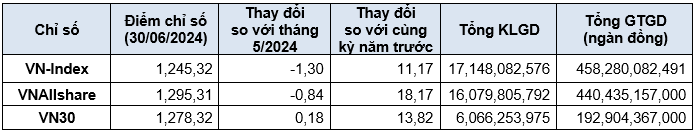

The HOSE indices mostly decreased compared to May 2024, with the exception of the VN30 which saw a slight increase. At the close of the last trading session of June 2024, the VN-Index stood at 1,245.32, VNAllshare at 1,295.31, and VN30 at 1,278.32. Compared to the end of May 2024, the VN-Index and VNAllshare decreased by 1.30% and 0.84%, respectively, while the VN30 index rose slightly by 0.18%.

Compared to the end of 2023, the VN-Index, VNAllshare, and VN30 recorded increases of 10.21%, 12.20%, and 12.98%, respectively.

|

June 2024 Trading Statistics by Index

Source: HOSE

|

Most sector indices declined compared to May 2024, with the energy sector index (VNENE) witnessing the sharpest drop of 5.61%. The real estate sector index (VNREAL) fell by 4.22%, and the consumer staples sector index (VNCONS) decreased by 3.27%.

On the other hand, three sector indices posted gains, with the information technology sector (VNIT) continuing its strong performance, rising 10.18% compared to May 2024 and a remarkable 53.63% increase compared to the end of 2023.

Market liquidity in June showed a mixed picture, with the stock and ETF markets growing, while the covered warrant (CW) market contracted compared to May.

Specifically, the average trading volume (TV) on the stock market exceeded 857 million shares per day, an increase of 3.71%. The average trading value (TV) was over 22,914 billion VND per day, up 6.11%.

For ETFs, the average TV reached 9.03 million, an increase of 6.38%, while the average TV was more than 241.74 billion VND, a surge of 54.53%.

The CW market, on the other hand, saw a decrease in average TV to 40.13 million CW/day and an average TV of 44.19 billion VND/day, corresponding to a 13.7% drop in volume and a 7.05% decline in value.

|

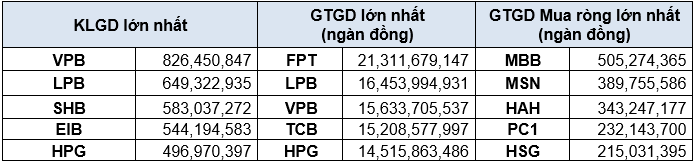

Top 5 Most Traded Stocks in June 2024

Source: HOSE

|

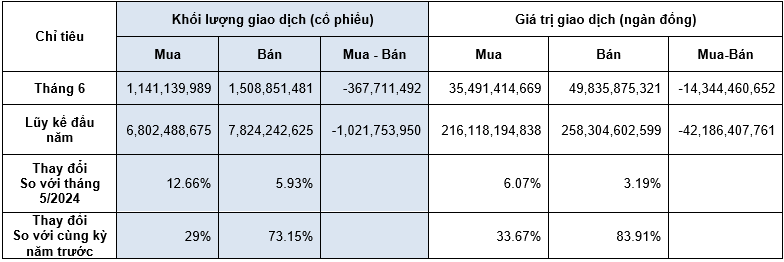

The total trading value of foreign investors (FIIs) in June 2024 exceeded 85,327 billion VND, accounting for over 9.3% of the total trading value of the entire market. FIIs were net sellers during the month, with a net selling value of more than 14,344 billion VND.

|

Foreign Investor Trading Statistics for June 2024

Source: HOSE

|

In terms of scale, as of June 30, 2024, HOSE had 511 listed and traded securities, including 395 stocks, 4 closed-end fund certificates, 15 ETF certificates, and 97 covered warrants, with a total volume of nearly 159 billion securities listed.

The market capitalization of stocks on HOSE exceeded 5.08 million billion VND, equivalent to 50.26% of GDP in 2023 (at current prices), a decrease of 1.11% compared to May 2024 but still an increase of over 11.58% compared to the end of 2023. This accounts for over 93.46% of the total market capitalization of listed stocks in the market.

In June 2024, HOSE welcomed one new member to its listing, the MCM stock of Moc Chau Dairy Cow Breeding JSC.

As of June 30, 2024, HOSE had 42 enterprises with a market capitalization of over 1 billion USD, including the Vietnam Joint Stock Commercial Bank for Industry and Trade (VCB), the only enterprise with a market capitalization of over 10 billion USD.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.