prices remained stagnant this Sunday as banks halted the sale of SJC gold bars. The selling price of SJC gold remained at VND 77 million per tael during this weekend’s trading session, while large gold enterprises bought gold at VND 75 million per tael. SJC gold prices have been stagnant for over three consecutive weeks.

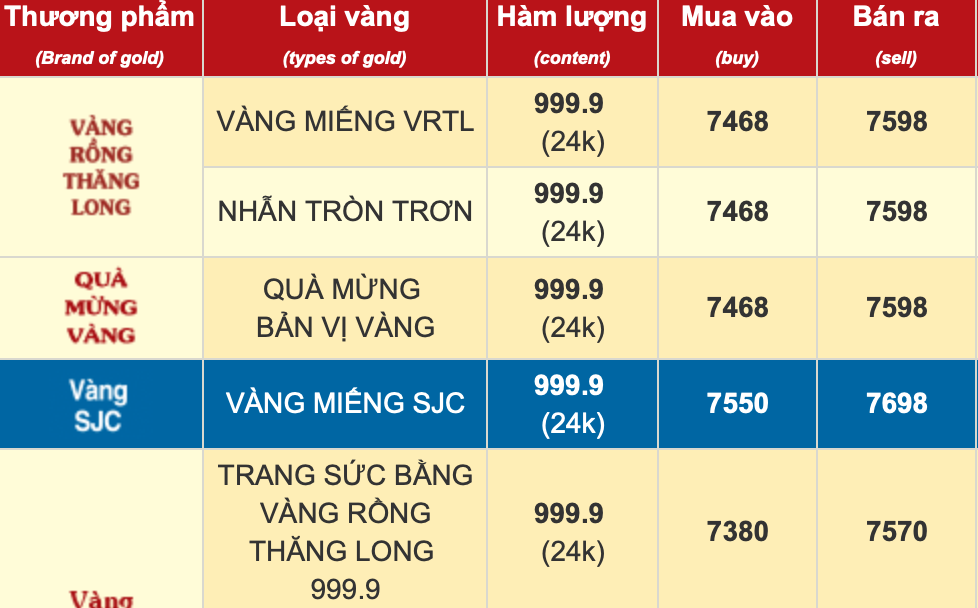

Today’s plain gold ring prices at some brands continued to increase slightly by VND 50,000-150,000 per tael. For instance, Bao Tin Minh Chau listed their price at VND 74.68-75.98 million per tael, an increase of VND 130,000 per tael compared to yesterday. DOJI Group maintained their price at VND 74,65-75,9 million per tael. SJC listed theirs at VND 73,95-75,65 million per tael, and PNJ applied a price of VND 73,95-75,6 million per tael.

Over the past week, plain gold ring prices have increased by VND 200,000-300,000 per tael. Currently, the buying price of plain gold rings is close to that of SJC gold (only a difference of VND 500,000 per tael), while the selling price difference is only VND 1 million per tael.

In the international market, gold prices stand at $2,327 per ounce. When converted according to Vietcombank’s VND/USD exchange rate, the international gold price is equivalent to VND 71.5 million per tael. In contrast, when converted according to the black market’s USD/VND exchange rate, the international gold price is equivalent to VND 73 million per tael. USD rates at banks remained stable last week, still listed at the NHNN-mandated ceiling rate, ending the week at VND 23,473 per USD. Meanwhile, the black market’s USD rate surged past VND 26,000 per USD, the highest ever.

Consequently, the gap between domestic and international gold prices has narrowed to VND 2-5.5 million per tael.

International gold prices are still under pressure due to the strong US dollar. The DXY index, which measures the strength of the US dollar against major currencies, has increased to around 106 points. However, many experts believe that the fundamental factors in the long term still support a gold price increase; it is just lacking the catalyst to create a new recovery. These factors include geopolitical tensions and the prospect of interest rate cuts boosting the demand for safe-haven assets.

This week, 12 Wall Street analysts participated in Kitco News’ Gold Survey. Four experts, accounting for 33%, predicted that gold prices would rise next week, while two analysts, equivalent to 17%, forecast a price decline. The remaining six experts, representing 50%, anticipated that gold prices would stabilize. Phillip Streible, Chief Market Strategist at Blue Line Futures, is optimistic about gold but cautions that now is not the time to enter the market. He advises, “If you don’t have a position, don’t chase the market at these levels.”

Deadline for Reporting Gold Market Management and Operations Results to SBV Today, January 31

As per the directive of Prime Minister Pham Minh Chinh, today (January 31, 2024) is the deadline for the State Bank of Vietnam (SBV) to submit a report on the summary of Decree 24, which includes proposals for amending and supplementing certain regulations for managing the gold market.

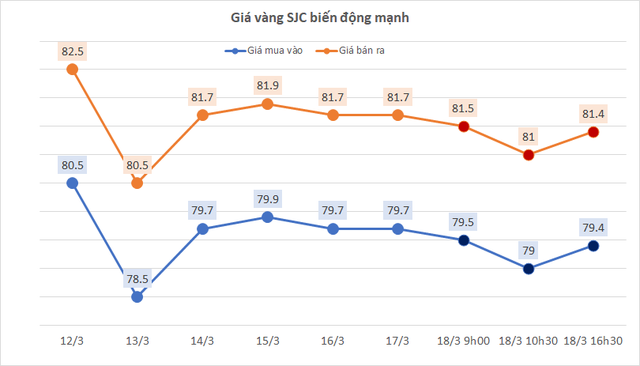

Gold prices surge to nearly 79 million dong per tael ahead of Tet, investors make huge profits.

After dropping sharply from 80.5 million VND per tael to 74 million VND per tael at the beginning of the year, SJC gold price has been showing signs of recovery recently. On February 2nd, the price of gold continued to rise significantly and reached nearly 79 million VND per tael.