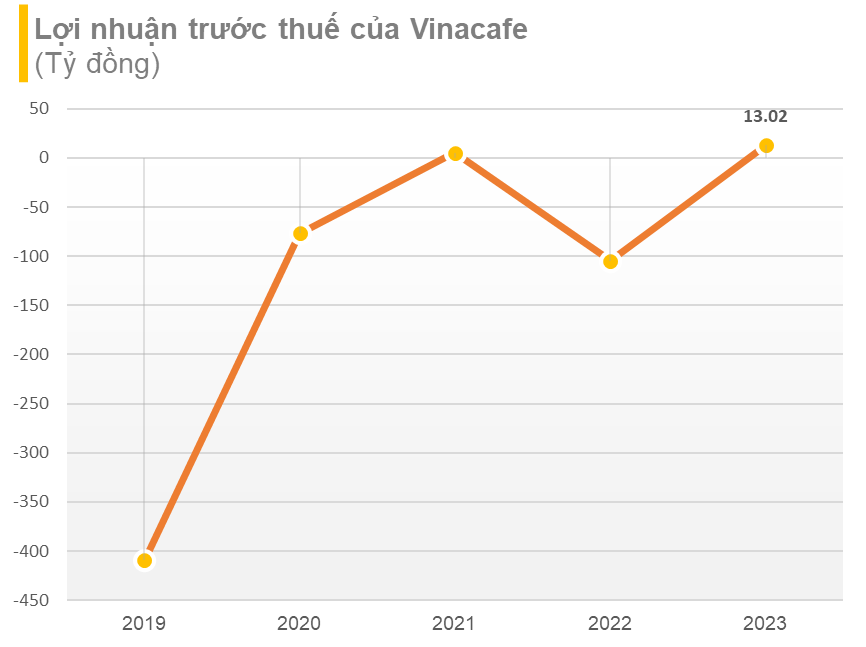

VINACAFE TURNS A PROFIT BUT STILL FACES CUMULATIVE LOSSES IN THE BILLIONS

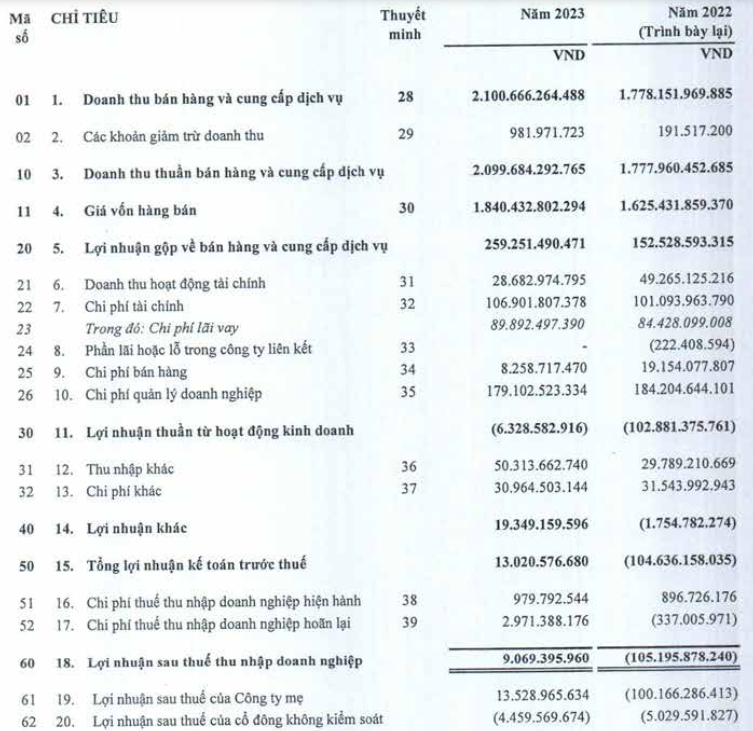

The Vietnam National Coffee Corporation (Vinacafe) recently released its 2023 audited financial report, revealing a positive trajectory in its financial performance. For the past year, the Corporation’s net revenue reached 2,100 billion VND, an impressive 18% increase compared to the previous year. After deducting the cost of goods sold, Vinacafe’s gross profit stood at 259 billion VND, marking a significant 70% jump from 2022.

In 2023, Vinacafe recorded a notable improvement in other profits, amounting to over 19 billion VND, in contrast to a loss of 1.75 billion VND in the previous year.

Consequently, Vinacafe’s 2023 after-tax profit reached a positive figure of over 9 billion VND, a remarkable turnaround from the 105 billion VND loss incurred in 2022.

As of December 31, 2023, Vinacafe’s balance sheet reflected total assets of 2,886 billion VND, a slight decrease of nearly 57 billion VND from the beginning of the year. The Corporation has set aside provisions for short-term difficult-to-recover receivables of 428 billion VND and long-term difficult-to-recover receivables of 13 billion VND. The company’s liabilities stood at 2,414 billion VND, including total borrowings of 874 billion VND. Vinacafe’s equity was valued at 472 billion VND, while the Corporation faced cumulative losses of 1,090 billion VND as of the end of 2023.

According to the financial report, Vinacafe had 28 consolidated subsidiary companies as of December 31, 2023. Among these, 5 companies were part of the Comprehensive Plan for the Restructuring and Renewal of Agricultural Enterprises and the Restructuring of the Vietnam National Coffee Corporation. This plan is under the purview of the Ministry of Agriculture and Rural Development, in collaboration with relevant sectors.

Additionally, one subsidiary company was not consolidated in the financial report as it had filed for bankruptcy, and three associated companies had also ceased operations and were in the process of bankruptcy proceedings.

Regarding Vinacafe’s investment in Duc Nguyen Import-Export Coffee Joint Stock Company, the Corporation’s share of losses in this company exceeded the book value of the investment. Consequently, the book value of this investment as of December 31, 2023, was recorded as zero. The investment in Vinacafe Nha Trang Joint Stock Company, with an original cost of 4 billion VND, required a provision of nearly 2.7 billion VND. Investments in the three associated companies undergoing bankruptcy proceedings were also fully provisioned for their original cost.

SELLING ITS MOST VALUABLE ASSET TO MASAN

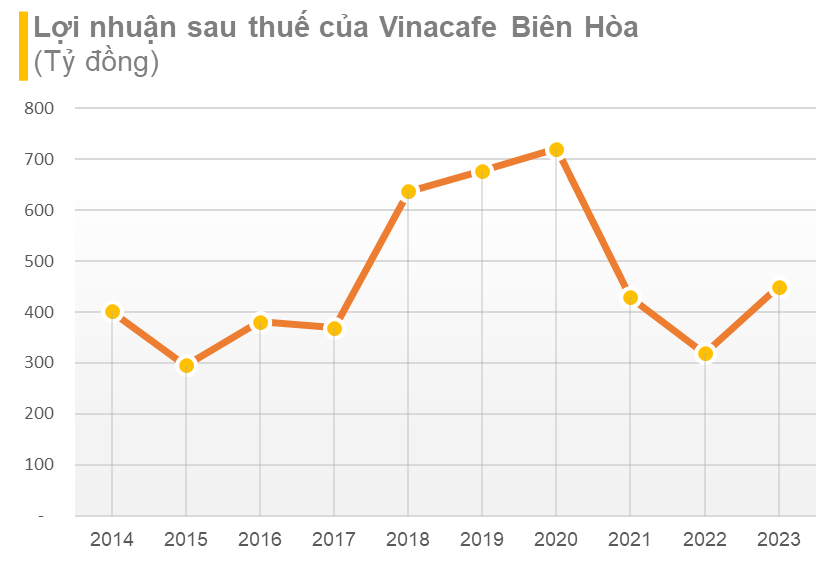

Vinacafe was once the parent company of Vinacafe Bien Hoa Joint Stock Company (VCF), but it has since divested entirely from this entity. Currently, Vinacafe Bien Hoa is a subsidiary of the Masan Group through Masan Beverage Company Limited, which holds 98.79% of VCF’s charter capital.

Vinacafé Bien Hoa traces its roots to a coffee manufacturing plant established by the French in 1968, and it began producing instant coffee in 1977. After its formation and growth in the coffee industry, the company underwent privatization in 2004 and officially listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol VCF in early 2011.

Prior to this, in 2010, Vinacafé Bien Hoa, recognized as one of the leading instant coffee manufacturers in Vietnam, caught the attention of the Masan Group due to its efficient business performance. This led to Masan’s strategic acquisition plans.

On October 11, 2011, Masan Consumer successfully acquired 50.11% of VCF’s charter capital. Subsequently, Masan continued to pursue additional shares of VCF with the goal of attaining 100% ownership.

Meanwhile, Vinacafe gradually divested from Vinacafe Bien Hoa, and by December 16, 2015, it had completely withdrawn its capital from the company.

Following its acquisition by Masan, VCF has maintained its efficient operations, generating revenue in the range of 2,000 to 3,000 billion VND annually. Although its after-tax profit has decreased compared to the 2018-2020 period, it still remains at a respectable level of 300 to 400 billion VND.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.