In the latest update on Vietnam’s consumer finance market from Fiingroup, experts opined that the industry faced its most challenging year in the past decade due to a sluggish economic growth environment and an unfavorable credit business landscape.

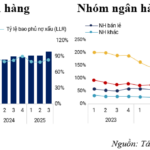

By the end of 2023, the total outstanding loans of consumer finance companies contracted by over 9% year-on-year amid weak credit demand, declining borrower credit quality, and rising non-performing loans, forcing lending institutions to tighten lending conditions.

From a growth rate of nearly 30% in 2019, consumer credit growth fluctuated before dropping to -9.1% in 2023 – considered the most difficult year in about a decade. The companies’ incomes plummeted, and profits turned negative as many reported losses of thousands of billion VND after the “golden goose” phase.

Consumer credit demand is expected to recover in the second half

The average non-performing loan ratio of consumer finance companies increased significantly from around 3% to about 11% in 2023…

Nevertheless, the Vietnamese consumer finance market is projected to have bottomed out and is preparing for a new growth cycle, despite ongoing challenges. The potential for recovery lies in the expected rebound in consumer credit demand in the latter half of 2024.

“In the short term, the recovery path will be supported by positive signs from the macroeconomic environment, including the revival of the manufacturing and export sectors, which are anticipated to enhance credit quality and credit demand among workers and laborers with low to middle incomes,” Fiingroup experts stated.

Notably, after a series of M&A deals in the market, with changes in ownership of several consumer finance companies, the market will continue to witness stronger participation from foreign investors and a trend of divestment by some domestic banks from their consumer finance subsidiaries.

According to our reporters, there have been several ownership changes in the consumer finance market recently. Home Credit Group transferred 100% of its capital contribution in Home Credit Vietnam to Thailand’s The Siam Commercial Bank Public Company Limited (SCB); SeABank sold its entire capital contribution in Postal Finance Company (PTF) to Japan’s AEON Financial Service Co., Ltd; SHB transferred 50% of the charter capital of SHB Finance Company to Thailand’s Krungsri Bank.

Previously, VPBank also transferred 49% of FE Credit’s charter capital to a subsidiary of Japan’s SMBC Group…