The Loud Debt Defaulters and the Never-Ending Spiral

In 2023, a survey by research firm Decision Lab revealed that 30% of Vietnamese workers lost their jobs or experienced a 10-50% reduction in income. This low-income group faced challenges in covering their living expenses, leading to long-term debts and difficulties in debt repayment.

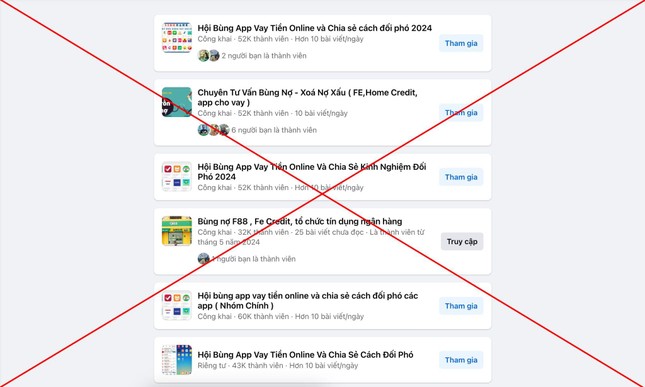

During the same year, some individuals took advantage of lax loan procedures, easy access to quick loans, and the focus of law enforcement on debt collection practices of financial companies. They deliberately defaulted on their loans, and unlike previous instances, this time, debt defaulting became a public and rampant issue on social media, with hundreds of different groups emerging to encourage this behavior.

Experts argue that this is the first time in the history of Vietnamese consumer lending that debt defaulting has become so “obvious” and “loud,” creating a serious social problem with significant consequences. For defaulters, there is the risk of criminal prosecution. Financial companies, on the other hand, face bad debts and losses, forcing them to tighten lending conditions, reducing opportunities for those seeking loans to overcome financial difficulties and escape poverty.

Social media groups encouraging debt defaulting, creating a serious social problem…

Within these debt-defaulting groups, amidst chants of “don’t be foolish and repay your debts,” members are guided towards alternative borrowing methods that are more dangerous and labyrinthine, with no clear way out. Faceless lenders, instant loans without income verification, bad credit history, or asset collateral—many individuals eagerly embrace these options without considering the potential consequences of defaulting on their loans.

Consequently, individuals find themselves trapped in a spiral of debt, with “app-stacking” leading to interest rates as high as several hundred or even a thousand percent per annum. This time, it’s not just any debt but involvement with loan sharks, and the outcome is all too familiar: ruin and a life spent in hiding.

Unexpected Consequences

According to senior lawyer Do Thi Hang of BFSC Law Company, the mentality of “go ahead and default, who dares to come and collect” stems from the misconception that financial companies engaging in debt collection are breaking the law and will be dealt with by the police. In reality, these companies have a solid legal basis to sue defaulters, and it’s only a matter of time.

Initially, the companies may try to persuade borrowers to repay, but if they refuse to cooperate, legal action will be taken. Even if someone has been defaulting for 5 or 10 years, they can still be held accountable depending on the severity of the case.

As shared by a large pawnshop lending company in Vietnam, in just over five months, they have filed 91 debt default cases with the police and submitted 71 lawsuits to the courts. Notable examples include Mai Ngoc N. (Thanh Hoa), Dang Cong M. (Bac Ninh), Trinh Xuan P. (Hoa Binh), Ho Van K. (Dak Lak), and Truong Tran Thanh S. (Da Nang).

Debt defaulting impacts not only the borrower but also the lender and prospective borrowers.

Once sued and found guilty by the authorities, defaulters may be convicted of “Abuse of trust to appropriate property” if they intentionally borrow with the intention to default or escape repayment by selling off secured assets. The minimum penalty is non-custodial reform or imprisonment from 6 months to 3 years, while the maximum can range from 12 to 20 years, as per Article 175 of the 2015 Criminal Code, amended and supplemented in 2017.

If the borrower intentionally forges documents or provides false personal information, they can be prosecuted for “Fraud” under Article 174 of the Criminal Code, with a maximum sentence of life imprisonment. Those who incite, instruct, or provide the necessary means for fraud may be criminally liable as accomplices.

For financial companies, taking legal action is not their preferred option. In fact, most lending institutions are willing to offer debt restructuring to borrowers as a way of sharing the burden. However, according to the leader of a pawnshop lending company, very few borrowers proactively request debt restructuring, and most choose to default regardless of the consequences.

Lawyer Hang advises, “Don’t avoid a short-term responsibility only to face legal or social risks associated with loan sharks later. Borrow only when necessary and within your repayment capacity.”

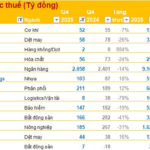

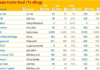

According to the latest data released by the Vietnam Banks Association in April 2024, the outstanding consumer loans of finance companies stood at approximately VND 138,800 billion, accounting for about 5% of the total consumer credit outstanding balance of the whole system. Consumer credit balance accounted for about 21% of the total outstanding credit balance of the economy, reaching nearly VND 2,900,000 billion, which is a significant figure.

3 Major Banks to Provide $1.8 Billion Loan for Long Thanh Airport Construction

In the early months of 2024, three state-owned commercial banks, including Vietcombank, Vietinbank, and BIDV, will sign a financing agreement for the construction of Long Thanh International Airport, with an estimated scale of $1.8 billion.

Unlocking Financial Opportunities: Empowering Businesses and Consumers with Accessible Loans

The entry of banks to alleviate difficulties for business and production, boost growth, and stabilize the economy will enable small businesses and traders to access loans more easily. With preferential interest rates and flexible procedures, these businesses can now thrive with the support of the banking sector.