City Auto Joint Stock Company (CTF) held its annual General Meeting of Shareholders (GMOS) in late June to discuss capital mobilization plans, elect new board members, and approve share offering and issuance schemes.

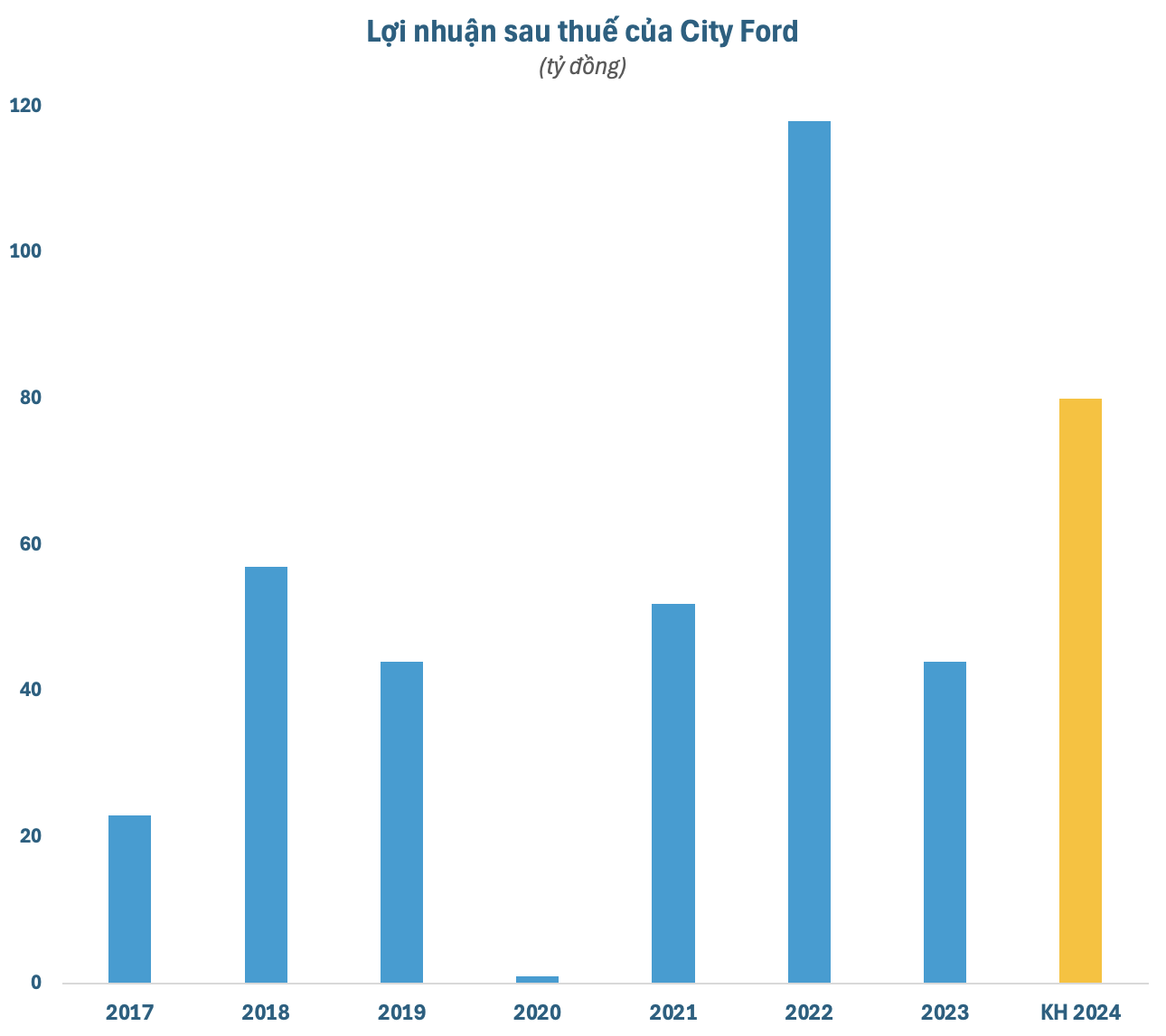

For 2024, CTF aims to sell 8,100 vehicles, a 3.7% increase from the previous year. Corresponding revenue is targeted at VND 8,100 billion, a 14.1% surge from 2023’s performance, marking the highest figure since its operation. Expected profit after tax is VND 80 billion, an 81.6% jump from the previous year. The dividend is projected at 7%.

The company remains optimistic about its prospects, given the robust growth of Vietnam’s automotive market, a large and youthful population, rising incomes, and a low car ownership rate in the region. Moving forward, CTF will focus on digital marketing by enhancing its website and gradually promoting online sales.

At the GMOS, shareholders approved a plan to issue shares as dividends for 2023, with a ratio of 7%, equivalent to approximately 6.2 million shares. The issuance will be funded by undistributed post-tax profits up to the end of 2023. The proceeds will be used as working capital for business operations.

Additionally, CTF intends to conduct a private placement of shares during 2024-2025, after paying 2023 dividends. The company plans to offer 15 million shares to professional investors at a price not lower than the book value at the end of 2023, approximately VND 11,000/share.

The privately placed shares will be restricted from transfer for at least one year. The expected minimum proceeds of VND 165 billion will be used as working capital, specifically for payments to automobile manufacturers and auto parts and accessories suppliers.

Furthermore, CTF also plans to privately offer an additional 15 million shares with convertible dividend privileges, aiming for a price no lower than the aforementioned amount. The offering is expected to take place in 2024-2025, after the payment of 2023 dividends.

The privileges of owning these convertible preferred shares include receiving a fixed dividend of 7%, along with a bonus dividend of at least 5% and a maximum of 7%. The preferential dividend period will last for a maximum of five years from the end of the offering period.

These preferred shares can be converted into common shares at any time after 12 months and before 60 months from the end of the offering period. The conversion price will not be lower than the book value at the time of offering.

CTF has the right to repurchase a portion or all of the preferred shares after one year from the end of the offering period. The repurchase price will be calculated so that the investor’s repurchase yield is no less than 150% of the preferential dividend rate announced before the expected repurchase by CTF.

However, shareholders holding preferred shares will not have voting rights, attend GMOS, or nominate directors or supervisors, except as provided by the Enterprise Law or CTF’s Charter.

If all the aforementioned offering and issuance plans are successfully executed, CTF’s charter capital will increase from nearly VND 900 billion to over VND 1,200 billion.

Regarding personnel matters, the GMOS also elected five members to the board of directors and three members to the supervisory board for the 2024-2028 term. The board of directors comprises Chairman Tran Ngoc Dan, along with members Tran Lam, Nguyen Dang Hoang, and Phan Hoang Son (Independent Member). The supervisory board includes Hoang Thi Thanh Hai, Do Thi Nhu Duyen, and Tran Thi En.

In the market, CTF’s share price has risen by 15% in the past month, currently trading at a historic peak of VND 34,400/share. Its market capitalization stands at over VND 3,000 billion.