Total assets of the system exceeded 20 million trillion VND

According to newly released data by the State Bank of Vietnam, the total assets of the system of credit institutions reached over 20,073 million trillion VND by the end of 2023, an increase of 9.83% compared to the end of 2022. Previously, the total assets of the entire system reached nearly 18,903 million trillion VND by the end of September. Thus, in the fourth quarter alone, the total assets of the system increased by nearly 1.17 million trillion VND – the highest quarterly increase in recent years.

The system’s total assets increased strongly in the last 3 months of the year, in line with the expansion rate of credit. Data from the State Bank of Vietnam showed that credit growth for the whole economy reached 13.71% by the end of December 2023, corresponding to an increase in credit scale of over 1,634 million trillion VND in 2023. In which, the credit scale increased by nearly 805,000 billion VND in the fourth quarter, accounting for nearly half of the annual increase in 2023. This is the highest credit growth rate in the fourth quarter in recent years and the highest in history in terms of scale.

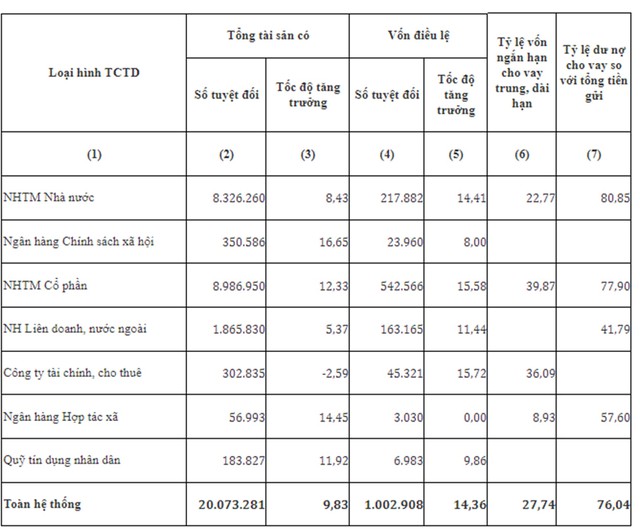

As of the end of 2023, the group of commercial banks had total assets of over 17,313 million trillion VND, accounting for 86.25% of the total assets of the entire system of credit institutions. In which, the total assets of the group of State-owned commercial banks (Agribank, BIDV, VietinBank, Vietcombank, CBBank, GP Bank, OceanBank) reached over 8,326 million trillion VND, an increase of 8.43% compared to the end of 2022. With this figure, the total assets of the group of State-owned commercial banks currently account for 41.5% of the total assets of the entire system and 48% of the total assets of commercial banks.

At the end of 2023, the total assets of the group of joint-stock commercial banks reached nearly 8,987 million trillion VND, an increase of 12.33% compared to the end of 2022 and the largest group in the system.

Source: SBV

Financial statements for the fourth quarter of 2023 show that BIDV continued to lead the system in terms of total assets with 2.3 million trillion VND, an increase of 0.6% compared to the beginning of the year. The second position belongs to VietinBank with over 2 million trillion VND, an increase of 12.4%.

Agribank also recorded total assets exceeding 2 million trillion VND, however, the exact number has not been announced. The asset scale of Vietcombank ranked fourth with nearly 1.84 million trillion VND, a slight increase of 1.4% compared to the end of the previous year.

In the group of joint-stock commercial banks, MB continued to rank first with a scale of nearly 945,000 billion VND, an increase of 29.7% compared to the end of 2022. Followed by Techcombank, VPBank, ACB, SHB, and HDBank.

Total charter capital of the system exceeded 1 million trillion VND

By the end of December 2023, the total charter capital of the entire system of credit institutions reached nearly 1,003 trillion VND, an increase of 14.36% compared to the end of 2022. In which, the charter capital of the Joint Stock Commercial Banking Group was 542,566 trillion VND, an increase of 15.58% and accounting for more than half of the total charter capital of the entire system. The group of State Commercial Banks has a total charter capital of 217,882 trillion VND, an increase of 14.41%.

In 2023, the State Bank of Vietnam has approved an increase in charter capital for 21 joint stock commercial banks, mainly from the bank’s owner’s capital (retained earnings and reserve funds). The approved banks include: HDBank, MB, SeABank, ACB, VIB, TPBank, LPBank, BacABank, VietABank, VietBank, Techcombank, Eximbank, OCB, ABBank, SHB, BVBank, MSB, KienLongBank, NamABank, NCB, VPBank.

In addition, SBV has also allowed State-owned commercial banks to increase charter capital such as VietinBank (+5,642 trillion VND), BIDV (+6,419 trillion VND), Agribank (+6,753 trillion VND), Vietcombank (+8,566 trillion VND).

At the end of 2023, VPBank is the bank with the highest charter capital, reaching nearly 80,000 trillion VND, far surpassing the remaining banks in the system.

BIDV – the bank with the second highest charter capital, recorded at over 57,000 trillion VND. Followed by Vietcombank (55,891 trillion VND), VietinBank (53,700 trillion VND), MB (52,141 trillion VND) and Agribank (41,000 trillion VND).