Illustrative image

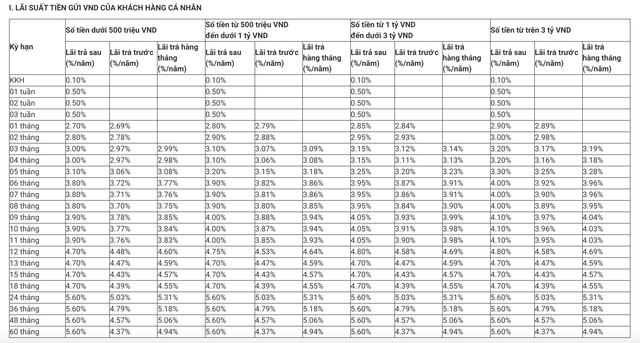

Interest rates for personal savings at MB Bank in June 2024

For personal deposits, MB divides interest rates into 4 tiers: Below VND 500 million, from VND 500 million to below VND 1 billion, from VND 1 billion to below VND 3 billion, and VND 3 billion or above.

Specifically, for deposits below VND 500 million, the interest rate for a 1-month term increased from 2.3%/year at the end of May to 2.7%/year, the 2-month term increased from 2.5%/year to 2.8%/year, the 3-4 month term increased from 2.7%/year to 3.0%/year, the 5-month term increased from 2.8%/year to 3.1%/year, the 6-8 month term increased from 3.6%/year to 3.8%/year, the 9-10 month term increased from 3.7%/year to 3.9%/year, the 11-month term increased from 3.8%/year to 3.9%/year, and the 12-18 month term increased from 4.6%/year to 4.7%/year.

Meanwhile, the 24-60 month terms continue to offer an interest rate of 5.6%/year.

For deposits from VND 500 million to below VND 1 billion, MB applies an interest rate that is 0.05-0.1 percentage points higher than the rate for deposits below VND 500 million for terms of 1-12 months, and an equivalent rate for terms over 12 months.

For deposits from VND 1 billion to below VND 3 billion, MB applies an interest rate that is 0.1-0.15 percentage points higher than the rate for deposits below VND 500 million for terms of 1-12 months, and an equivalent rate for terms over 12 months.

For deposits of VND 3 billion or more, MB applies an interest rate that is 0.1-0.2 percentage points higher than the rate for deposits below VND 500 million for terms of 1-12 months, and an equivalent rate for terms over 12 months.

Interest rate table for personal deposits at MB in June 2024

Source: MB

In addition, personal customers who deposit at branches in the Central and Southern regions will be offered interest rates that are about 0.1%/year higher than those in other regions (except for short-term deposits of less than 1 month). The interest rate ranges from 0.5-5.7%/year for end-of-term payments. The highest rate of 5.7%/year is offered for deposits with a term of 24-60 months.

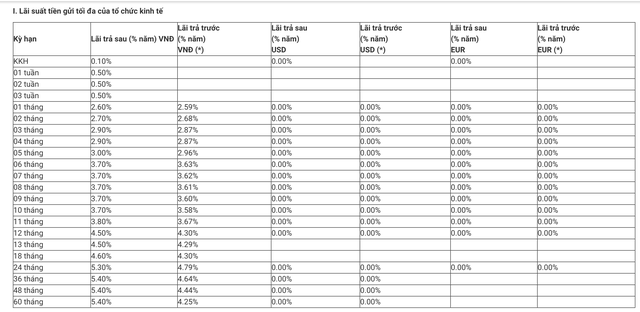

Interest rates for business savings at MB Bank in June 2024

In late June 2024, the interest rates offered by MB Bank for business customers range from 0.5-5.4%/year for end-of-term payments, an increase of 0.3-0.6%/year for many terms compared to the end of May.

Specifically, the interest rates for corporate deposits at short-term periods of 1 week, 2 weeks, and 3 weeks remain unchanged at 0.5%/year;

The interest rate for a 1-month term is 2.6%/year, 2.7%/year for a 2-month term, 2.9%/year for a 3-month term, 2.9%/year for a 4-month term, 3.0%/year for a 5-month term, 3.7%/year for a 6-10 month term, 3.8%/year for an 11-month term, 4.5%/year for a 12-13 month term, 4.6%/year for an 18-month term, and 5.3%/year for a 24-month term;

The longest terms, ranging from 36-60 months, offer the highest interest rate of 5.4%/year, unchanged from May. Non-term deposits from corporate customers are set at a minimum of 0.1%/year.

Maximum interest rate table for corporate deposits at MB in June 2024

Source: MB

MB also offers a separate interest rate framework for corporate customers in the Central and Southern regions (excluding Ho Chi Minh City), with interest rates that are 0.1%/year higher than those for regular customers for terms of 6 months or more. The highest interest rate of 5.5%/year is offered for corporate deposits with a term of 36-60 months.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.