On June 26, 2024, the Joint Stock Company Deo Ca Group held its annual general meeting, approving consolidated revenue of VND 8,956 billion, a 35% increase, and profit-after-tax of VND 733 billion, a 14% increase compared to the previous year. As of the first quarter of 2024, the Group’s revenue reached VND 1,750 billion, a 122% increase, and profit-after-tax was VND 169 billion, a 40% increase year-on-year.

Deo Ca is a prominent enterprise in the field of transport infrastructure, with a well-established brand through major projects in Vietnam such as Deo Ca Tunnel, Co Ma Tunnel, Hai Van Tunnel, Trung Luong – My Thuan Expressway, and Bac Giang – Lang Son Expressway.

The Group’s specific operational strategy for this year includes the following key points:

+ For investment activities, the Group continues to research and invest in projects such as Tan Phu – Bao Loc, Ho Chi Minh City – Chon Thanh, Ring Road 4 in Binh Duong province, and Ho Chi Minh City – Trung Luong – My Thuan (phase 1), with a total investment of nearly VND 80,000 billion. Additionally, they are working on the Vietnam-Laos railway project, specifically the Vung Ang – Mu Gia section, valued at over VND 47,600 billion.

+ In terms of construction, Deo Ca is executing a significant workload on the North-South Expressway in phase 2, including the Quang Ngai – Hoai Nhon Expressway, with a total investment of more than VND 20,400 billion. They are also involved in the construction of the Chi Thanh – Van Phong, Tuyen Quang – Ha Giang, and Khanh Hoa – Buon Ma Thuot expressways, as well as the Ho Chi Minh Road section from Chon Thanh to Duc Hoa, Ring Road 3 in Ho Chi Minh City, the Tan Van interchange, and two connecting roads to Long Thanh International Airport, among other projects, with a total value of nearly VND 15,000 billion.

4% Cash Dividend Payout

At the meeting, the Deo Ca leadership announced that the company has recently completed the Cam Lam – Vinh Hao Expressway, with a total investment of over VND 8,900 billion, and it was put into operation in late April. The Group is currently working on two projects: the Dong Dang – Tra Linh Expressway (phase 1), with a total investment of over VND 14,300 billion, which began construction in January, and the Huu Nghi – Chi Lang Expressway, with a total investment of over VND 11,000 billion, which broke ground in April.

In terms of construction installation, in 2023, the Group successfully completed numerous projects and contracts, including the Thung Thi Tunnel on the Mai Son – National Highway 45 Expressway, the Truong Vinh Tunnel on the Nghi Son – Dien Chau Expressway, the My Thuan 2 Bridge, the My Thuan – Can Tho Expressway, and the expansion of Deo Prenn Road, among others, with a total value of over VND 6,100 billion.

In the field of operation and management, Deo Ca is responsible for the operation, regular maintenance, safety assurance, and smooth traffic flow of nearly 410 kilometers of expressways and national highways, as well as over 30 kilometers of road tunnels. They also manage 18 BOT toll stations across Vietnam.

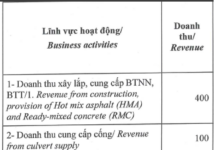

Regarding business performance, in 2023, Deo Ca recorded a consolidated revenue of VND 6,622 billion, a 51% increase compared to 2022. Specifically, service and construction installation revenue reached VND 6,358 billion, and financial activity revenue was VND 264 billion, increasing by 52% and 22%, respectively. The profit-after-tax amounted to VND 642 billion, a 53% increase. Based on these results, the Board of Directors proposed a 4% cash dividend payout, equivalent to VND 168 billion.

Given the above, the meeting agreed to maintain a 4% cash dividend payout, while the remaining profit will be retained to ensure equity capital when participating in bids for significant projects such as Ring Road 4 in Ho Chi Minh City and the Ho Chi Minh City – Chon Thanh Expressway.

Photo: Deo Ca’s Annual General Meeting on June 26, 2024.

Capital Increase to VND 6,300 Billion

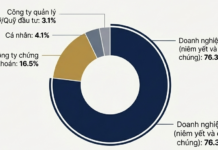

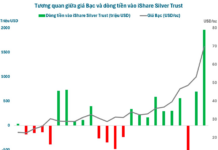

To secure capital for its business strategy, Deo Ca has planned to issue over 210 million shares to increase its charter capital to VND 6,309 billion, representing a 50% increase. The implementation timeline is set for 2024-2025, aligning with the progress of the Group’s projects.

In parallel, the company has been diversifying its capital mobilization sources. Mr. Nguyen Huu Hung, Vice Chairman of the Board of Directors, shared that Deo Ca previously relied mainly on equity capital and loans. However, the company has now expanded its capital sources to include budget capital, business cooperation, bonds, and increased equity capital. This diversification also helps the Group navigate the unpredictable interest rate fluctuations.

Furthermore, to participate in the investment of nearly 400 kilometers of expressways and railway projects with limited resources, Deo Ca takes the lead in innovating and utilizing the PPP++ model to diversify capital sources, enhance mobilization efficiency, and mitigate risks throughout the project implementation. In this model, P1++ represents budget capital (including central and local budget capital), P2++ stands for equity capital of the primary and secondary investors, and P3++ denotes capital mobilized from credit institutions, business cooperation, bonds, and other sources.

“The Board of Directors Has Set a 5-Year Roadmap for Listing Shares”

On the topic of share listing, Mr. Hung informed the shareholders that the Board of Directors and Executive Committee have set a goal of listing shares within a 5-year strategic development plan. However, the timing of the listing requires careful consideration. The past 2 to 3 years have not been favorable for the business operations of infrastructure companies, particularly in the transport sector, due to objective factors such as the COVID-19 pandemic, rising material prices, and increasing interest rates.

“The Board of Directors has set a 5-year roadmap for listing shares and will choose the most opportune moment to do so,” affirmed Mr. Hung.

Currently, a subsidiary of Deo Ca Group, Ha Tang Giao Thong Deo Ca, is listed on the stock exchange under the ticker symbol HHV.

Which 19 projects will the Ministry of Transport start in 2024?

The 2023 conference and 2024 plan implementation of the Ministry of Transport have identified that one of the key tasks of the Ministry in 2024 is to effectively invest in the development of the national transportation infrastructure. This includes the commencement of 19 major infrastructure projects in 2024.

Accelerate Implementation for Early Start of North-South High-Speed Rail Project

The North-South high-speed railway is a strategically important project for the nation and its people, serving as a catalyst for breakthrough development in the socio-economic sector.