The stock of NVT, a construction and investment company, is a notable example. Within just five consecutive sessions from June 17-21, 2024, NVT soared from 8,000 VND to 11,100 VND per share, a staggering increase of nearly 39%, accompanied by a surge in trading volume from 2-3 thousand matched orders to 100,000 shares traded.

On June 24, NVT continued its remarkable rally, marking the sixth consecutive session of reaching the maximum daily price change limit. However, at the time of writing, NVT has undergone a slight correction, retreating to 10,300 VND per share. This adjustment is considered necessary after the stock’s impressive performance.

Ninh Van Bay, formerly known as Tuan Phong Construction and Investment Joint Stock Company, was established in September 2006 with an initial chartered capital of 1 billion VND. In September 2009, the company increased its chartered capital to 265 billion VND and changed its name to Ninh Van Bay Tourism Real Estate Joint Stock Company, as it is known today. NVT operates in the tourism real estate sector, specializing in investing, constructing, and operating premium eco-tourism resorts in Vietnam. The company owns and operates several renowned projects, including Six Senses Ninh Van Bay, Emeralda Ninh Binh, Lac Viet New Tourist City, and Six Senses Sai Gon River.

In terms of business performance, NVT reported impressive growth in the first quarter of 2024, with revenue reaching 114 billion VND, a 23% increase compared to the same period last year. The company also recorded a net profit of nearly 3.6 billion VND, a significant improvement from the previous year’s loss of nearly 5.6 billion VND.

Similarly, another stock in the services and tourism industry, CDH, belonging to Hai Phong Tourism Service and Public Works Joint Stock Company, has witnessed an incredible rally. Today marks the eleventh consecutive session of CDH hitting the daily price change limit, resulting in a staggering 320% increase over the past two weeks.

CDH has a long history, tracing back to 1969 when it was established as the Town Hall under the management of the People’s Committee of Do Son Town. In 2015, the company officially transformed into a joint-stock company, and in June 2016, it was listed on the UPCoM exchange.

CDH primarily engages in service packages in the field of public utilities, including managing, operating, repairing, maintaining, and upgrading roads, pavements, and sea dikes; planting, maintaining, and caring for the green tree system; managing and operating the public lighting system; and collecting and transporting non-hazardous waste to ensure urban aesthetics. The company’s business area covers Do Son and Duong Kinh districts in Hai Phong.

As of the end of 2023, the company’s shareholder structure included Hai Phong People’s Committee, holding over 1.15 million shares, equivalent to 57.52% of the capital. Four major shareholders are Construction Joint Stock Company (holding 5% capital), Binh Khanh Limited Company (5% capital), Ms. Nguyen Thi Minh Phuong (10.17% capital), and Mr. Nguyen Van Hien (7.61% capital).

In terms of specific plans, the company targets a total revenue of 128.9 billion VND, a modest 3% increase compared to the previous year. The profit-before-tax target is set at 4.95 billion VND, slightly lower than the previous year. The expected dividend rate remains at 5% in cash.

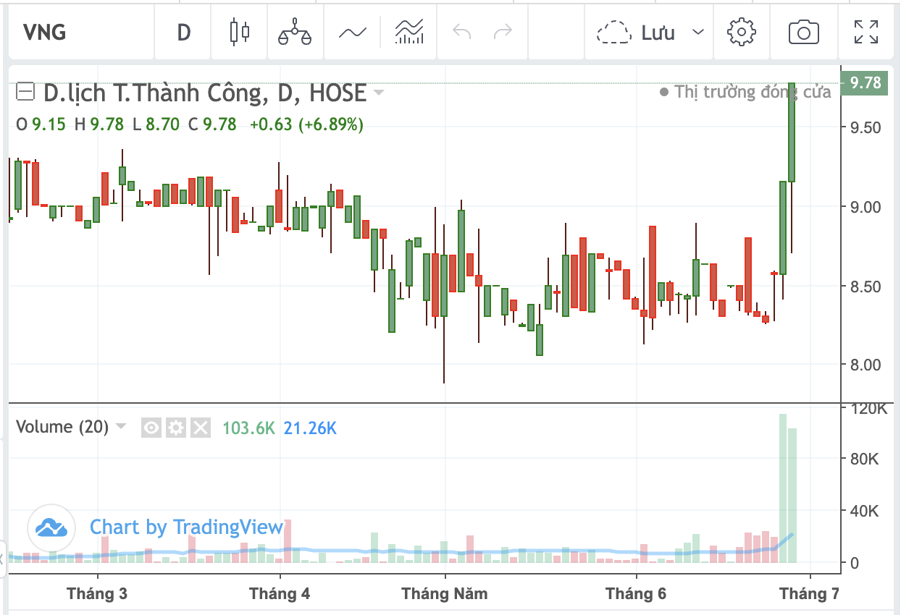

Shares of two leading travel companies, Du Lich Thanh Cong and Vietravel, also surged significantly during today’s trading session.

VNG, a leading gaming and entertainment company, closed at the maximum daily price change limit, surging 6.90% to 9,780 VND per share. In the past two sessions, VNG’s share price has climbed 18%, accompanied by a surge in trading volume, with nearly 100,000 shares traded per session, in contrast to the previous lackluster volume of only 20,000 shares.

For 2024, VNG sets ambitious targets, with expected revenue of 760 billion VND and a pre-tax profit of 23 billion VND, slightly higher than the 742 billion VND revenue and 23 billion VND pre-tax profit achieved in 2023. According to the company’s management, the Tourism General Department predicts a positive trend in international visitor numbers, expected to range from 12.6 million to 18 million, not yet reaching pre-pandemic levels but indicating a promising outlook for Vietnamese tourism. Currently, 80% of TTC Travel’s customers are external, and the company continues to collaborate with strategic partners to expand its customer base.

Vietravel’s stock, VTR, also experienced an impressive surge, climbing 4.40% today. Over the past week, VTR has gained 13%, with today’s trading volume spiking to 207,000 shares traded.

According to statistics from the Tourism General Department, international visitor arrivals to Vietnam in May 2024 reached 1.38 million, an 11.1% decrease compared to April 2024 but a significant 51.0% increase compared to the same period in 2023. For the first five months of 2024, Vietnam welcomed an estimated 7,583,034 international visitors, a 64.9% increase compared to the same period in 2023.

Domestic tourist numbers for May 2024 were estimated at 12 million, including approximately 8 million with accommodation. Cumulative domestic tourist volume for the first five months of 2024 is estimated at 52.5 million. Total revenue from tourism in the first five months of 2024 is estimated at over 352 trillion VND.

Michael Kokalari, VinaCapital’s Chief Economist, cited predictions from the China Tourism Academy, which forecasts that the number of Chinese tourists traveling abroad this year will exceed 80% of pre-COVID levels. Consequently, VinaCapital anticipates a recovery in Chinese tourist arrivals to Vietnam from 30% of pre-COVID levels last year to 85% this year.

Regarding US travelers, the percentage of American consumers planning to travel internationally in the next six months has doubled compared to pre-COVID-19 levels, reaching record highs. Interest income and dividends earned by American savers are projected to increase nearly fivefold, from $770 billion in 2020 to $3.7 trillion this year, and there is evidence that some of this money will be spent on travel. In Vietnam, the number of American tourists has already surpassed pre-COVID levels, and their spending has contributed to higher occupancy rates at upscale hotels.

Based on these positive trends, it is predicted that total tourist arrivals to Vietnam will increase from 70% of pre-COVID levels last year to around 105% of pre-COVID levels this year, equivalent to 19 million visitors. Revenue of domestic travel service companies has also increased by nearly 50% compared to the same period last year, reflecting the industry’s strong recovery.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.