Illustrative image

The State Bank of Vietnam has recently issued Circular No. 12/2024/TT-NHNN (Circular 12), amending certain provisions on bank lending activities under Circular No. 39/2016/TT-NHNN, effective from July 1, 2024.

The Circular stipulates that credit institutions shall consider and decide to lend to customers who meet the following conditions:

First, the customer is a legal entity with civil legal capacity as prescribed by law. The customer is an individual aged 18 or older with full civil act capacity as prescribed by law or from the age of 15 to under 18 with full civil act capacity or no restriction on civil act capacity as prescribed by law.

Second, the loan is intended for legitimate use;

Third, the customer has the financial capacity to repay the loan;

Fourth, the customer has a feasible capital usage plan. This condition is not mandatory for small-value loans. Circular 12/2024/TT-NHNN also adds a provision that a small-value loan is a loan as prescribed in Clause 2, Article 102 of the Law on Credit Institutions and does not exceed VND 100 million.

Thus, from July 1, bank loans below VND 100 million will not be required to provide a feasible capital usage plan.

For these loans, Circular 12 stipulates that credit institutions and foreign bank branches must monitor the use of loans to ensure that customers use the capital for the committed purpose and repay the debt, ensuring the ability to fully recover the principal and interest on time as agreed.

Credit institutions must also have, at a minimum, information about the legitimate purpose of the loan and the financial capacity of the customer before making a lending decision.

For loan agreements and credit contracts signed before the effective date of this Circular (July 1), credit institutions and customers shall continue to perform the contents of the loan agreements and credit contracts signed in accordance with the provisions of the law in force at the time of signing those agreements or contracts. In case of any amendment or supplement to the loan agreement or credit contract, the amended or supplemented content must comply with the provisions of this Circular.

Previously, the State Bank of Vietnam stated that this regulation is suitable for the characteristics of small loans, helping to create more favorable conditions for customers in accessing bank credit with simpler procedures. It also contributes to expanding lending activities for livelihood and consumption purposes, thereby limiting “black credit.”

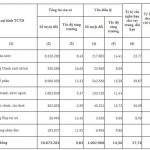

Total assets of commercial banks reach 20 quadrillion VND for the first time, how much do Agribank, BIDV, VietinBank, and Vietcombank account for?

As of the end of 2023, the total assets of the State Commercial Bank Group amounted to over 8,326 trillion VND, while the Joint Stock Commercial Bank Group reached nearly 8,987 trillion VND.